Bloomberg

Everything you need to know about market data in overnight equities trading

As overnight trading continues to capture attention, a growing number of data providers are taking in market data from alternative trading systems.

2026 will be the year agent armies awaken

Waters Wrap: Several AI experts have recently said that the next 12 months will see significant progress for agentic AI. Are capital markets firms ready for this shift from generative AI to agents?

The next phase of AI in capital markets: from generative to agentic

A look at some of the more interesting projects involving advanced forms of AI from the past year.

Robeco tests credit tool built in Bloomberg’s Python platform

This follows the asset manager’s participation in Bloomberg’s Code Crunch hackathon in Singapore, alongside other firms including LGT Investment Bank and university students.

Bloomberg expands GenAI summary options on Terminal

The additions include an expansion of its AI-powered news summaries, as well as a new AI summary tool for company-related news content.

Buy-side data heads push being on ‘right side’ of GenAI

Data heads at Man Group and Systematica Investments explain how GenAI has transformed the quant research process.

BST Awards 2025: Best buy-side compliance product (trading)—Bloomberg

Product: Bloomberg CMGR

S&P shutters NMRF solution amid audit questions

Vendors face adverse economics due to a low number of IMA banks and prospects of regulatory easing.

How an asset manager employs analytics to evaluate performance

Channing Capital, an institutional investment firm managing nearly $5 billion in assets, uses Aapryl to analyze its performance.

Bloomberg integrates AI summaries into Port

One buy-side user says that while it’s still early for agentic tools, they’re excited by what they’ve seen so far.

Bloomberg: Driving innovation across Apac

Bloomberg’s offshore RMB repo initiative offering is helping Apac clients address their trading needs.

Asia Awards 2025 winner’s interview: Bloomberg

Bloomberg's win for Best new product or service introduced over the past 12 months in 2025’s WatersTechnology Asia Awards.

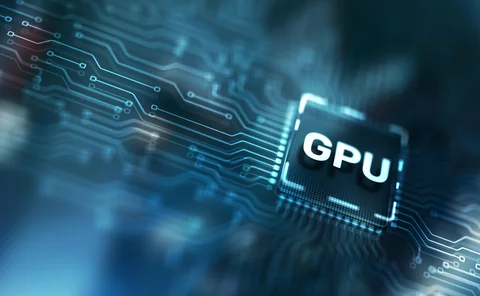

New GPU indexes to provide transparency into AI compute

Silicon Data, a company backed by DRW and Jump Trading, has launched its H100 and A100 indexes, providing transparency into the economics of AI compute.

Man Group sees alpha-generating strategies from agentic AI

The firm is seeing actionable use cases from AI agents, said CTO Gary Collier, speaking at a conference in London hosted by Bloomberg.

M&G Investments replaces research platform with Bloomberg’s RMS

The chief investment officer of the London-based asset manager explains why the firm opted to use Bloomberg’s RMS platform for its research capabilities.

SS&C withdraws SEC application for clearing exemption

The fintech had been granted exemption in 2015 for SSCNet, a global trade network, that allowed it to provide matching and ETC services.

The industry is not ready for what’s around the corner

Waters Wrap: As cloud usage and AI capabilities continue to evolve (and costs go up), Anthony believes the fintech industry may face a similar predicament to the one facing journalism today.

Industry deep dive—Bloomberg outlines current and future tech and data strategies

Discussion on data consumption habits and the technologies available to help firms manage ever-increasing data volumes.

Cboe to exit Japan equities, S&P/Barclays partner, LSEG mulls 24-hour trading, and more

The Waters Cooler: Regnology acquires Wolters Kluwer’s FRR unit, and storms ahead for the $500 billion Stargate project.

Waters Rankings 2025: Best buy-side order management system (OMS) provider—Bloomberg

Name of product or service: Bloomberg AIM

The Model Context Protocol brings agents to life—along with risk

Waters Wrap: From chat to infrastructure modernization, Anthropic’s MCP offers a ‘bridge’ to agentic AI, but its early days may prove disillusioning.