CTO and CIO

‘The end of the beginning’: Brown Brothers Harriman re-invents itself

Voice of the CDO: Firms who want to use AI successfully better start with their metadata, says BBH’s Mike McGovern and Kevin Welch.

The TNS–Radianz deal hints at underlying issues in trader voice

Waters Wrap: As part of its cost-cutting program, BT shipped its Radianz unit to TNS, but the deal didn’t include its Trading & Command trader voice property. Anthony finds that interesting.

DORA delay leaves EU banks fighting for their audit rights

The regulation requires firms to expand scrutiny of critical vendors that haven’t yet been identified.

Wall Street hesitates on synthetic data as AI push gathers steam

Deutsche Bank and JP Morgan have differing opinions on the use of synthetic data to train LLMs.

AI fails for many reasons but succeeds for few

Firms hoping to achieve ROI on their AI efforts must focus on data, partnerships, and scale—but a fundamental roadblock remains.

Swedish startup offers European cloud alternative for US-skeptic firms

As European firms look for more homegrown cloud and AI offerings, Evroc is hoping to disrupt the US Big Tech providers across the pond.

The great disappearing internet—and what it could mean for your LLM

AI-generated content, bots, disinfo, ads, and censorship are killing the internet. As more of life continues to happen online, we might consider whether we’re building castles atop a rotting foundation.

Speakerbus ceases operations amid financial turmoil

Sources say customers were recently notified that the trader voice vendor was preparing to file for administration and would no longer be operational.

‘AI for everyone, everywhere, with everything’

Waters Wrap: Anthony looks at some interesting projects involving machine learning, generative AI, and agentic AI from the last year.

The industry is not ready for what’s around the corner

Waters Wrap: As cloud usage and AI capabilities continue to evolve (and costs go up), Anthony believes the fintech industry may face a similar predicament to the one facing journalism today.

Overbond’s demise hints at cloud-cost complexities

The fixed-income analytics platform provider shuttered after failing to find new funding or a merger partner as costs for its serverless cloud infrastructure “ballooned.”

Agentic AI comes to Bloomberg Terminal via Anthropic protocol

The data giant’s ubiquitous terminal has been slowly opening up for years, but its latest enhancement represents a forward leap in what CTO Shawn Edwards calls, “the way we should talk to the world.”

M&G Investments braves cost headwinds in pursuit of AI

The UK asset manager’s AI ambitions started with the creation of a data lake to ensure high-quality data is being fed into models.

Numerix strikes Hundsun deal as China pushes domestic tech

The homegrown tech initiative—‘Xinchuang’—is a new challenge for foreign vendors.

Deutsche Bank casts a cautious eye towards agentic AI

“An AI worker is something that is really buildable,” says innovation and AI head

LLMs are making alternative datasets ‘fuzzy’

Waters Wrap: While large language models and generative/agentic AI offer an endless amount of opportunity, they are also exposing unforeseen risks and challenges.

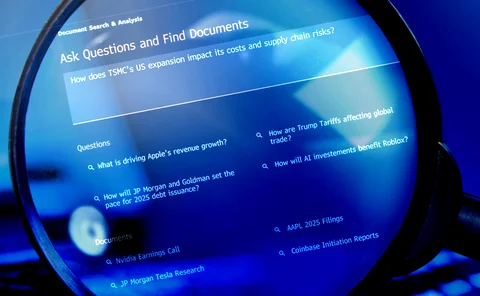

Bloomberg expands user access to new AI document search tool

An evolution of previous AI-enabled features, the new capability allows users to search terminal content as well as their firm’s proprietary content by asking natural language questions.

Perceive, reason, act: Agentic AI, graph tech used to assess risk

Industry executive Jay Krish is experimenting with large language models to help PMs monitor for risk.

BNY standardizes internal controls around data, AI

The bank has rolled out an internal enterprise AI platform, invested in specialized infrastructure, and strengthened data quality over the last year.

LSEG–MayStreet: When good partnerships go bad

Waters Wrap: MayStreet’s founder and former CEO is suing LSEG for fraud and breach of contract. Anthony considers what the damage control might look like.

Everything’s a chatbot. Soon, your sales trader might be, too

Morgan Stanley, Citi, and Kepler Cheuvreux are among firms considering making their internal AI assistants available to clients.