Bad News from the Cryptocurrency World

Finance's blockchain romance is over as major venues see breaches

Back in June, transactions on the Ethereum blockchain had to be effectively rolled back.

This so-called "hard fork" was implemented in order to recover millions of dollars' worth of the cyptocurrency Ether that had been stolen from a fund that lives on the blockchain, the decentralized autonomous organization (DAO).

And then, in early August, came news that bitcoin exchange Bitfinex had been hacked to the tune of millions.

Not all that long ago, these exploits and the ensuing debates would have played out in tiny online communities of nerds and made scarcely a ripple in the mainstream media. But finance has recently been having something of a love affair with blockchain, and so banks, market infrastructure providers and journalists took note of the news.

With so few use cases for blockchain yet adequately demonstrated, finance is looking anxiously to the cryptocurrency world and to ventures such as Ethereum for intelligence on the future of blockchain. Despite its rebranding in financial services as "distributed ledger technology" (DLT)—doesn't the finance world just love an acronym?—cryptocurrencies are where blockchain still truly shines.

And the news that's emerging lately is not encouraging. Banks are expressing fundamental questions about data security on blockchains and how governance can function in decentralized systems. The news of the Bitfinex hack has come at just the wrong moment for proponents of DLT.

The hype around blockchain—sorry, DLT—happened probably because firms are looking to leapfrog the expensive and quixotic task of fixing legacy systems, and because they are tired of the same old post-trade inefficiencies.

But DLT, as I have said before, doesn't do anything that centralized databases don't, once you take away the cryptocurrency element. There's interesting work being done, in the realm of legal contracts, for example, and a lot of money invested in DLT, but it will probably take years to prove its efficacy—and only then if it isn't mitigated by a lack of standardization. Apparently it may not be as cheap as advertised, either. An analyst tells me that the difficulty involved in migrating from centralized databases to DLT is about the same as that of migrating from relational to NoSQL databases.

I suspect the backlash against blockchain has well and truly begun.

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@waterstechnology.com or view our subscription options here: https://subscriptions.waterstechnology.com/subscribe

You are currently unable to print this content. Please contact info@waterstechnology.com to find out more.

You are currently unable to copy this content. Please contact info@waterstechnology.com to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@waterstechnology.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@waterstechnology.com

More on Data Management

Exchange M&A, US moratorium on AI regs dashed, Citi’s “fat-finger”-killer, and more

The Waters Cooler: Euronext-Athex, SIX-Aquis, Blue Ocean-Eventus, EDM Association, and more in this week’s news roundup.

EDM Council expands reach with Object Management Group merger

The rebranded EDM Council now includes members from industries outside financial services.

As datacenter cooling issues rise, FPGAs could help

IMD Wrap: As temperatures are spiking, so too is demand for capacity related to AI applications. Max says FPGAs could help to ease the burden being forced on datacenters.

Bloomberg introduces geopolitical country-of-risk scores to terminal

Through a new partnership with Seerist, terminal users can now access risk data on seven million companies and 245 countries.

A network of Cusip workarounds keeps the retirement industry humming

Restrictive data licenses—the subject of an ongoing antitrust case against Cusip Global Services—are felt keenly in the retirement space, where an amalgam of identifiers meant to ensure licensing compliance create headaches for investment advisers and investors.

LLMs are making alternative datasets ‘fuzzy’

Waters Wrap: While large language models and generative/agentic AI offer an endless amount of opportunity, they are also exposing unforeseen risks and challenges.

Cloud offers promise for execs struggling with legacy tech

Tech execs from the buy side and vendor world are still grappling with how to handle legacy technology and where the cloud should step in.

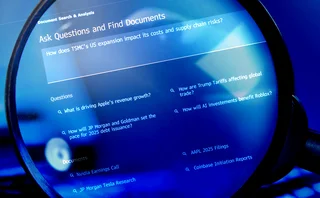

Bloomberg expands user access to new AI document search tool

An evolution of previous AI-enabled features, the new capability allows users to search terminal content as well as their firm’s proprietary content by asking natural language questions.