Not Your Granddad’s Surveillance

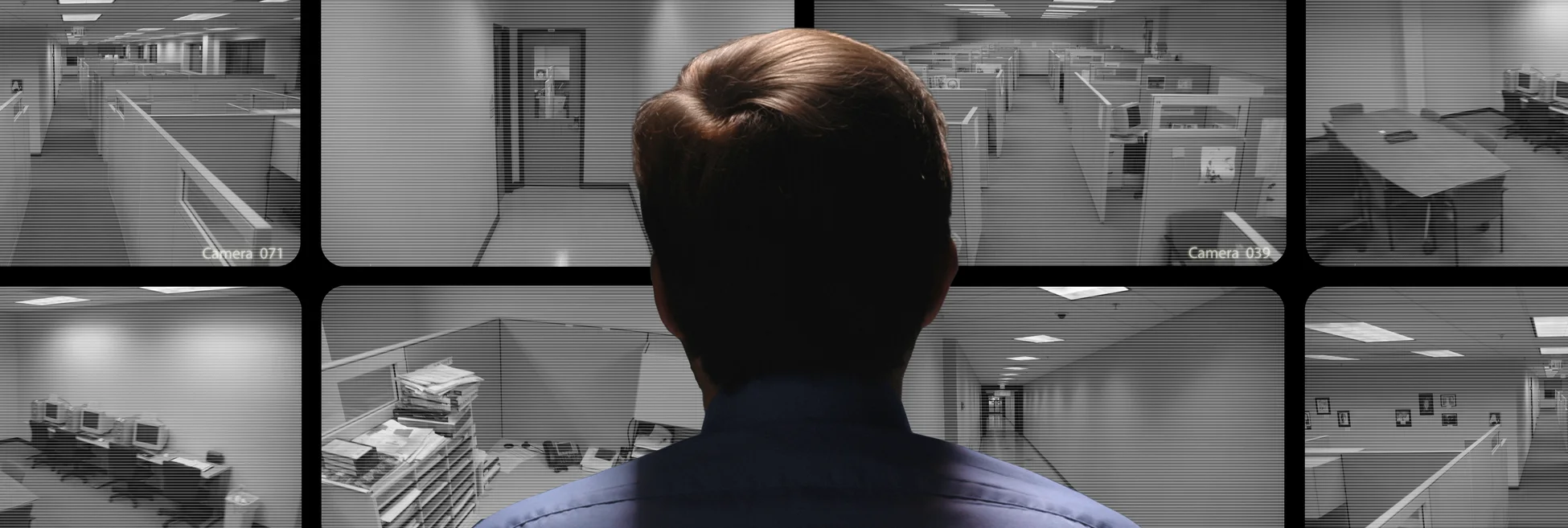

For years, sophisticated data monitoring and analytics have been a key component of developing trading strategies. Now, as Joanne Faulkner discovers, firms are taking approaches first developed for use by traders and turning the tables, and are using them outside the trading flow to monitor the traders themselves.

Financial institutions have traditionally only been able to put in place solutions that are fragmented and focus on distinct specialisms, such as analyzing transactional data, or voice and electronic communications, with only limited “joining the dots” between the data points. However, technology advancements are not only allowing institutions to monitor more data, more quickly, but are also expanding the scope of the data they can assess.

“When we look at the way misconduct has happened in the

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@waterstechnology.com or view our subscription options here: http://subscriptions.waterstechnology.com/subscribe

You are currently unable to print this content. Please contact info@waterstechnology.com to find out more.

You are currently unable to copy this content. Please contact info@waterstechnology.com to find out more.

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Printing this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@waterstechnology.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Copying this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@waterstechnology.com

More on Emerging Technologies

Waters Wavelength Podcast: Broadridge’s Joseph Lo on GPTs

Joseph Lo, head of enterprise platforms at Broadridge, joins the podcast to discuss AI tools.

Man Group CTO eyes ‘significant impact’ for genAI across the fund

Man Group’s Gary Collier discussed the potential merits of and use cases for generative AI across the business at an event in London hosted by Bloomberg.

BNY Mellon deploys Nvidia DGX SuperPOD, identifies hundreds of AI use cases

BNY Mellon says it is the first bank to deploy Nvidia’s AI datacenter infrastructure, as it joins an increasing number of Wall Street firms that are embracing AI technologies.

This Week: Linedata acquires DreamQuark, Tradeweb, Rimes, Genesis, and more

A summary of some of the latest financial technology news.

Systematic tools gain favor in fixed income

Automation is enabling systematic strategies in fixed income that were previously reserved for equities trading. The tech gap between the two may be closing, but differences remain.

Euronext microwave link aims to cut HFT advantage in Europe

Exchange plans to level playing field between prop firms and banks in cash equities with cutting edge tech.

Why recent failures are a catalyst for DLT’s success

Deutsche Bank’s Mathew Kathayanat and Jie Yi Lee argue that DLT's high-profile failures don't mean the technology is dead. Now that the hype has died down, the path is cleared for more measured decisions about DLT’s applications.

‘Very careful thought’: T+1 will introduce costs, complexities for ETF traders

When the US moves to T+1 at the end of May 2024, firms trading ETFs will need to automate their workflows as much as possible to avoid "settlement misalignment" and additional costs.

Most read

- Chris Edmonds takes the reins at ICE Fixed Income and Data Services

- Deutsche Börse democratizes data with Marketplace offering

- Sell-Side Technology Awards 2024: All the winners