CME, Google Ally for Cloud Market Data Access

The partnership will allow existing and potential subscribers around the world to access all CME Group data via a connection to Google Cloud.

CME Group is making real-time market data from all its marketplaces available via Google Cloud in a bid to expand its client base and the reach of its data by using a new connectivity model to simplify data access for end users.

“We are putting all our real-time data into Google Cloud, and converting all our Market Data Platform (MDP) channels into a Google service called Pub/Sub, so anyone can access them via Google from anywhere on the planet,” says Adam Honoré, executive director of data services at CME. “The specific use case for this is how do we take advantage of native cloud services to lower the barrier to accessing our data. … We are creating a low-cost global transport solution for all our market data.”

The initiative responds to customer demand to address the costs of transport, data ingest, compute power and storage. “We’ve done some work on compute and storage, and now we’re tackling transport, and ingest cost is on our roadmap,” Honoré says.

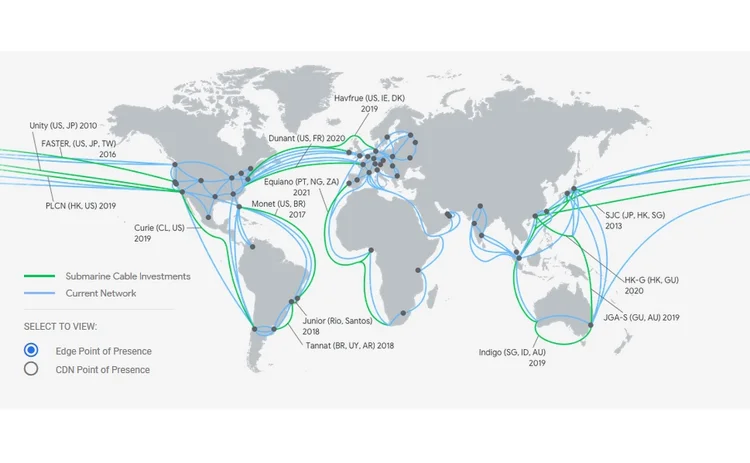

While financial markets connectivity has traditionally been the exclusive domain of specialist extranet providers, Google touts impressive credentials of its own: “We have the largest proprietary network in the world, and we continue to expand on that,” says Tais O’Dwyer, global director of financial services strategy and solutions at Google Cloud.

“Google Cloud has 20 regions [regional collections of datacenters], 61 zones [distinct compute, storage and networking resources across those regional datacenters], 134 network edge locations, and is available in more than 200 countries—plus, we’ve opened seven new cloud regions since 2018. When you think about the scale and ability to handle massive amounts of data, that’s part of our DNA. Our network and datacenters around the world have been designed to handle enormous amounts of data … at lightning speed,” she adds.

To enable the service, Google deployed a direct connect into CME’s datacenter in Aurora, Illinois, allowing CME to push data into its cloud, from where it can be accessed anywhere in the world with a connection to Google’s cloud. As a result, anyone with an existing license agreement for CME data and a Google Cloud account could connect to CME data within a day, using code from CME for connecting to Pub/Sub, Google’s cloud-based enterprise messaging middleware. New subscribers can license CME’s data via the exchange’s self-service entitlements portal.

“We maintain physical hubs in regions around the world, but we’re now extending that to anywhere with access to Google Cloud. We’ve expanded our network and capabilities with the same level of service across the world, while lessening the pain and cost of getting it there,” Honoré says.

The initiative’s cost structure also represents an experiment for CME: Though users must pay the normal fees for the data itself, instead of paying fixed charges for leased-line connectivity or rack space and cross-connects in datacenters, CME will charge a $1.49 fee per hour to access its data. While cloud access removes the need for dedicated backup and replay feeds, this model also provides the flexibility of being able to turn access on and off as needed.

The offering addresses the needs of both existing and potential clients: “We want to extend our global reach for direct connectivity. Clients say they want more direct relationships with the exchange. … But we also want new customers, so we want to make it as easy as possible for people to consume our data,” Honoré says.

The target client base for the new service runs the gamut of financial markets participants, though Honoré says it is initially aimed at firms with existing expertise in dealing with CME’s binary data format, such as software vendors, firms based outside the US, and those using CME markets for hedging.

“If you look at the ability Google has to provide real-time data around the world, this will generate interest from firms that don’t currently participate on CME’s marketplaces,” O’Dwyer says.

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@waterstechnology.com or view our subscription options here: http://subscriptions.waterstechnology.com/subscribe

You are currently unable to print this content. Please contact info@waterstechnology.com to find out more.

You are currently unable to copy this content. Please contact info@waterstechnology.com to find out more.

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Printing this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@waterstechnology.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Copying this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@waterstechnology.com

More on Data Management

Symphony boosts Cloud9 voice offerings with AI

The messaging and collaboration platform builds on Cloud9’s capabilities as it embraces the AI wave in what CEO Brad Levy calls “incremental” steps.

MSCI counts the cost of bank M&A, looks ahead to custom indexes, AI

Cancellations of overlapping contracts following a bank merger put a dent in MSCI’s earnings, but management remains upbeat about the potential of recent acquisitions and new technology developments.

Nasdaq reshuffles tech divisions post-Adenza

Adenza is now fully integrated into the exchange operator’s ecosystem, bringing opportunities for new business and a fresh perspective on how fintech fits into its strategy.

This Week: HKEx's new derivatives platform; GoldenSource; Quonian-SimCorp, and more

A summary of some of the latest financial technology news.

Chris Edmonds takes the reins at ICE Fixed Income and Data Services

Edmonds is now leading ICE’s fixed income and data business as the rush to provide better data and analytics in fixed income builds.

Deutsche Börse democratizes data with Marketplace offering

Deutsche Börse Group is set to unveil its Marketplace, a one-stop data shop designed to simplify and streamline data acquisition and consumption for its clients, while also surfacing data from across the firm to its own users. Jan Stiebing and Sven…

DSB says industry is ready to meet UPI mandate ahead of deadline

The Unique Product Identifier will be required for certain OTC derivatives in the EU at the end of April, following US adoption in January.

Mapping a successful data journey: strategy, execution and sustainability

A well-planned data journey can positively impact an organization’s long-term trajectory. However, it is important to have clarity not only in the strategy but also in successful execution and sustainability for the long haul, argues data veteran Subbiah Subramanian.

Most read

- Chris Edmonds takes the reins at ICE Fixed Income and Data Services

- Deutsche Börse democratizes data with Marketplace offering

- Nasdaq reshuffles tech divisions post-Adenza