Reading the Basel Tea Leaves

Months after the Basel Committee on Banking Supervision extended the timeline for compliance with Basel III capital adequacy requirements into phases running through 2019, the committee is now starting to fill in some of the gaps in the rules.

This week, the committee re-emerged with proposals on leverage ratios, collateral and derivatives exposures. Other than a concrete minimum of 3% for leverage ratios, which the committee is testing, the proposals are short on numbers and long on complex verbiage and formulas for determining aspects of capital adequacy.

Although the complexity of the language in these proposed Basel III provisions could conceal loopholes that legal experts might be more likely to find, a layman's reading uncovers statements that firms may not net collateral against derivatives exposures and must increase the calculations of their exposure based on how much collateral is in derivatives.

This appears to be an about-face—if not in scope, at least in temperament—from the committee's actions in January, when it allowed more types of securities to be counted as liquid assets and lowered thresholds for depositor exits.

What is the Basel Committee up to? The latest action apears to take a harder line on what can be counted toward capital adequacy. Its guidance in January on liquidity coverage ratios leaned toward leniency.

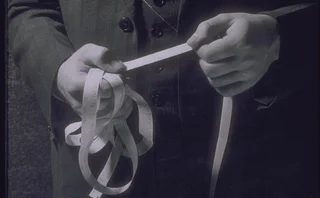

Watching from afar, these developments remind a US observer of the classic TV game show "To Tell The Truth." To play on that show's signature moment—will the real Basel Committee please stand up?

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@waterstechnology.com or view our subscription options here: https://subscriptions.waterstechnology.com/subscribe

You are currently unable to print this content. Please contact info@waterstechnology.com to find out more.

You are currently unable to copy this content. Please contact info@waterstechnology.com to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@waterstechnology.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@waterstechnology.com

More on Regulation

Nasdaq’s blockchain proposal to SEC gets mixed reviews from peers

Public comment letters and interviews reveal that despite fervor for tokenization, industry stakeholders disagree on its value proposition.

FCA files to lift UK bond tape suspension, says legal claims ‘without merit’

After losing the bid for the UK’s bond CT, Ediphy sued the UK regulator, halting the tape’s implementation. Now, the FCA is asking the UK’s High Court to end the suspension and allow it to fight Ediphy’s claims in parallel.

Treasury market urged to beef up operational resilience plans

NY Fed panel warns about impact of AI and reliance on critical third parties.

Technology alone is not enough for Europe’s T+1 push

Testing will be a key component of a successful implementation. However, the respective taskforces have yet to release more details on the testing schedules.

Waters Wavelength Ep. 338: BBH’s Mike McGovern

This week, Mike McGovern of Brown Brothers Harriman talks with Tony about the importance of open architectures and the need for better data management in this increasingly AI-driven world.

Plaintiffs propose to represent all non-database Cusip licensees in last 7 years

If granted, the recent motion for class certification in the ongoing case against Cusip Global Services would allow end-user firms and third-party data vendors alike to join the lawsuit.

S&P shutters NMRF solution amid audit questions

Vendors face adverse economics due to a low number of IMA banks and prospects of regulatory easing.

Row breaks out over cause of FX settlement fails

One European bank blames T+1 for a 50% jump in FX fails, but industry groups dispute the claims.