The Next Stretch

It’s always been about the stretch for John Metzner. In a little more than 15 years, Metzner has gone from college graduate to president of Plural Investments, one of the hotter hedge funds in the US. He couldn’t have done that without stretching himself and actively seeking out the next mountain to climb.

It would have been easy for Metzner to become a star in the vendor world. It would have been easy to—like so many before him—spend his career at Morgan Stanley and slowly ascend the corporate ladder. And it would have been easy to bask in the light that is endlessly shone on Eton Park.

When it launched in 2004, Eton Park was one of the most talked about hedge fund startups the industry had ever seen. For Metzner, CTO of Eton Park, it was an exciting, pressure-filled, innovative time. But by 2008, Eton was well-established and all systems were built and running to perfection.

It was time for the next stretch. It’s always been about the stretch—as it was when he jumped ship from Eton Park to get in on the ground floor at Plural Investments, the technologically savvy hedge fund startup run by Matthew Grossman. When Grossman approached Metzner about his new venture, Eton’s CTO was open to the idea of a change.

“At Eton, we had built so much of the platform, and while there was still some interesting work going on, it was a pretty mature business,” Metzner recalls.

It wasn’t an immediate pairing. The two, who met through a mentor of Metzner’s, spoke for several months. Metzner was looking for a new opportunity. He told Grossman he wanted to broaden his business background and be part of the management committee of the organization. Grossman agreed—and it didn’t hurt that Plural was building its own technology platform at a cost of $20 million.

“It was going to be a real technology-focused firm and as a CTO, that’s a fantastic opportunity,” Metzner says. “Matt committed to me that he would help me develop my skills so that I could grow into a larger role in the organization over time. So that was very appealing to me from a professional development perspective.”

Plural launched on January 2, 2009, with $450 million under management in a market still reeling from the fallout from the previous year’s credit crisis. Nearly three years later, the grunt work is in the past and the firm is looking to use its technology to become a major player on Wall Street.

A Massive Launch

Metzner’s résumé prior to joining Plural was impressive: After graduating from Stanford University in 1995 with a degree in symbolic systems—a hybrid computer science major that applied cognitive psychology, linguistics and logic to technology—he worked his way through the vendor world, making his bones at Market Methodology, Advent Software and Financial Models Co.

Then, in 2001, he jumped to Morgan Stanley to build a client technology consulting practice within the firm’s prime brokerage unit. This served as an invaluable training ground as he learned how hedge funds grew, what made them work, and how the best hedge funds managed their businesses.

“For me, it was like a four-year MBA in hedge funds,” Metzner says. “I got to work with some of the largest hedge funds at the time and developed a deep understanding of how they built out their platforms and the issues they faced as their businesses grew and changed—whether that was the addition of new funds, going into new product types for the first time, adding offices, and the impacts that those things had on the back or front office.”

Some may have been surprised when famed former Goldman Sachs wunderkind Eric Mindich and Stu Hendel snagged Metzner from Morgan Stanley to run Eton’s technology. After all, he didn’t have true hands-on experience building out an enterprise-wide platform—he was a consultant, an observer.

But he had been studying. He had been analyzing. Rather than working on one company’s systems, he was learning what the best practices were across Morgan Stanley Prime Brokerage’s hedge fund clients. And unlike many CTOs, who tend to come from engineering backgrounds, Metzner had a deep understanding of how business works and how technology can support business.

Metzner started at Eton in June 2004 and the fund launched at the end of October—that’s not a lot of time to build out the infrastructure for a behemoth $3.5 billion startup that would be trading complex derivatives in New York and London from day one.

It was a chaotic time, but Metzner and his team created a roadmap and phased in its infrastructure, where information was disbursed in all locations in real time. It was a learning experience that would prove valuable at Plural.

“I worried way too much about the infrastructure in the early days because I didn’t understand how all of it fitted together,” Metzner says. “If you ask those guys that I worked with in the early days at Eton, they would tell you that I was all over them. It’s a mission-critical part of the business—without a doubt—but with the right redundancies and people in place you don’t have to worry so much.”

Metzner knew the firm’s IT was fully functional after Eton’s November 2007 acquisition of R6 Capital Management, and its $300 million in assets. “Ultimately, I think the most interesting thing that happened was the acquisition of R6 Capital Management,” he says. “In six weeks we were able to take that entire business and add it to our existing platform and I was very happy with that.”

It was at this time that Grossman and Plural came calling.

The Right Stuff

To understand Plural’s technology, it is first important to note that Grossman—who made his name at SAC Capital—had a clear vision of what he wanted when he started Plural, which specializes in long–short equity strategies. That vision was of a hedge fund that would differentiate itself through its technology.

“Matt’s a huge technology fan. He was prepared to invest significantly—he felt it could add alpha to the business. He’s passionate about this,” Metzner says. “And he was also putting together a really exciting team of people. As a group, we felt that we could put together a best-in-class platform.”

As Grossman told Waters’ sibling publication Hedge Funds Review earlier this year, “The vision I have is to create a firm where portfolio managers have access to better data and analytics so they can make better investment decisions. Some portfolio managers may have a natural feel for the currency sensitivity of the portfolio but our systems will statistically highlight that for our managers so they can calibrate the amount of currency sensitivity they want in their portfolios.”

From the start, Metzner was charged with building a system that was institutional, scalable, with strong disaster recovery capabilities and that provided depth in terms of its analytics, performance and risk attribution. Metzner started in March 2008 and the fund—Plural Partners—went live on January 2, 2009. That gave Metzner and his team about 10 months to build out this robust platform, which, when compared to his time at Eton, was something of a stroll in the park.

