Bloomberg’s chatbots streamline external data sharing, OTC trading

The vendor details the expansion of chatbot support outside of a firm’s enterprise, and addresses user reservations about cost and spambots.

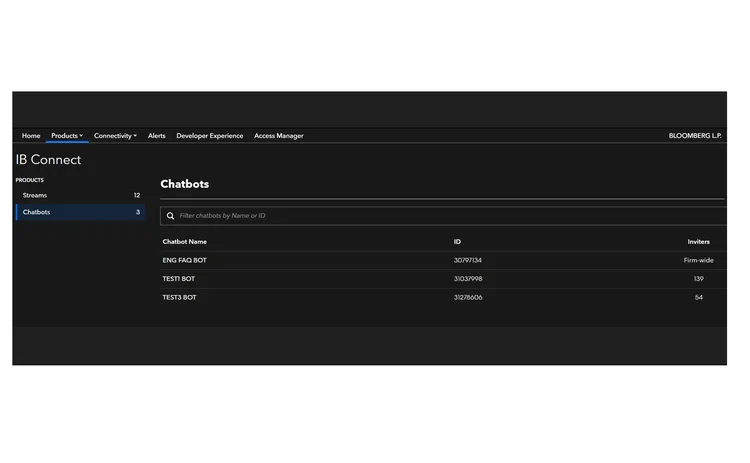

Bloomberg’s announcement this week that it will allow financial firms to deploy third-party chatbots in chat rooms on Instant Bloomberg with a new service called IB Connect: Cross-Firm Chatbots promises to increase the speed and ease with which firms can share information—such as pricing and research—with counterparties without leaving Instant Bloomberg to retrieve data. The move also aims to further entrench Instant Bloomberg as the preferred tool for trade negotiation in over-the-counter markets, where trades are often agreed via chat messages before being executed between counterparties.

“Chats still serve as the primary means of communications for execution of OTC trades,” the CEO of one proprietary trading fund tells WatersTechnology. They add that liquidity providers have developed bots such as these to demonstrate their value-add. Bloomberg had previously allowed firms to use bots in Instant Bloomberg to share information within their own organizations.

Wil Goldsholl, product manager for chatbots at Bloomberg, says the vendor had received customer demand to introduce bots to its chat, and saw success with the internal-only chatbots, which a firm might deploy to respond to inquiries from one of its sales traders about the status of an order, or for sharing market color and research with its clients.

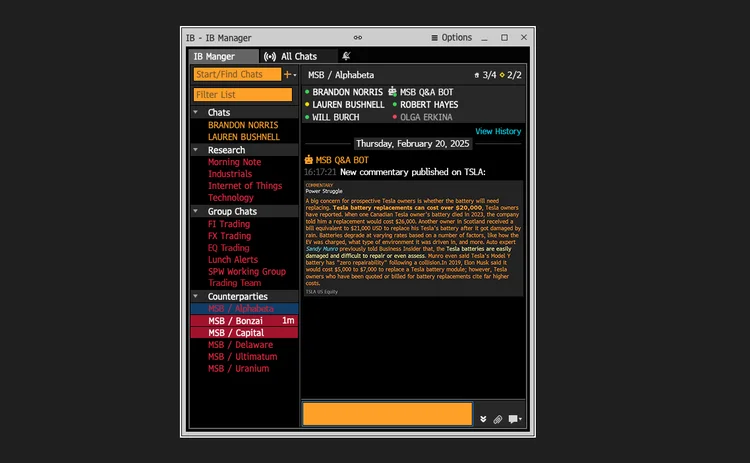

With this upgrade, firms can use them to share information in chats with other firms. The information could include data points, prices, order status updates from trading systems, research, trade ideas, and negotiations. The bots use Bloomberg’s natural-language processing (NLP) technology to understand requests, and use a two-way API to access data from other systems. They can also respond to requests by posting free text, tables, and links, as well as structured boxes of text called BCards. Currently, Bloomberg has templates for market color and order updates, and Goldsholl says the vendor will build out more BCard templates for other uses.

