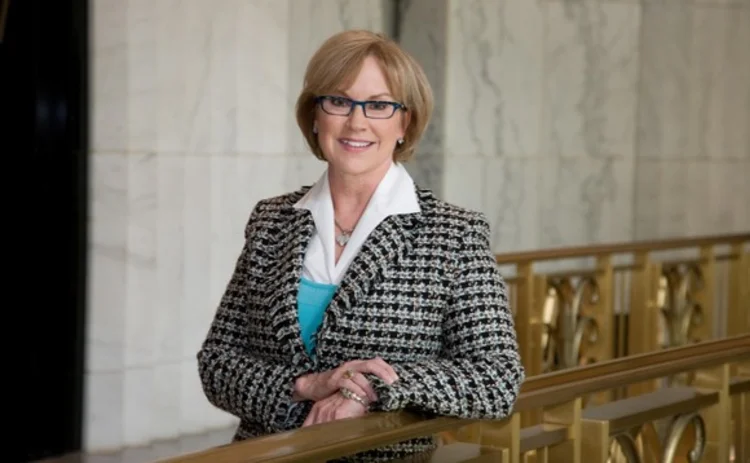

Bank of America's Catherine Bessant: All Business

Catherine Bessant speaks to Anthony Malakian about her rise to the top of the technology stack at B of A, and explains why it's not essential for CIOs to be 'techies.'

To be or not to be a technologist: That was never the question for Catherine Bessant—at least not when she was in college.

When Bessant was attending the University of Michigan, she was enveloped in the world of literature. She was an English major with a focus on the writings of William Shakespeare. By the year 2011, Bessant figured at the time that she would still be in Ann Arbor, but instead of being the student, she would be the teacher of all things iambic pentameter.

And then—a year away from graduating—Bessant’s father gently reminded her that she would be footing the bill for graduate school. With a cold splash of reality, being an expert on Shakespearean characters didn’t seem so appealing anymore.

So Bessant changed course and enrolled in Michigan’s Business School, where she received a bachelor’s degree in business administration. She was recruited out of college by First National Bank in Dallas—still far away from technology—where she was pulling in about $21,500 a year, which was a lot more than most any English major was earning straight out of college.

On the Move

In 1982, at a time when there were few women corporate bankers, Bessant moved on to Bank of America. She rose up through the ranks at BofA with stints in consumer real estate and community development banking, and small business. She was the president of Bank of America’s Florida operations and was even the firm’s chief marketing officer. Most recently, she was president of global corporate banking after moving over from the global treasury services and global product solutions group—her first taste of technology.

It took many people by surprise when newly minted BofA CEO Brian Moynihan named Bessant to the role of global technology and operations (GT&O) executive, where she would be responsible for delivering end-to-end technology and operations across the company. She would report directly to Moynihan, who added her to the company’s 15-person executive committee.

But the question remains: How did an English major land one of the most coveted roles in financial services technology? The answer lies at the heart of what Bank of America has become—a behemoth with a bevy of operations.

Size Matters

Much of what Bessant does centers on the bank’s retail banking operations such as mobile banking, and corporate initiatives such as reducing the company’s carbon emissions. Bank of America’s headquarters are far from Wall Street—Bessant works out of the firm’s office in Charlotte, North Carolina—but the bank proved to be a significant player on the Street when it stepped in to rescue Merrill Lynch from the tumult of the 2008 financial storm. And BofA’s scale is impressive: Bessant’s GT&O organization operates in 35 countries and has nearly 110,000 employees and contractors worldwide.

Bessant’s job—even before she took the position—became far more global after the Merrill Lynch acquisition. Merrill had a wide sphere of operations and adding the investment bank's business created a whole new ballgame for BofA.

“On the operating side, we always had a reasonable presence outside of the US—not so much in credit and in investment banking, but our payments and cash management businesses always had a strong presence outside of the US,” Bessant says. “But what Merrill brought was a real presence and with that presence came a program of upgrading our systems.”

The Merrill Lynch Factor

What Merrill also brought to the table were impressive, robust trading platforms and talented technicians, according to Bessant.

