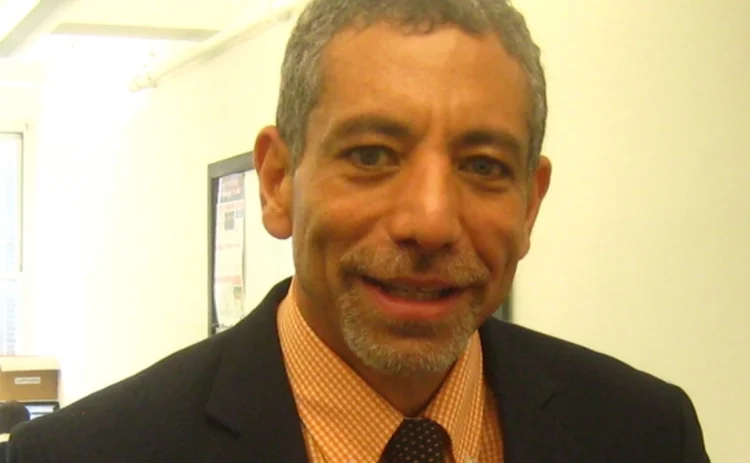

60 Seconds with Emilio Mercado of Simplified Financial Information

What does your company do?

Simplified Financial Information answers the growing need that market data professionals have to better manage risk and market exposure by understanding the impact of volatile and unpredictable conditions. We are doing this by building a complete solution for capturing usage, simulating and playing back high-volume data, and integrity testing client trading-related applications.

What does your job entail?

While I would like to say I do everything, I spend the majority of my time directing and orchestrating the marketing, technology, business development and strategy for the firm I started four months ago. My work entails scouting new clients while keeping the team and investors up to speed.

What trends do you see in the market?

Greater client acceptance of managed services.

How has the regulatory environment affected business?

It is creating new opportunities for us in providing solutions such as risk and reporting, whereas providing intra-day visibility has been difficult.

What do you do to unwind?

Run! I clocked 1,250 miles in 2011, 1,350 miles in 2012, and am on track for another 1,200 miles this year.

Who is the most influential person in your business life? Why?

Thirty-five years ago, I worked with a district manager at Red Lobster who taught me two lessons. He emphasized how important people are and to acknowledge and enable them. And he taught me to fill in the gaps in my management teams. These two vital things take you out of your comfort zone and make the team successful.

What is your favorite part of your job?

Building solutions that solve major client problems at a compelling price point.

What was your first car?

It was a 1974, tan, three-on-the-column Plymouth Duster! It was the last car I owned where I could actually see the ground through the engine compartment.

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@waterstechnology.com or view our subscription options here: https://subscriptions.waterstechnology.com/subscribe

You are currently unable to print this content. Please contact info@waterstechnology.com to find out more.

You are currently unable to copy this content. Please contact info@waterstechnology.com to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@waterstechnology.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@waterstechnology.com

More on Emerging Technologies

AI & data enablement: A looming reality or pipe dream?

Waters Wrap: The promise of AI and agents is massive, and real-world success stories are trickling out. But Anthony notes that firms still need to be hyper-focused on getting the data foundation correct before adding layers.

Waters Wavelength Ep. 343: Broadridge’s Jason Birmingham

This week, Jason Birmingham of Broadridge talks with Tony about the importance of fundamentals as technology rapidly evolves.

Data standardization is the ‘trust accelerator’ for broader AI adoption

In this guest column, data product managers at Fitch Solutions explain AI’s impact on credit and investment risk management.

BNY inks AI deal with Google, Broadridge moves proxy voting to AWS, Expero delivers ICE market data, and more

The Waters Cooler: TSX Venture Exchange data hits the blockchain, SmartTrade acquires Kace, and garage doors link to cloud costs in this week’s news roundup.

Everyone wants to tokenize the assets. What about the data?

The IMD Wrap: With exchanges moving market data on-chain, Wei-Shen believes there’s a need to standardize licensing agreements.

Google, CME say they’ve proved cloud can support HFT—now what?

After demonstrating in September that ultra-low-latency trading can be facilitated in the cloud, the exchange and tech giant are hoping to see barriers to entry come down.

Waters Wavelength Ep. 342: LexisNexis Risk Solutions’ Sophie Lagouanelle

This week, Sophie Lagouanelle, chief product officer for financial crime compliance at LNRS, joins the podcast to discuss trends in the space moving into 2026.

Citadel Securities, BlackRock, Nasdaq mull tokenized equities’ impact on regulations

An SEC panel of broker-dealers, market-makers and crypto specialists debated the ramifications of a future with tokenized equities.