SocGen's New Lease: CTO Bob Schmeider Prepares a Built-to-Spec New York Trading Floor

On January 20, 2008, Bob Schmeider was off to a quiet start, early—he likes to be in the office by 6:30—driving to a morning meeting across the Hudson River with a reliable cycle of news, weather, and sports on the radio. His BlackBerry began to light up; soon it was unstoppably abuzz. The news came back around with Société Générale leading headlines as the day quickly became the one a CTO never wants to face, but always has to prepare for. The world, Schmeider included, was learning the name of Jérôme Kerviel and the details of a €4 billion ($5.8 billion) rogue trading scandal that would take five years to resolve.

France’s second-largest financial group—one that favors assured reserve over Wall Street bombast—was in for a period of introspection and, from a technical standpoint, radical change. “People were really angry and for me it was an unexpected, if understandable, reaction—to have worked so hard, and feel that it was all undone so quickly,” says Schmeider, Americas CTO of the firm’s Corporate and Investment Banking (SG CIB). For the first time, he came to feel for the company he had joined nearly a decade earlier.

In that event’s aftermath, the bank rallied with resolve to learn hard lessons, and SG CIB—including its Delta One desk, the scene of the scandal—remains one of the world’s great equity derivatives houses. As it increasingly leverages that strength in North America, one part of the strategy involves a new, built-to-spec trading floor in New York—a task that has occupied Schmeider for about three years—as the bank moves into Bear Stearns’ former head offices near Grand Central Terminal this July.

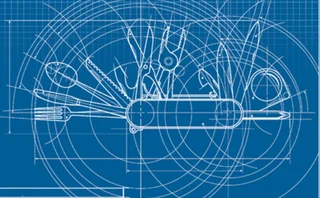

With that project, wholesale reorganization of the firm’s data and virtualization strategies are on tap. Breaking infrastructure components down and reconfiguring them, as if molecules in a compound, is not for everyone—not even for all technologists. But for a chemical engineer like Schmeider, it’s tailor-made.

Rote Processes

A graduate of New York’s Cooper Union for the Advancement of Science, Schmeider has spent a career tracking infrastructure foot-by-foot, though not always in finance. While at Cooper, his most memorable experience wasn’t tackling advanced organic chemistry—rather, it was surviving a meandering discussion of James Joyce’s Ulysses in one of the school’s required humanities classes, which feature an eclectic mix of its engineering, architecture, and art students. “The engineers just wanted to get back to working formulas and equations,” he recalls.

“Here more than Europe, we’re in a permanent physical race to market to implement and take advantage of an opportunity first. So for me, it’s about time to delivery down to the switch and server level, moving capabilities faster at our co-locations with sufficient fault-testing and minimal human error.” —Bob Schmeider

At its heart, chemical engineering is about the physical process of making things—using rote processes that account for phenomena like fluid dynamics to manufacture and design everything from biotechnology to sprawling industrial complexes. Many chemical engineering applications are in pharmaceuticals, and after graduation, Schmeider was looking in that direction—instead, he ended up at Intergraph, a firm that uses computer-aided design (CAD) layered with data-driven intelligence to measure utility operations.

Working on a project amidst the glamour of a Midtown Manhattan Con Edison steam plant, the CTO first wrapped his head around computational—rather than chemical—systems. A few years on, jumping to a new role at Barclays Capital brought with it a crash course in the capital markets.

“It would be fair to say I’ve learned a lot on the fly,” Schmeider says. “At BarCap, I remember working on the foreign-exchange desk with an early customized foreign exchange (FX) rates system—where instead of just spots and forwards, traders could plug in timeframes. I was working with a counterpart in London, and realized I didn’t really know what it all meant, so I enrolled in FX classes at New York University to become more comfortable telling a trader what the system does, rather than only about the technology behind it. That was a turning point in understanding what a client, especially an internal financial services client, wants.”

Climbing Mountains

Around the same time, SG CIB pioneered exotic options—known in the industry as “mountain ranges”—as it built out its equity derivatives business in 1997 with “Everest,” a basket of 10 stocks that guarantees 100 percent return of the worst-performing stock after a pre-established duration of time. Since then, its global equity flow products and advisory, most of which serve complex hedging strategies, have grown to become some of the world’s strongest, with SG CIB accounting for about 8 percent of market share on Euronext.