“Merrill Lynch had a long history of sustained investment in technology and platforms. Bank of America had grown through a period of rapid acquisition—merger and acquisition integrations had been the bulk of the work within the Bank of America organization. What Merrill offered in the wealth management business and in global markets, sales and trading, were world-class platforms that had been well invested in over time,” she says.

“Merrill Lynch really helped us leapfrog in certain businesses—institutional and wealth management—the caliber of our platforms. Most, but not necessarily all, of the Bank of America platforms will be merged into legacy Merrill platforms,” says Bessant.

While BofA has struggled to keep some of Merrill’s top rainmakers, Bessant confirms that the bank was not only able to retain Merrill’s top technologists, but had also poached talent from other major investment banks on Wall Street.

BofA itself piggybacked on this talent influx and began investing in the technology team a couple years ago, Bessant says.

“Over the last two years we have aggressively built technology talent within the organization,” she says. “So we have more capability to produce outcomes in-house and a much better capability to evaluate third-party applications and solutions. I feel like we’re much closer to getting toward the objective we’re after.”

Not Necessarily a Man’s World

Scale of operations and a winding path to technology are not the only things that make Bessant unique from other Wall Street tech heads—she’s also a woman, which is a rare find in this industry.

Even among Bessant’s own internal ranks, she’s clearly a trend-setter. About half of the top 3,000 employees of GT&O are women, she says. That number drops off precipitously at the upper echelons of the group, however. Of the technologists who report directly to Bessant, only one is a woman. It’s a bit disconcerting, although it should be noted that outside of technology, BofA has an impressive roster of women heading the organization.

“It doesn’t take long in the technology space to realize that there aren’t enough women,” she says. “I’ve made a huge push to support the activities both inside and outside the company aimed at increasing the proportion of women in the math and technology spaces.”

Bessant has taken her role as a female leader very seriously. She is active in a group called Women in Technology & Operations, which helps with career development and is designed to both attract new women to the company and keep them throughout the duration of their careers, just like Bessant.

Great Responsibility

Bessant has clearly earned her spot in an industry that can be construed as a Boys’ Club. Her performance will determine whether she stays there.

When she first signed on to lead GT&O, her main concern was the vastness of the organization and how she would keep all these businesses running at maximum capacity. But those fears dissipated. Now she worries about using technology to reduce risk and create efficiencies. The questions that occupy her now are: Is the firm moving fast enough to improve? Does her team have enough urgency in its actions? Does the group have the right talent in place?

Of the major projects she has under way, Bessant points to three specific areas of improvement: reducing risk, increasing efficiencies, and helping to grow the various business units throughout the organization.

Under the risk reduction mantra, BofA is working to redesign its entire data strategy. The firm is at the beginning stages of re-architecting its platforms to bring simplification to some of the more complex systems in the firm, Bessant says.

The current regulatory environment has helped in this push, as well, she explains. “What the regulatory environment has done is make our appetite for data voracious because the regulatory appetite for data is voracious,” she says.

The endgame, which is still years away—as these projects tend to be ongoing—will allow the bank to deliver information that is repeatable, reliable, timely, accurate and complete, says Bessant.

Additionally, BofA is replacing its legacy systems throughout the bank. Bessant reiterates that most, but not necessarily all, of the Bank of America platforms will be merged into legacy Merrill platforms over the coming months and years.

On the efficiency end, the firm is digging through its manual processes to find anything that can be automated.

BofA is also looking at “anything” that can be consolidated in order to reduce, for example, four systems or processes down to one.

Means to an End

The results of these initiatives will—Bessant hopes—create capacity, scalability, and further room for investment to help grow the various businesses.

She views solving these problems as not that of a technological roadblock—they’re business problems to be overcome, she says. She sees technology as a means to an end goal, rather than a destination. “I wouldn’t say that it was daunting at first—it was more a re-framing of how I look at the business,” Bessant recalls. “There was obviously a big learning curve, but like I said, the complication of how to apply technology at Bank of America is about the business issues, not so much about the technology or code or infrastructure or architecture. I can’t write code. I frequently design datacenter structures on the back of a napkin—much to the horror of my team—so I do know more than enough to be dangerous. But far more important is how technology integrates into the company and for that, my background has been very helpful.”

