Eliot Raman Jones

Eliot is a reporter for WatersTechnology. Prior to joining WatersTechnology in 2022, he attended Cardiff University where he graduated with an MA in News Journalism along with a diploma from the National Council for the Training of Journalists (NCTJ). You can reach him at eliot.ramanjones@infopro-digital.com or at +44 20 7316 9219.

Follow Eliot

Articles by Eliot Raman Jones

AllianceBernstein enlists SimCorp, BMLL and Features Analytics team up, and more

The Waters Cooler: Mondrian chooses FundGuard to tool up, prediction markets entice options traders, and Synechron and Cognition announce an AI engineering agreement in this week’s news roundup.

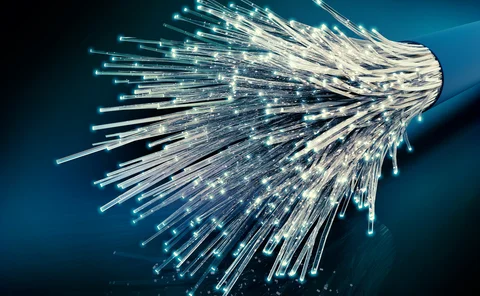

Fiber’s AI gold rush risks a connection drop

In search of AI-related profits, investors flocked to fiber cables, but there are worrying signals on the horizon.

TMX Datalinx makes co-location optionality play with Ultra

Data arm of the Canadian stock exchange group is leveling up its co-lo capabilities to offer a range of options to clients.

DTCC tests 24x5 trading, State Street launches digital asset platform, and more

The Waters Cooler: STG carves out S&P Global’s data businesses, Arcesium expands in Hong Kong, and Rimes partners with three vendors in this week’s news roundup.

RBC takes European traders to the Endgame

The Canadian bank’s complex execution algorithm, increasingly popular with traders stateside, is making landfall in Europe. But the region’s fragmented markets mean adoption is not simply a matter of plug-and-play.

Despite regulatory thaw in US, major questions remain globally for 2026

From crypto and tokenization to the CAT to consolidated tapes to T+1’s advancement, the regulatory space will be front and center in the New Year.

BNY inks AI deal with Google, Broadridge moves proxy voting to AWS, Expero delivers ICE market data, and more

The Waters Cooler: TSX Venture Exchange data hits the blockchain, SmartTrade acquires Kace, and garage doors link to cloud costs in this week’s news roundup.

Citadel Securities, BlackRock, Nasdaq mull tokenized equities’ impact on regulations

An SEC panel of broker-dealers, market-makers and crypto specialists debated the ramifications of a future with tokenized equities.

Tokenized assets draw interest, but regulation lags behind

Regulators around the globe are showing increased interest in tokenization, but concretely identifying and implementing guardrails and ground rules for tokenized products has remained slow.

Bloomberg expands GenAI summary options on Terminal

The additions include an expansion of its AI-powered news summaries, as well as a new AI summary tool for company-related news content.

Buy-side data heads push being on ‘right side’ of GenAI

Data heads at Man Group and Systematica Investments explain how GenAI has transformed the quant research process.

EY and Microsoft partner to bring agentic AI to risk management

The two firms are part of a deal to bring agentic AI processes to core operations like lending, servicing and risk, starting at Eurobank.

Experts urge banks to prep for quantum’s reckoning

Mathematicians across the world warn that current encryption methods will be crackable by quantum computers inside the current decade, but banks have been reluctant to prepare.

Nasdaq looks to ramp up tokenized securities efforts

Nasdaq CEO Adena Friedman wants to see tokenized securities come to the US markets “in a staged process.”

S&P’s $1.8 billion buy, an FIA restructure, a tokenization craze, and more

The Waters Cooler: CAIS creates CAISey, BNY deploys EquiLend, and more in this week’s news roundup.

Bloomberg integrates AI summaries into Port

One buy-side user says that while it’s still early for agentic tools, they’re excited by what they’ve seen so far.

Man Group sees alpha-generating strategies from agentic AI

The firm is seeing actionable use cases from AI agents, said CTO Gary Collier, speaking at a conference in London hosted by Bloomberg.

M&G Investments replaces research platform with Bloomberg’s RMS

The chief investment officer of the London-based asset manager explains why the firm opted to use Bloomberg’s RMS platform for its research capabilities.

OEMS interest sputters

Combined order and execution management systems once offered great promise, but large buy-side firms increasingly want specialization, leaving OEMS vendors to chase smaller asset managers in a world of EMS consolidation.

Chief investment officers persist with GenAI tools despite ‘blind spots’

Trading heads from JP Morgan, UBS, and M&G Investments explained why their firms were bullish on GenAI, even as “replicability and reproducibility” challenges persist.

Wall Street hesitates on synthetic data as AI push gathers steam

Deutsche Bank and JP Morgan have differing opinions on the use of synthetic data to train LLMs.

CFTC adopts Nasdaq tech, LSE gets Pisces OK, HFT startup gets funding, and more

The Waters Cooler: Tradeweb makes uncleared derivatives history, BNP Paribas nixes outsourced trading desk, and Taco Bell dumps its AI in this week’s news roundup.

Swedish startup offers European cloud alternative for US-skeptic firms

As European firms look for more homegrown cloud and AI offerings, Evroc is hoping to disrupt the US Big Tech providers across the pond.

Waters Wavelength Ep. 328: FundGuard’s Lior Yogev

He joins the podcast to discuss legacy tech stacks at asset management firms.