Why recent failures are a catalyst for DLT’s success

Deutsche Bank’s Mathew Kathayanat and Jie Yi Lee argue that DLT's high-profile failures don't mean the technology is dead. Now that the hype has died down, the path is cleared for more measured decisions about DLT’s applications.

With generative AI dominating headlines and captivating capital spend, distributed-ledger technology (DLT)/blockchain has taken a back seat.

Ever since its arrival on the world stage, DLT has promised much—to disintermediate, standardize and transparentize legacy processes within financial markets. Nevertheless, it has failed to make a long-term dent as a budgeting priority.

Skepticism remains high as the 2022–2023 crypto turmoil cast a shadow of doubt not just on cryptocurrencies, but also on the future of DLT. For proponents, though, the upheaval served as a silver lining, filtering out superficial “memes” and marking a significant step toward a maturing technology.

Amid these divergent beliefs, a pertinent question arises—is DLT merely a transient hype destined to fade, or are we navigating a prolonged evolution, akin to the gradual ascent witnessed by breakthroughs like AI and cloud computing before it emerges as an indispensable enabler powering the financial system?

Darwinism in technological development

Like biological species, technologies gradually evolve over a prolonged period to adapt to the ever-changing market. Those with features deemed desirable by its users are systematically favored for mass adoption while others fade into obsolescence.

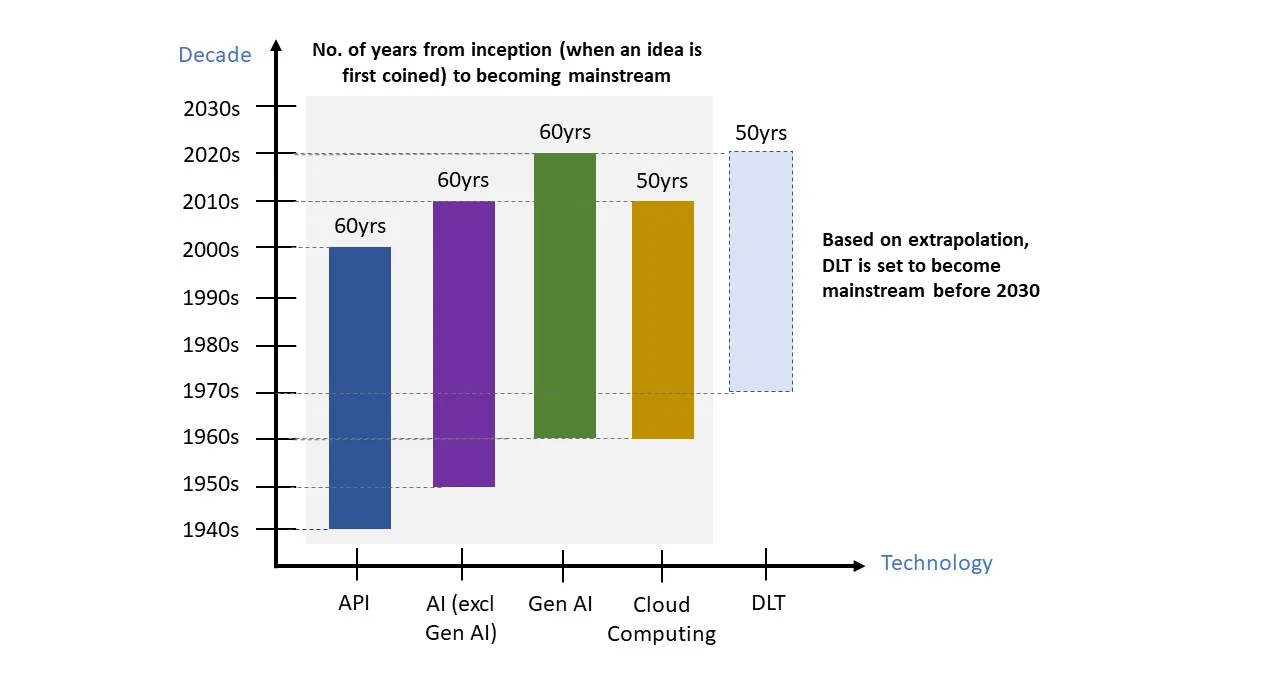

In a study of recent breakthroughs (Fig 1), it takes approximately 50–60 years from inception (when an idea is first coined) to wide adoption. While the concept of DLT was only recently popularized by the invention of bitcoin in 2009, the idea dates far back into the 1970s–1980s. If DLT were to follow in the footsteps of its predecessors, we should expect it to become a core component of enterprise technology stack before 2030.