Exotic options are taxing from a performance perspective. Many of SocGen’s products can only be properly priced using Monte Carlo simulations that are now more widely used for risk management. The result, says Thomas Droumenq, US head of equity flow, is that the computing power of SG CIB—one of the sell side’s first and more active users of graphical processing units (GPUs)—was boosted early on, so much so that it is said to rival and have briefly surpassed the famed computing capacity of Météo-France, the French meteorological service.

The same quality is required of SocGen’s algorithmic execution offerings. “I would say about 10 percent of our customers have some kind of customization,” says Richard Johnson, head of US quantitative electronic services. “Flexible technology architecture is vital to being able to offer that tailored service. We can turn around simple customizations—such as opting out of certain execution venues—within minutes. More complex ones may take a day or two; occasionally, we receive a complex request that requires longer-term consultation with our quants.”

Two-Way Flow

As both services have steadily made their way across the Atlantic, Schmeider, who joined SG CIB in 2000, has seen a variety of roles, culminating with CTO in 2007, and from the very start his objective was to bring form to a rapidly expanding operation. “We were an incredibly siloed organization when I first arrived—to the point where our datacenter cabinets were labeled off by individual IT staff members’ names,” he says. “I wish I had a picture of it: Everyone treated theirs differently, and depending on how they managed their three rows, it was either really nice, or a disaster.”

How things change. SG CIB’s North American personnel working on infrastructure, alone, has grown to about 100 in New York, matched by a dual-language presence in Montreal. “Because of our size, our North American presence makes us a great case study. It’s interesting culturally: Our US trading floor always asks for solutions faster, while the home office in the La Défense district in Paris wants us to add some form and workflow around what we develop, to eventually push it out globally,” he says.

The result is a managed, two-way flow: On one hand, Schmeider initiated NetApp’s cloud platform adoption in New York and firm-wide implementation of a bring-your-own-device (BYOD) mobile strategy last year, with European privacy rules more difficult to navigate. On the other, investment tools first developed in Paris—proprietary statistical arbitrage algorithms or the bank’s AlphaY internal crossing network that matches hedges, for example—often require subtleties around co-location and connectivity that reflect US market microstructure.

“In the US more than Europe, we’re in a permanent physical race to market to implement and take advantage of an opportunity first,” the CTO says. “So for me, it’s about time to delivery down to the switch and server level, moving capabilities faster at our co-locations with sufficient fault-testing and minimal human error.”

Transport Phenomena

Geography also comes into play with Schmeider’s largest current preoccupation: the move. The 2010 deal for SG CIB to lease Bear Stearns’ former space was one of that year’s largest in New York commercial real estate, and in anticipation of the move in July, the CTO now makes the 15-minute walk across Midtown regularly. Perhaps more important, though, is that as part of the move, the firm’s primary data infrastructure is currently being relocated to a Cervalis datacenter in Totowa, NJ, closer to SG CIB’s backup facility northeast of Manhattan.

“The Federal Reserve published updated post-9/11 recommendations on disaster recovery, with mileage between datacenters, so those were our initial guide as we decided the tolerable minimum and maximum distances, or radii, from the primary to secondary locations. As the previous distance was 23 miles, we decided to keep that as our minimum in order to be able to provide recovery in the event of a major disaster. The maximum distance was defined by our ability to maintain synchronous replication of data with a limited loss of speed. This led to a criteria of greater than 23 miles from the secondary facility and less than 60 fiber miles for the network, creating something akin to an acceptable ‘donut,’” Schmeider says.

“We moved our secondary in 2007, but even since then, I have been amazed how many more choices there are now,” he says. “We engaged consultants and did a full request-for-proposal (RFP) process, starting with 19 options, to determine the right fit. That piece alone was a sizeable investment, even if the distances narrowed the options down pretty quickly.”

Migrating physical servers and on-boarding the firm’s wider virtualization strategy has been organized in eight successive “waves” from December 2012 through this month—what amounts to a mini-business continuity plan in its own right, with SG CIB’s trading floor infrastructure moving last. Schmeider and Droumenq worked together extensively to iron out which equity-flow applications could be virtualized, with the eventual goal to allow a trader to access their workflow environment anywhere on the trading floor. They both agree the process will continue well after the final wave of the move is complete.

