Theo Normanton

Theo is a reporter for WatersTechnology, based in our London newsroom. He was previously a Moscow correspondent for business newspaper bne IntelliNews, and holds a bachelor’s degree in Russian with French from the University of Cambridge. His email is theo.normanton@infopro-digital.com.

Follow Theo

Articles by Theo Normanton

Bond tape hopefuls size up commercial risks as FCA finalizes tender

Consolidated tape bidders say the UK regulator is set to imminently publish crucial final details around technical specifications and data licensing arrangements for the finished infrastructure.

Can the EU and UK reach T+1 together?

Prompted by the North American migration, both jurisdictions are drawing up guidelines for reaching next-day settlement.

The Waters Cooler: ‘Tis (almost) the season

Outer-space datacenters, a bumper week for data product announcements … and did I mention that I sing?

BNY doubles down on AI investments amid operating model overhaul

The bank’s CEO said he remains convinced of the potential of AI to enhance client offerings and increase the efficiency of employees.

CBOE and Aquis to make bid for European equities tape

The challenger exchanges have plans to become the second public bidder for provider of the European equities tape, following EuroCTP’s incorporation last year.

UK, EU prepare for bond tape tender as Ediphy enters fray

Competition for the role of consolidated tape provider is heating up as regulators confirm tenders to open in Q1 next year.

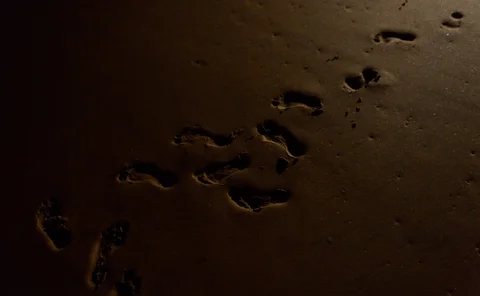

Footsteps in the dark: Private markets’ data quality “problem”

Data quality in the private markets is poor. But is this a quirk of the market or a problem that needs fixing?

New equity trading protocols want traders to show their hand

A new generation of trading venues has emerged with the goal of unlocking liquidity and improving the efficiency of trades.

South Africa’s equity markets court HFTs with tech upgrades

Competition for flow has driven innovation in connectivity, risk, and data provision.

TMX’s indexing pivot bears first fruit

The acquisition of index provider VettaFi has boosted revenues in the exchange’s analytics division, but further growth could mean taking on the heavyweight data providers like S&P, FTSE Russell, and MSCI.

Size matters: US equity market players wrangle over new tick size regime

The industry expects the SEC to finalize the Reg NMS shake-up as soon as late summer. While there is broad agreement about the need for change, the extent of the reduction in access fees and tick sizes will have a big impact on markets.

EU firms press for faster move to T+1 after smooth US rollout

Following the example set by North America, 70% of attendees at a European hearing on shorter settlement cycles favored a Q4 2027 switch to next-day settlement.

Waters Wavelength Podcast: Deutsche Bank’s Boon-Hiong Chan

Boon-Hiong Chan from Deutsche Bank joins the podcast to talk about blockchain interoperability.

Finra clears hurdle with CAT launch, but several others remain

Two major components of the consolidated audit trail are now in place. But wrangling over the CAT’s future continues.

Ace high or busted flush? Digital Asset’s mixed fortunes mirror DLT adversity

The vendor hoped to remodel post-trade using blockchain technology—and it still might—but its bumpy progress raises questions over the future of DLT in finance.

All eyes turn to North America as T+1 arrives

As T+1 settlement becomes a reality in North America, long-lingering questions will get their answers.

Can exchanges leverage new tech to claw back ETF share from RFQ platforms?

Systematic trading strategies and proliferating data are bringing efficiency to an otherwise-fragmented European ETF market.

Waters Wavelength Podcast: Countdown to T+1

DTCC’s Val Wotton joins the podcast this week to discuss the impending move to T+1 in the US.

Consolidated tape hopefuls gear up for uncertain tender process

The bond tapes in the UK and EU are on track to be authorized in 2025. Prospective bidders for the role of provider must choose where to focus their efforts in anticipation of more regulatory clarity on the tender process.

European exchanges turn to dark trading in battle for flow

The EU’s two biggest exchanges are launching dark pools this year. The apparent change in their stances on dark trading reflects a profound shift in equities markets.

Dark horse: Deutsche Börse building dark pool

New functionality allowing exchange members to execute sweep trades comes hot on the heels of European rival Euronext launching its own dark pool.

European firms prime for lopsided settlement in North America and at home

With T+1 imminent in North America and increasingly likely to traverse the Atlantic, operations and trading professionals in Europe are fighting on two fronts.

Waters Wavelength Podcast: Looking into the EU regulatory landscape

Eflow’s Ben Parker joins the podcast to discuss EU regulations.

Settling scores: industry pushes back on new penalties in settlement efficiency drive

Esma is asking for feedback on proposals that could see penalties for settlement fails increase by 25 times. But affected parties say adapting to the new system would be a technical upheaval and are calling for more structural reform.