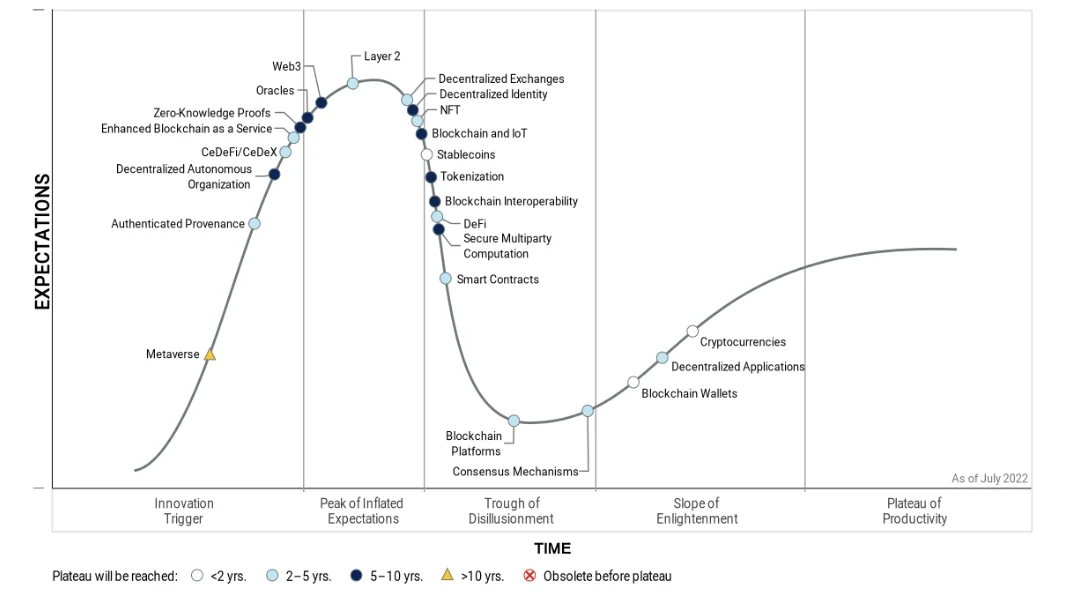

Gartner’s Hype Cycle for Blockchain has a similar timeline (Fig 2). As of July 2022, blockchain platforms stand at the “Trough of Disillusionment,” where enthusiasm starts waning and realities around implementational challenges come crashing. Nevertheless, the cycle suggests that an upturn is imminent and mainstream adoption (“Plateau of Productivity”) could take off in two to five years.

Unraveling the present landscape

Within capital markets, the majority believe that the timeline is achievable after witnessing how quickly DLT has evolved beyond mere proofs-of-concept, with a minority expecting it to deliver after five years. Thirty-nine percent of the industry is now live with DLT, with 75% of the projects delivering as expected and 39% in revenue-generation stage. To no surprise, cost savings and efficiency gains came in as the top motivators.

DLT as category killer for mainframes

Post-trade, in particular, has been grappling with its labyrinthine network of intermediaries, each with their own archaic systems incapable of seamlessly communicating with one another to provide a unified view. Like a ticking bomb, these decades-old infrastructures are on the brink of breakdown, having endured countless makeshift upgrades to meet fast-changing demands.

DLT emerges as the long-awaited lifeline, amalgamating ecosystem players onto a shared database, offering real-time visibility into a single source of truth that automatically reconciles through smart contracts.

Some DLT projects, like Synapse by Hong Kong Exchanges and Clearing (HKEX), Spunta Banca DLT by Italian Banking Association, and Calastone’s global Distributed Market Infrastructure achieved success, while others like the CHESS replacement project by Australian Securities Exchange (ASX), faced setbacks.

Fit for purpose or fit for use?

Critics argue that the termination of ASX’s DLT project unveiled the harsh truth of DLT’s inevitable downfall, whereas successful applications were perceived as one-trick ponies designed for niche use cases.

However, not all DLTs are created equal, and one needs to distinguish between a technology that is not fit for purpose from one that is not fit for use. While a technology that is incapable of addressing pain points to fulfill desirable outcomes (not fit for purpose) can never be fit for mainstream use, the inverse may not be true—the cause of DLT project failures may have nothing to do with the effectiveness of the technology. Clear and deeper understanding of where DLT can be applied is important to address the problem statements and avoid disappointments.

