Regulation Webcast: Risk and Reward

TOPICS COVERED BY THE WEBCAST:

- The ways in which firms are challenged by the frequency of new regulation, and the number of different directions it is coming from, along with short timeframes for compliance.

- The role of technology in managing this global reform, from swaps reform through to market surveillance and other areas.

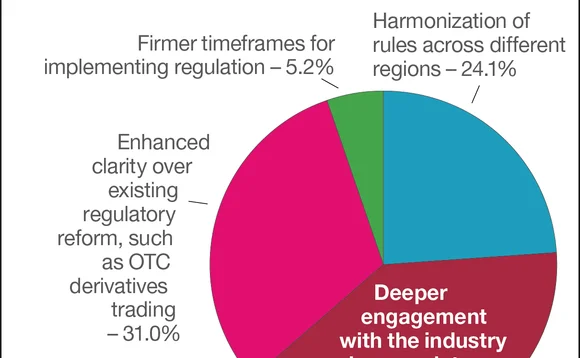

- Managing the risk of regulatory arbitrage, and debating questions over more harmonized approaches to global regulation.

- How vendors, institutions and regulators can work more closely with one another to reduce the risks inherent in non-compliance, particularly in fragmented regulatory environments such as the ones international firms operate in.

On a global basis, financial firms are being buffeted by the winds of change. The US financial sector is experiencing the widest reform since the Great Depression on the back of the Dodd–Frank Act, while those operating in Europe are dealing with the review of the Markets in Financial Instruments Directive (Mifid II). For international firms, questions of managing reform and the potential for regulatory arbitrage present significant challenges to the way in which they operate, as borne out by discussions in a recent Waters webcast, which explored the ways in which businesses can navigate the intensity of regulation after the financial crisis of 2008.

Moderated by James Rundle, deputy editor, sell side, of Waters, panelists included Nick Green, head of fixed-income markets e-business at Crédit Agricole; Alan Eddie, head of risk IT Americas, global head of regulatory risk and operational risk IT at RBS; Bill Nosal, head of business development and product strategy for Smarts Broker at Nasdaq OMX; and Ed Royan, COO at AxiomSL, EMEA.

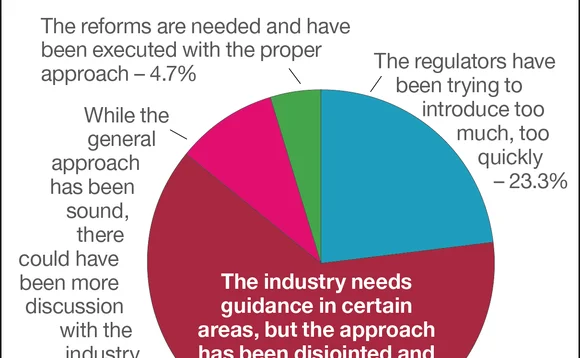

Risk Elements

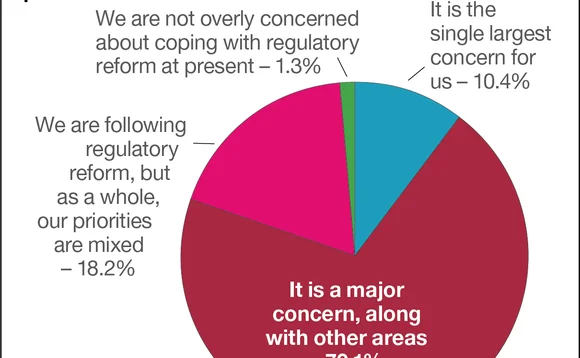

Although the primary objective of macro-regulation such as Dodd–Frank and Mifid II is the reduction of systemic risk, panelists debated the question of whether this new landscape, and both the frequency and direction of new regulation, were actually introducing new elements of risk, given the stiff penalties for breaches and the often short timeframes in which to ensure compliance.