“Through a lot of feedback, we identified the ways that customers said using this technology could be more valuable,” Goldsholl says. “Using chatbots between firms was the natural next step.”

Though trade execution itself will continue to take place completely outside of and separate from Instant Bloomberg, the integration of these data bots will speed up trade negotiations, and allow firms to capture data from their internal systems and present it to clients or counterparties within chat rooms faster, without having to leave the chat and search for data on other platforms then re-type it or copy and paste it into the chat.

“Instant Bloomberg is a separate system; it’s a communication channel. It may be used for trade negotiation and sharing information around a potential transaction,” Goldsholl says.

Matthew Cheung, CEO of London-based Ipushpull, a software vendor that builds applications for extracting data from chat messages, echoes the prop fund CEO’s comments: “Generally, in the OTC world, trading is done in chat. There’s still a small amount that happens on the phone, but most of it is just on chat these days. All of that information now is accessible in a very different way than it was before, because you just couldn’t get into that chat before.”

Some firms had built unofficial workarounds to this, allowing them to scrape information out of chat messages, Cheung says. Now, these APIs from Bloomberg give users the ability to push data into the chat as well as extract it. “The actual chatbots have been around for maybe six to nine months on Bloomberg, but now you can do the cross-firm piece, which is what everyone wanted.”

Indeed, client interest spans a diverse range of global and cross-asset-class use cases, Goldsholl says. “We’ve seen use cases centered around distribution of market color and commentary—what clients and counterparties have to say about what’s going on in the world.”

More than one source told WatersTechnology the move will reinforce the Bloomberg Terminal’s position “at the center stage of the financial world,” as competing tech vendors build out their own ecosystems. Cheung says Ipushpull has developed workflows for all kinds of firms participating on those other systems, but says Bloomberg still dominates chat messaging among firms’ front offices.

The value proposition is definitely there; it’s just a question of, are we actually going to still have margin if we sign up to the service?

CIO at a G-Sib

The chatbot integration may not only reinforce Bloomberg’s front-office dominance, but may also help it re-establish itself in other areas throughout an organization and win back messaging flow that may have migrated to other platforms.

“We see these kinds of integrations being useful across the front, middle, and back office,” Goldsholl says. “There’s no reason to pigeonhole it just to trading desks.”

The CIO of corporate and investment banking at a global systemically important bank (G-Sib) familiar with the new features says they will provide an array of benefits for different audiences. For one, they can play a vital role in gaining access to non-primary client bases, they say.

“For existing clients, where you’ve got an existing relationship—and that’s true for most global banks—a lot can be done, especially with regards to bot deployment or capability deployment, that helps smooth out that workflow between you and the client,” the CIO says, citing, as an example, BlackRock’s API suite, which they say allows greater client participation and interaction. “That’s where we see the market moving to. Bloomberg obviously has a bit of a lead with regard to tying all financial institutions into a communication network. So, it’s a very natural add-on.”

Sticking point

This extra value does come at a cost, however. Bloomberg declines to say how much this will be, but the G-sib CIO says the price is enough to give the firm pause.

“The value proposition is definitely there; it’s just a question of, are we actually going to still have margin if we sign up to the service? Do we actually gain sufficient benefit based on the amount of money we’re going to have to pay from a licensing fee perspective?” the CIO says. “Like most institutions, we are grappling with how we actually reduce our [Bloomberg] bill because Bloomberg Terminals are very expensive. They’ve started creating add-on services, which in a lot of cases, are undeniable in terms of value. But the reality is, there are a number of alternative solutions that are available for most of these services that are equally seeking to disintermediate Bloomberg’s stranglehold on these functions.”

However, in the case of chatbots on Instant Bloomberg, that extra cost reflects additional protections that the vendor has incorporated, and which alternative solutions may not offer.

For example, one source told WatersTechnology the chatbots would be “pushing runs and pricing content into IB Chat and just sort of pushing flow, which isn’t real conversations.”