Take for instance the Spunta Banca DLT, an epitome of DLT’s “fit for purpose” and “fit for use” in creating a single source of truth within a complex ecosystem, and its ability to perform automation at scale. Since 2020, 91% (over 100) of Italian banks have been leveraging DLT for interbank reconciliation, processing more than 300 million transactions annually with an automatic match rate of 98.2%. When operating at full capacity, the infrastructure can process an astounding 8.4 billion transactions.

Given this usability, one would think it would be simple to replicate the same model and benefits to securities processing. However, the cessation of ASX’s DLT project shows that a technology that has proven to be fit for purpose does not necessarily translate to fit for use. The choice of an unfitting DLT type and other non-technological issues can cause failures too.

Accenture’s analysis of the project unveiled that “workflows weren’t tailored for a DLT environment, designs were haphazard, and issues around latency and concurrency persisted.” As project mismanagement was amplified in the face of nascent and complex technology at the time of inception, the seven-year-long journey culminated in a retrogression to traditional databases and served as an important lesson learnt for future implementations.

On the other hand, HKEX, which had engaged the same technology partner, Digital Asset, as ASX, reiterated DLT’s fit for purpose in the securities space. Instead of attempting a full-scale overhaul of its post-trade infrastructure with DLT—as in the case of ASX—HKEX had a clear, targeted goal of standardizing and streamlining its settlement instruction workflows to enable concurrent processing.

HKEX also ensured that Synapse is interoperable with traditional infrastructure via GUI, API and ISO 20022 Swift, enabling ecosystem players, regardless of whether they are on DLT, to seamlessly plug and play into the platform for efficient integrations. The success of Synapse in challenging the status quo by transitioning from sequential to concurrent processes marks a momentous stride toward transforming global trade processes.

As the varying outcomes suggest, while DLT may have proven its efficacy within financial markets, careful and expert deliberation of its design, given current technical limitations, is critical to finding its place within existing setups and avoiding costly adjustments in the future.

Variables of influence

Beyond careful product design and sound project management, the fate of DLT hinges on several other factors.

The chicken-and-egg problem remains to be the toughest hurdle—the industry waits to benefit from the network effect of DLT, yet no one wants to be the early mover to grow the network. Drawing lessons from the history of share dematerialization, a major transition within capital markets is incumbent on a concerted effort between regulators, depositories and exchanges to provide standardized and regulatory-compliant infrastructure on a mutualized basis.

Leading this charge, DTCC, the world’s largest central securities depository (CSD), initiated Project Ion with the aim of providing a resilient, secure and scalable platform capable of supporting a T+0 settlement cycle. Currently running as a record-keeping book for over 160,000 bilateral equity transactions daily in parallel with DTCC’s existing settlement system, the minimum viable product (MVP) pilot has successfully demonstrated its scalability.

However, as a multi-year phased project governed by the consensus of hundreds of stakeholders, its full benefits will only materialize over several years. If successful, Project Ion has immense potential to supercharge DLT transition within equity markets and serve as a blueprint for the rest of the capital market.

In the meantime, we expect to see positive developments in the digital cash leg in the next one to two years, which when combined with tokenized securities, will pave the way for true digital DVP and a new era of capital markets.

