Analytics

Everything you need to know about market data in overnight equities trading

As overnight trading continues to capture attention, a growing number of data providers are taking in market data from alternative trading systems.

Robeco tests credit tool built in Bloomberg’s Python platform

This follows the asset manager’s participation in Bloomberg’s Code Crunch hackathon in Singapore, alongside other firms including LGT Investment Bank and university students.

How an asset manager employs analytics to evaluate performance

Channing Capital, an institutional investment firm managing nearly $5 billion in assets, uses Aapryl to analyze its performance.

Bloomberg integrates AI summaries into Port

One buy-side user says that while it’s still early for agentic tools, they’re excited by what they’ve seen so far.

LSEG unveils tick history data with AI-enhanced capabilities

Tick history data with AI-enhanced capabilities and the benefits to LSEG Data & Analytics’ clients

Halftime review: How top banks and asset managers are tackling projects beyond AI

Waters Wrap: Anthony highlights eight projects that aren’t centered around AI at some of the largest banks and asset managers.

Euroclear readies upgrade to settlement efficiency platform

Euroclear, Taskize, and Meritsoft are working together to deliver real-time insights and resolution capabilities to users settling with any of Euroclear’s CSDs.

Waters Rankings 2025 winner’s interview—S&P Global Market Intelligence

S&P Global Market Intelligence's Justine Iverson discusses the firm's wins in the 2025 Waters Rankings, alongside the versatility its S&P Capital IQ Pro offering platform.

Overbond’s demise hints at cloud-cost complexities

The fixed-income analytics platform provider shuttered after failing to find new funding or a merger partner as costs for its serverless cloud infrastructure “ballooned.”

Pico’s IntelliVUE brings observability to its networks

Leveraging its 2019 acquisition of Corvil Analytics, Pico is providing users with real-time oversight and monitoring of their connectivity.

LSEG officially sunsets Eikon

The exchange operator withdrew the platform from its product lineup this week.

Cloud Wars: Are EU and APAC firms really pining for homegrown options?

Waters Wrap: In the wake of tariffs and regional instability, there’s chatter about non-US firms lessening their dependency on the major hyperscalers. Anthony is not buying it.

Bloomberg introduces geopolitical country-of-risk scores to terminal

Through a new partnership with Seerist, terminal users can now access risk data on seven million companies and 245 countries.

SEC pulls rulemaking proposals in bid for course correction

The regulator withdrew 14 Gensler-era proposals, including the controversial predictive data analytics proposal.

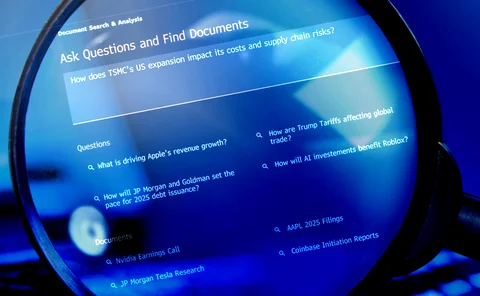

Bloomberg expands user access to new AI document search tool

An evolution of previous AI-enabled features, the new capability allows users to search terminal content as well as their firm’s proprietary content by asking natural language questions.

Best data analytics provider/vendor—Bloomberg

Bloomberg wins Best data analytics provider/vendor at the IMD & IRD Awards 2025.

Bloomberg adds web traffic data as leading indicator of market moves

The vendor’s deal to incorporate website visit data from Similarweb is the latest move in its ongoing expansion of alternative datasets.

APIs keep their eyes on the prize

The IMD Wrap: As the API economy continues to expand, connecting an ever-increasing number of broker and data interfaces is becoming a cottage industry in itself.

Growing pains: Why good data and fortitude are crucial for banks’ tech projects

The IMD Wrap: Max examines recent WatersTechnology deep dives into long-term technology projects at several firms and the role data plays in those efforts.

Investing in the invisible, ING plots a tech renaissance

Voice of the CTO: Less than a year in the job, Daniele Tonella delves into ING’s global data platform, gives his thoughts on the future of Agile development, and talks about the importance of “invisible controls” for tech development.

Optiver relies on BMLL market data for quant strategy

The market-maker has built its trading business on top of BMLL’s Level 3 data. But the collaboration is young, and the pair have grand plans to make options the next quant frontier.