But Goldsholl says the vendor has taken steps to ensure this doesn’t happen. First, bots are clearly represented as such in any Instant Bloomberg chat room, with a recognizable icon and having “bot” as their last name, and their entrance to any chat is clearly announced.

“So, users are always very much aware when they’re interacting with a non-human,” Goldsholl says.

The platform also includes configuration rules and controls, such as who is allowed to invite a bot into a chat where they are the admin, or what types of chat room a specific bot can enter. There’s also an “abandon ship” rule that if all users from the firm that built the bot leave the chat, the bot will also leave.

“We want to ensure that the chat rooms that bots are in remain habitable … and that they are there to support the participants, not to replace them,” he says.

Other sources were wary of allowing bots to automatically respond to customer inquiries, insisting on keeping human oversight in the loop. But Bloomberg says it has that covered, too. Requesting information from a bot can only be done by a person invoking the bot by using an “@” mention.

“If we allowed systems to pump unconstrained amounts of information into a room, there would be no room for people,” Goldsholl says.

Ipushpull’s Cheung says these features should quell fears of bots spamming Bloomberg users.

“What is interesting with Bloomberg is it’s a new thing for them, enabling these types of workflows. … There are technical restrictions around how many updates you can do per minute, per room, and per bot and so on,” Cheung says, adding that he thinks this is so the vendor can observe how firms deploy and use bots within Instant Bloomberg.

What future evolutions will look like remains to be seen. Cheung, for example, believes the chatbots are the tip of the iceberg. “I think Bloomberg will probably be looking to build some sort of agents themselves, because the beauty of Bloomberg is they’re sitting on the best dataset on the planet because there’s so much information in the terminal,” he says.

However, Goldsholl says Bloomberg will be focused on increasing the usability of bots and self-service features. “We’re always listening to the voice of the customer. We’re always evolving alongside customers, and will develop other Instant Bloomberg integrations.”

With additional reporting from Nyela Graham and Rebecca Natale.

Further reading

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@waterstechnology.com or view our subscription options here: https://subscriptions.waterstechnology.com/subscribe

You are currently unable to print this content. Please contact info@waterstechnology.com to find out more.

You are currently unable to copy this content. Please contact info@waterstechnology.com to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@waterstechnology.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@waterstechnology.com

More on Data Management

CME rankles market data users with licensing changes

The exchange began charging for historically free end-of-day data in 2025, angering some users.

Data heads scratch heads over data quality headwinds

Bank and asset manager execs say the pressure is on to build AI tools. They also say getting the data right is crucial, but not everyone appreciates that.

Reddit fills gaping maw left by Twitter in alt data market

The IMD Wrap: In 2021, Reddit was thrust into the spotlight when day traders used the site to squeeze hedge funds. Now, for Intercontinental Exchange, it is the new it-girl of alternative data.

Knowledge graphs, data quality, and reuse form Bloomberg’s AI strategy

Since 2023, Bloomberg has unveiled its internal LLM, BloombergGPT, and added an array of AI-powered tools to the Terminal. As banks and asset managers explore generative and agentic AI, what lessons can be learned from a massive tech and data provider?

ICE launches Polymarket tool, Broadridge buys CQG, and more

The Waters Cooler: Deutsche Börse acquires remaining stake in ISS Stoxx, Etrading bids for EU derivatives tape, Lofthouse is out at ASX, and more in this week’s news roundup.

Fidelity expands open-source ambitions as attitudes and key players shift

Waters Wrap: Fidelity Investments is deepening its partnership with Finos, which Anthony says hints at wider changes in the world of tech development.

Data standardization key to unlocking AI’s full potential in private markets

As private markets continue to grow, fund managers are increasingly turning to AI to improve efficiency and free up time for higher-value work. Yet fragmented data remains a major obstacle.

Digital employees have BNY talking a new language

Julie Gerdeman, head of BNY’s data and analytics team, explains how the bank’s new operating model allows for quicker AI experimentation and development.