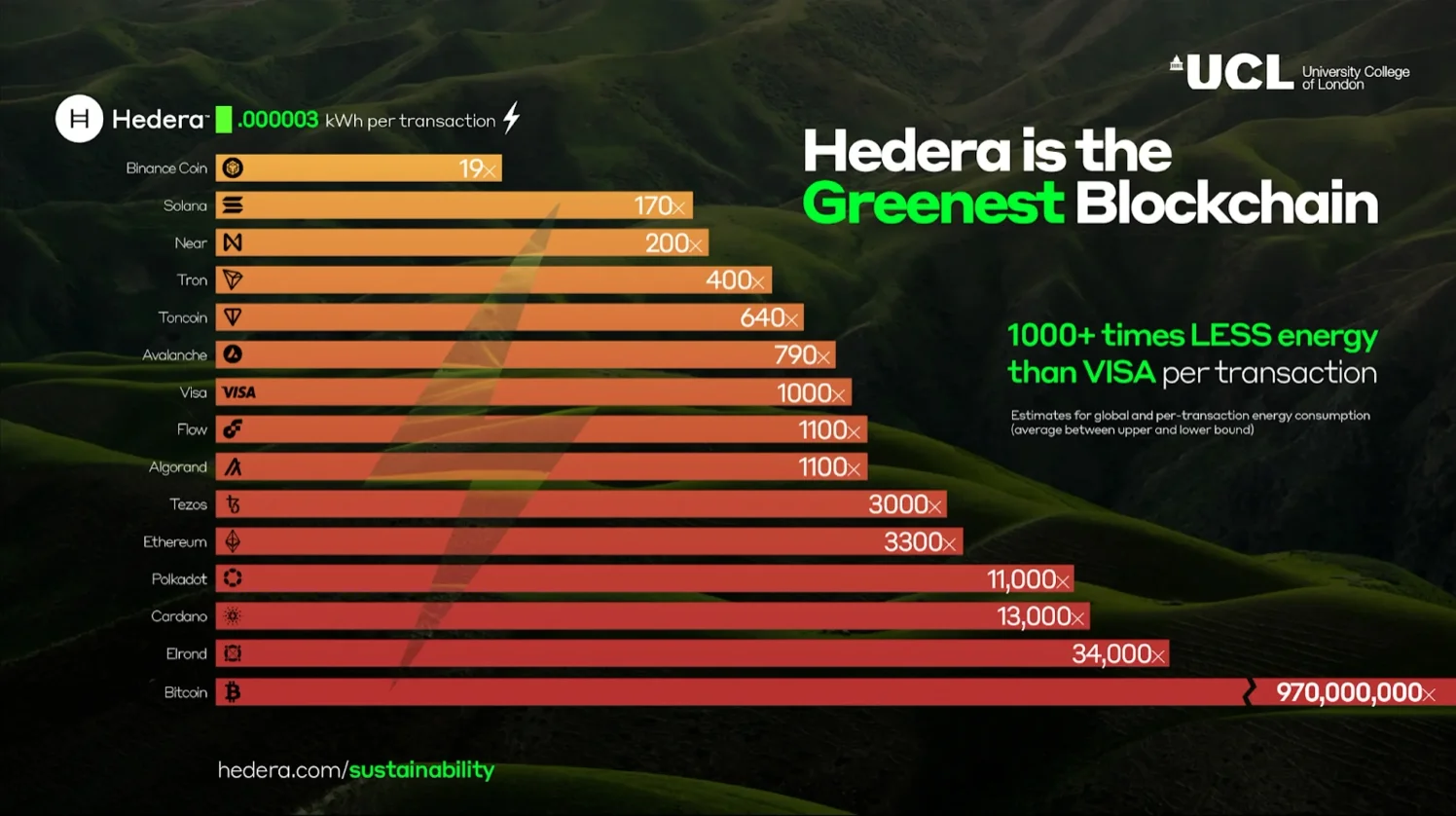

In a world that is progressively moving toward net-zero, DLT transition may be frowned upon as public DLTs are perceived to be particularly energy-intensive given their close association with bitcoin. To the contrary, a study by UCL Centre for Blockchain Technologies (Fig 3) found that the 7 DLTs are “greener” than Visa, with the Hedera blockchain using just 0.000003 kWh per transaction, or the equivalent of 0.1% of Visa’s.