“Globally, our IT change processes are far more complex than in the past, with change windows smaller, intense coordination, and impact assessment of any change being critical. As far as we can take it, virtualization presents a huge opportunity to revamp what we do, whether operationally, in terms of sustainability, or also for combating external threats,” Schmeider says.

Forensic

More business flexibility, perhaps counter-intuitively, begets a need for greater technological monitoring and control. Droumenq and Johnson both say forensic-quality surveillance that Schmeider has overseen post-Kerviel—including dedicated personnel for email monitoring, tracking access to network-attached storage (NAS) servers, and software tools that detect where, when, and by whom any proprietary code is published across the system—stands to become more important as SG CIB further develops offerings built and iterated in concert with buy-side clients, rather than simply brokered.

US delivery of AlphaY, set for later this year, is one example; expanding application of algorithmic execution and direct market access (DMA) for futures is yet another. “Managing hedging risk or moving faster on opportunities, the inward-facing technology for our core business has become much less of an issue during Bob’s time here. As far as backing our structured products, we’ve mastered that,” Droumenq says. “Today, our challenge is always to better connect with clients, communicate with them and implement the outward-facing software.”

For Schmeider, it’s about keeping a watchful eye at a seemingly molecular level, and recruiting graduates, including engineers, who can design in anticipation of systematic weakness—or fraught human behavior—but who, like him, might not initially consider finance.

“Above all, what we need are people who can think processes through. We can almost always achieve what’s required technologically—the security afterward is the real challenge,” he says, explaining that data loss prevention (DLP) and regular checks and balances around permissioning and recertification are far more essential, if indeed less flashy, parts of any sell-side chief technologist’s job. As COOs and CTOs elsewhere have since found out, downplaying them comes at one’s own peril.

“The industry looked introspectively after Kerviel, and we learned from each other quite a bit, though clearly not always well enough. Managing technology infrastructure you never point a finger, so much as empathize and look after your own yard, knowing you could always be next.” In New York, SG CIB’s yard grows ever larger. As for the house itself, it’s been engineered by a knowing hand, ready to mark a new era.

Bob Schmeider Fundamental Data

Name: Bob Schmeider

Title: Americas CTO, Société Générale Corporate and Investment Banking (SG CIB)

Tenure: 13 years, became CTO in 2007

Number of Staff: About 100

Education: BS in chemical engineering, Cooper Union for the Advancement of Science and Art; MBA, St. John’s University

Activities: Mentor for both SG CIB and Columbia University’s Masters in Technology Management program

Family: Two daughters, the older studying architecture; the younger considering engineering

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@waterstechnology.com or view our subscription options here: http://subscriptions.waterstechnology.com/subscribe

You are currently unable to print this content. Please contact info@waterstechnology.com to find out more.

You are currently unable to copy this content. Please contact info@waterstechnology.com to find out more.

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Printing this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@waterstechnology.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Copying this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@waterstechnology.com

More on Emerging Technologies

Ice moves to meet demand for greater cloud, AI capabilities

The exchange also outlined competitive advantages behind managing its data and cloud strategy internally during its Q1 earnings call on Thursday.

FactSet looks to build on portfolio commentary with AI

Its new solution will allow users to write attribution summaries more quickly and adds to its goal of further accelerating discoverability, automation, and innovation.

How Ally found the key to GenAI at the bottom of a teacup

Risk-and-tech chemistry—plus Microsoft’s flexibility—has seen the US lender leap from experiments to execution.

The IMD Wrap: Beginning of the end for data audits?

This week, there’s exciting news for data bean-counters in the form of a partnership between two vendors that could change the way we view and track data usage and audits.

S&P debuts Spark Assist genAI copilot, draws up ‘Blueprints’ of combined datasets

S&P’s Kensho subsidiary has rolled out new emerging tech products leveraging AI to explore and combine the vendor’s wealth of datasets to solve common use cases.

Nasdaq reshuffles tech divisions post-Adenza

Adenza is now fully integrated into the exchange operator’s ecosystem, bringing opportunities for new business and a fresh perspective on how fintech fits into its strategy.

Liquidnet sees electronic future for gray bond trading

TP Icap’s gray market bond trading unit has more than doubled transactions in the first quarter of 2024.

Most read

- Chris Edmonds takes the reins at ICE Fixed Income and Data Services

- DTCC urges affirmation focus ahead of T+1 move

- FactSet looks to build on portfolio commentary with AI