Some of the systems were purchased through vendors like Advent and MIK Fund Solutions, in addition to third-party vendors for Plural’s general ledger system and for certain risk metrics. Plural decided to build out its infrastructure for warehouse data and it built applications on top of that warehouse to support trading and portfolio management, risk and performance attribution, among other processes. They also built systems for compliance, as well as products to support counterparty research.

For Plural, it was important to have a well-integrated system. In those days leading up to the launch, it conducted extensive testing and analyzed the data coming back in excruciating detail. And despite the turmoil circling around Plural at the end of 2008, Metzner says that before Grossman would manage even a single dollar of clients’ capital, Plural had to have the right systems in place.

Managing Risk

Plural’s various systems feed into a single platform housed down the hall from the trading floor at Plural’s midtown Manhattan offices. The platform is designed to allow Plural’s 22 investment professionals to access clean data in a format where everyone is using the same data sets.

The firm’s risk systems look at more than 90 risk factors, all in real time. This is vital because of the firm’s unique investment strategy where it has significantly more exposure during times of volatility than when the markets are more benign.

Metzner says that Grossman and Plural’s CRO Jeff Hurwitz wanted a risk dashboard,or mosaic, which would provide a clear picture—when analyzed together—of the firm’s risk exposure.

“Like a cockpit in an airplane, no single instrument gives you a view of exactly what’s happening, but combined you know how to fly through airspace,” he says. Perhaps it is no coincidence that Metzner is only a few months away from earning his private pilot’s license.

Metzner says that of the many things he learned at Eton and took to Plural, he has a great respect for common data and the need to look at one piece of information firm-wide. It becomes exponentially more difficult to manage risk during volatile times if everyone is working with different sets of data.

The Horizon

The other advantage of creating a common set of clean data that is easily accessible is that it can be analyzed and picked apart. Metzner says that how Plural goes about slicing and dicing its information is one of the more exciting parts of his job because it’s very different from conventional thinking.

“We’ve been collecting a huge amount of data over the last few years and we’re getting to the point where we can start to analyze that in a much more sophisticated manner and look for patterns that may exist in the data,” he says. “Now we’re starting to get a critical mass of data and that could lead to some interesting opportunities.”

In addition to its ventures in data mining, the firm is also working on a user interface for its platform that links products and applications through what he calls “right-click” functionality. The idea is that the investment manager has a set of parameters for names, dates or stocks, and then right-clicks the information to pass it through a series of other applications. This allows Plural’s management to better understand workflows and how portfolio managers are using apps in sequence, thus allowing the firm to make the process more efficient.

Metzner is also excited by the potential of portability. Plural is actively testing a Citrix-type solution that will allow it to tap into the Apple iPad’s hardware to provide its on-the-road employees with more efficiency in accessing and providing information to and from the office.

Additionally, Plural continues to enhance its tools that capture research in order to provide teams of portfolio managers and analysts with the ability to work together and manage that workflow. To this end, Plural is also enhancing its idea-analysis framework so that it will be more capable of working in a team environment.

Finally, Plural is developing a flagging system that will alert its analysts if a particular deadline is approaching—for a thesis idea or timeline—so that the analyst can update the information. It’s plain to see that Metzner still has a lot on his plate; such is the natural evolution of any hedge fund.

Metzner has made impressive strides in his career. When asked if he was thinking about the next move, he says absolutely not. He’s put a lot into this firm—a firm that has moved him along from CTO to COO to his current role as president—and it’s still only the beginning. They have built the systems, tested them and taken them live, and they have learned from their miscues. But now is the time to grow.

Be that as it may, it’s hard not to think that there are still a few more stretches left in Metzner’s career.

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@waterstechnology.com or view our subscription options here: http://subscriptions.waterstechnology.com/subscribe

You are currently unable to print this content. Please contact info@waterstechnology.com to find out more.

You are currently unable to copy this content. Please contact info@waterstechnology.com to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@waterstechnology.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@waterstechnology.com

More on Emerging Technologies

TMX buys ETF biz, Iress reinvests in trading tools, UBS data exposed, and more

The Waters Cooler: Euroclear’s next-gen service, MarketAxess launches e-trading for IGBs, and new FX services are in this week’s news round-up.

SEC pulls rulemaking proposals in bid for course correction

The regulator withdrew 14 Gensler-era proposals, including the controversial predictive data analytics proposal.

Waters Wavelength Ep. 322: Navigating air travel and cybersecurity

This week, Reb, Nyela, and Shen discuss concerns around air travel and notable cybersecurity incidents.

Cloud offers promise for execs struggling with legacy tech

Tech execs from the buy side and vendor world are still grappling with how to handle legacy technology and where the cloud should step in.

Deutsche Bank to debut tokenization platform in November

Dama 2 minimizes up-front hardware and infrastructure costs for firms exploring tokenization.

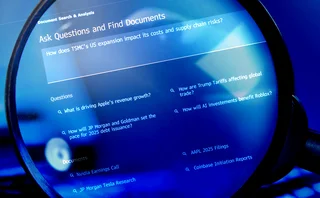

Bloomberg expands user access to new AI document search tool

An evolution of previous AI-enabled features, the new capability allows users to search terminal content as well as their firm’s proprietary content by asking natural language questions.

Agentic AI takes center stage, bank tech projects, new funding rounds and more

The Waters Cooler: SEC hack investigation, FCA–Nvidia partnership, LTX BondGPT upgrade, and CDO problems are also in this week’s news round-up.

Waters Wavelength Ep. 321: AccessFintech’s Par Cassells

This week, Par Cassells joins Nyela to discuss shorter settlement cycles and the role of vendors in the transition.