With the worst of the 2008–2009 financial crisis now in the rear-view mirror, Bessant says her team can turn its attention to those longer-term projects, rather than simply firefighting. “I think that we’re about to head into one of the most exciting periods for the bank in technology and operations because we’ll have the time to pay attention to doing things right and to capitalize on growth and to fix the things that need to be fixed,” she says.

The Next Act

The answer to the earlier question about how Bessant landed such a high-ranking tech position is simple: complexity.

If you’re going to run technology and operations for a vast business like BofA, you have to understand the company’s entire business. Bank of America is much more than simply the sum of its parts—mortgage loans, retail and investment banking, high-frequency trading, corporate lending, and so on—and you need more than just a technologist’s acumen to lead the group. But at the same time you must obtain a strong understanding of technology. This is a job designed for a well-rounded individual.

“I didn’t plan it this way, but from where I sit now, I’ve had the opportunity to touch on almost every part of the business that we have,” Bessant says. “I have a strong sense of what customers want and I understand the demands of running a P&L because I’ve done those things.”

Bessant is only 18 months into her new role as head of technology and operations. Her story of success, or failure, has yet to be written—and as many BofA executives have learned recently, no job is permanent at such a complex institution; just ask Kenneth Lewis.

But Bessant, who has spent about 30 years at Bank of America, believes that unlike one of Shakespeare’s tragedies, this play will have a happy ending.

“I feel like my greatest business success is yet to come—I’ve always felt that way. At 51, while I have a lot to be proud of, I feel my greatest accomplishment is yet to come,” Bessant says. “What I hope is, and what I believe it will be, is that I’ll be a part of a team that successfully executes on our vision to be the best financial institution in the world. To me, that’s a tangible thing: We can see it, we know that we have the right capabilities in the company to do it, and being a part of that will be my greatest accomplishment.”

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@waterstechnology.com or view our subscription options here: http://subscriptions.waterstechnology.com/subscribe

You are currently unable to print this content. Please contact info@waterstechnology.com to find out more.

You are currently unable to copy this content. Please contact info@waterstechnology.com to find out more.

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Printing this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@waterstechnology.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Copying this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@waterstechnology.com

More on Emerging Technologies

S&P debuts Spark Assist genAI copilot, draws up ‘Blueprints’ of combined datasets

S&P’s Kensho subsidiary has rolled out new emerging tech products leveraging AI to explore and combine the vendor’s wealth of datasets to solve common use cases.

Nasdaq reshuffles tech divisions post-Adenza

Adenza is now fully integrated into the exchange operator’s ecosystem, bringing opportunities for new business and a fresh perspective on how fintech fits into its strategy.

Liquidnet sees electronic future for gray bond trading

TP Icap’s gray market bond trading unit has more than doubled transactions in the first quarter of 2024.

Verafin launches genAI copilot for fincrime investigators

Features include document summarization and improved research tools.

Waters Wrap: Open source and storm clouds on the horizon

Regulators and politicians in America and Europe are increasingly concerned about AI—and, by extension, open-source development. Anthony says there are real reasons for concern.

Waters Wavelength Podcast: Broadridge’s Joseph Lo on GPTs

Joseph Lo, head of enterprise platforms at Broadridge, joins the podcast to discuss AI tools.

Man Group CTO eyes ‘significant impact’ for genAI across the fund

Man Group’s Gary Collier discussed the potential merits of and use cases for generative AI across the business at an event in London hosted by Bloomberg.

BNY Mellon deploys Nvidia DGX SuperPOD, identifies hundreds of AI use cases

BNY Mellon says it is the first bank to deploy Nvidia’s AI datacenter infrastructure, as it joins an increasing number of Wall Street firms that are embracing AI technologies.

Most read

- Chris Edmonds takes the reins at ICE Fixed Income and Data Services

- Deutsche Börse democratizes data with Marketplace offering

- Waters Wavelength Podcast: Broadridge’s Joseph Lo on GPTs