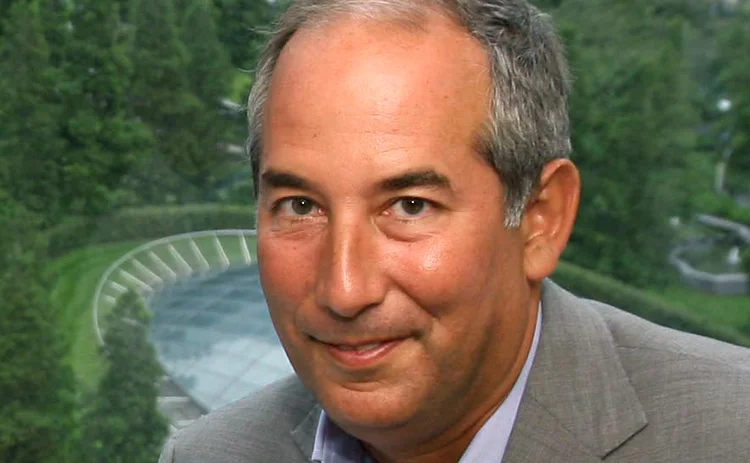

Tom Glocer Joins Algomi's Team as Strategic Advisor

Additionally, Howard Edelstein has been appointed to Algomi's board.

"Fixed income markets continue to suffer from a lack of liquidity," said Glocer in a statement. "This will only worsen as capital requirements bite. Algomi's approach of creating a bank balance-sheet based on actual data, and virtualizing the assets in the market is fascinating and I'm looking forward to working closely with them."

Algomi's Honeycomb Network helps banks create a virtual balance sheet based on live bond data ─ including trade information, enquiries, and holdings ─ and lets buy-side firms see this validated virtual balance sheet at the banks, according to the company. Algomi has over 160 buyside and 15 banks signed up to the Honeycomb Network.

Deep Experience

After four years as Thomson Reuters' CEO, Glocer departed in 2012 to take over as managing partner of Angelic Ventures, where he still resides. Angelic focuses on early-stage investments in fintech, media, big data and healthcare. It was also announced that Glocer has made an investment in the business for an undisclosed amount.

Edelstein is currently the chairman of REDI Holdings, which provides an order/execution management system (OEMS).

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@waterstechnology.com or view our subscription options here: http://subscriptions.waterstechnology.com/subscribe

You are currently unable to print this content. Please contact info@waterstechnology.com to find out more.

You are currently unable to copy this content. Please contact info@waterstechnology.com to find out more.

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Printing this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@waterstechnology.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Copying this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@waterstechnology.com

More on Emerging Technologies

Nasdaq reshuffles tech divisions post-Adenza

Adenza is now fully integrated into the exchange operator’s ecosystem, bringing opportunities for new business and a fresh perspective on how fintech fits into its strategy.

Liquidnet sees electronic future for gray bond trading

TP Icap’s gray market bond trading unit has more than doubled transactions in the first quarter of 2024.

Verafin launches genAI copilot for fincrime investigators

Features include document summarization and improved research tools.

Waters Wrap: Open source and storm clouds on the horizon

Regulators and politicians in America and Europe are increasingly concerned about AI—and, by extension, open-source development. Anthony says there are real reasons for concern.

Waters Wavelength Podcast: Broadridge’s Joseph Lo on GPTs

Joseph Lo, head of enterprise platforms at Broadridge, joins the podcast to discuss AI tools.

Man Group CTO eyes ‘significant impact’ for genAI across the fund

Man Group’s Gary Collier discussed the potential merits of and use cases for generative AI across the business at an event in London hosted by Bloomberg.

BNY Mellon deploys Nvidia DGX SuperPOD, identifies hundreds of AI use cases

BNY Mellon says it is the first bank to deploy Nvidia’s AI datacenter infrastructure, as it joins an increasing number of Wall Street firms that are embracing AI technologies.

This Week: Linedata acquires DreamQuark, Tradeweb, Rimes, Genesis, and more

A summary of some of the latest financial technology news.

Most read

- Chris Edmonds takes the reins at ICE Fixed Income and Data Services

- Deutsche Börse democratizes data with Marketplace offering

- Waters Wavelength Podcast: Broadridge’s Joseph Lo on GPTs