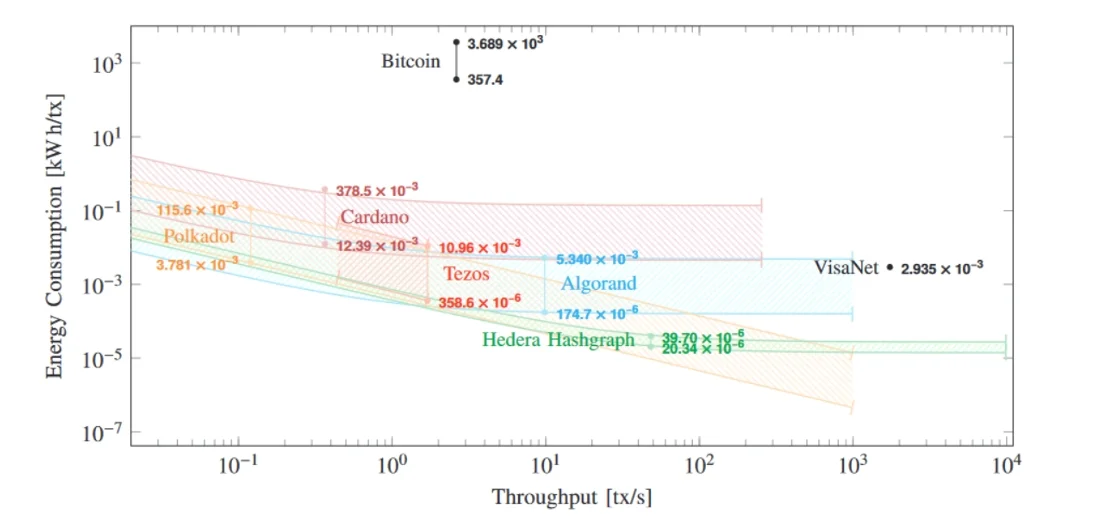

Even after considering the impact of higher throughputs (number of transactions completed per second) on energy consumption per transaction, several proof of stake (PoS) systems are found to remain energy efficient, with some still consuming less energy than VisaNet at the same level of throughput (Fig 4). Should the likes of Ethereum and other mainstream DLTs move up the “green ranking,” it could help further justify the case for the transition.

Lower boundary for each curve indicates the energy consumption under an optimistic validator hardware assumption while the upper boundary indicates a pessimistic scenario. The 2 points per DLT indicate the latest observation.

VisaNet is the main electronic payment processing system of Visa.

While smart contracts are key to realizing new value from the programmability offered by DLT, smart contract coding remains a specialized work of art mastered by a small pool of programmers. So before we can scale DLT into application networks for high performance and 24/7 availability, we first need to build up a robust pool of readily accessible DLT experts.

Finally, it is essential to recognize that as we tread through this arduous journey, other technologies are evolving concurrently, if not at a faster rate. It is therefore crucial to pre-empt future risks to DLT such as quantum computing and embark on early preventive measures. Integrating quantum-resilient measures during DLT infrastructure design by referencing forthcoming standards from the National Institute of Standards and Technology (Nist) is a prudent starting point for future-proofing.

A potential enduring force

While interest in DLT seems to wane, it does not necessarily signify failure; rather, the hype has diminished to make way for clearer decisions about DLT’s applications and the story is still unfolding. Lessons have been learned, expertise has become more accessible, and the technology continues to mature. DLT may not have yet revolutionized many facets of the financial market at present, but it has undoubtedly left an indelible mark on how financial systems can be transformed and continues to promise a brighter future.

Whether DLT will overcome recent failures to emerge as a success story rest in the hands of the market—it is not about where DLT is now, but where the market dares to take it.

Jie Yi (Jaelynn) Lee is a graduate analyst at Deutsche Bank. Mathew Kathayanat is head of product and securities services for Asia-Pacific at Deutsche Bank.

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@waterstechnology.com or view our subscription options here: http://subscriptions.waterstechnology.com/subscribe

You are currently unable to print this content. Please contact info@waterstechnology.com to find out more.

You are currently unable to copy this content. Please contact info@waterstechnology.com to find out more.

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Printing this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@waterstechnology.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Copying this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@waterstechnology.com

More on Emerging Technologies

How Ally found the key to GenAI at the bottom of a teacup

Risk-and-tech chemistry—plus Microsoft’s flexibility—has seen the US lender leap from experiments to execution.

The IMD Wrap: Beginning of the end for data audits?

This week, there’s exciting news for data bean-counters in the form of a partnership between two vendors that could change the way we view and track data usage and audits.

S&P debuts Spark Assist genAI copilot, draws up ‘Blueprints’ of combined datasets

S&P’s Kensho subsidiary has rolled out new emerging tech products leveraging AI to explore and combine the vendor’s wealth of datasets to solve common use cases.

Nasdaq reshuffles tech divisions post-Adenza

Adenza is now fully integrated into the exchange operator’s ecosystem, bringing opportunities for new business and a fresh perspective on how fintech fits into its strategy.

Liquidnet sees electronic future for gray bond trading

TP Icap’s gray market bond trading unit has more than doubled transactions in the first quarter of 2024.

Verafin launches genAI copilot for fincrime investigators

Features include document summarization and improved research tools.

Waters Wrap: Open source and storm clouds on the horizon

Regulators and politicians in America and Europe are increasingly concerned about AI—and, by extension, open-source development. Anthony says there are real reasons for concern.

Waters Wavelength Podcast: Broadridge’s Joseph Lo on GPTs

Joseph Lo, head of enterprise platforms at Broadridge, joins the podcast to discuss AI tools.

Most read

- Chris Edmonds takes the reins at ICE Fixed Income and Data Services

- Deutsche Börse democratizes data with Marketplace offering

- Nasdaq reshuffles tech divisions post-Adenza