“The scale of reform we’re seeing across the world is without precedent. Just look at Dodd–Frank, a prime example of large-scale reform,” RBS’ Eddie says. “It’s always risky, and particularly so when the whole industry has to do it at the same time—it’s not just one firm that has to change.”

“The scale of reform we’re seeing across the world is without precedent. Just look at Dodd–Frank, a prime example of large-scale reform. It’s always risky, and particularly so when the whole industry has to do it at the same time – it’s not just one firm that has to change.” Alan Eddie, RBS

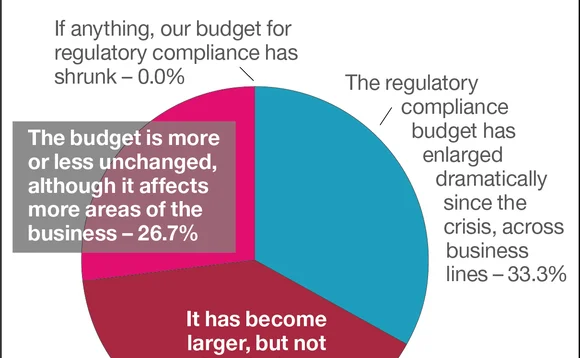

According to Eddie, simply keeping track of what regulation was coming from where, and when regulators expected compliance, was a significant challenge. Others say this was mainly a capacity problem, and although the immediate commercial benefits of increasing compliance capacity aren’t readily apparent, some firms are actively exploring ways in which their compliance procedures and ability to adapt to regulation can be a competitive differentiator.

Carrot and Stick

The panelists say that although the burden of regulatory change is relentless, there are some benefits. Requirements under Dodd–Frank for certain institutions to centrally clear interest-rate swaps on March 11, for instance, went smoothly in part due to vendors having their systems in place to handle the new method of trading, while other regulatory reforms around derivatives transactions potentially offer new areas of growth.

“There is risk inherent in the scale and the pace of the change,” says Crédit Agricole’s Green. “But on the other hand, there are opportunities. Central clearing gives a tremendous opportunity for many of the dealers to expand the range of clients they deal with, and by reducing the risk between the counterparties, it gives the potential for that asset class to be used a lot more extensively and to be a lot more attractive to users over time.”

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@waterstechnology.com or view our subscription options here: http://subscriptions.waterstechnology.com/subscribe

You are currently unable to print this content. Please contact info@waterstechnology.com to find out more.

You are currently unable to copy this content. Please contact info@waterstechnology.com to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@waterstechnology.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@waterstechnology.com

More on Regulation

EU banks want the cloud closer to home amid tariff wars

Fears over US executive orders have prompted new approaches to critical third-party risk management.

Friendly fire? Nasdaq squeezes MTF competitors with steep fee increase

The stock exchange almost tripled the prices of some datasets for multilateral trading facilities, with sources saying the move is the latest effort by exchanges to offset declining trading revenues.

Europe is counting its vendors—and souring on US tech

Under DORA, every financial company with business in the EU must report use of their critical vendors. Deadlines vary, but the message doesn’t: The EU is taking stock of technology dependencies, especially upon US providers.

Regulators can’t dodge DOGE, but can they still get by?

The Waters Wrap: With Trump and DOGE nipping at regulators’ heels, what might become of the CAT, the FDTA, or vendor-operated SEFs?

CFTC takes red pen to swaps rules, but don’t call it a rollback

Lawyers and ex-regs say agency is fine-tuning and clarifying regulations, not eliminating them.

The European T+1 effect on Asia

T+1 is coming in Europe, and Asian firms should assess impacts and begin preparations now, says the DTCC’s Val Wotton.

FCA sets up shop in US, asset managers collab, M&A heats up, and more

The Waters Cooler: Nasdaq and Bruce ATS partner for overnight market data, Osttra gets sold to KKR, and the SEC takes on DOGE in this week’s news roundup.

Waters Wavelength Ep. 312: Jibber-jabber

Tony, Reb, and Nyela talk about tariffs (not really), journalism (sorta), and pop culture (mostly).