LSEG Data & Analytics’ Tim Anderson discusses how AI can be used to enhance the value proposition of the firm’s vast tick history repository in the cloud and what that might mean to practitioners on both sides of the industry. Also under discussion was the emergence of infused reasoning—a flavor of agentic AI that acts autonomously and typically features the ability to reason, plan and act—and the promise it holds for an industry struggling to process and interrogate ever-increasing quantities of data.

Key takeaways

- AI is one of the only means available to industry participants to interrogate large volumes of tick history data at lightning speed with the view to identifying and understanding the hidden patterns and signals embedded within it.

- Cloud underpins LSEG Data & Analytics’ tick history data delivery through partnerships with a range of cloud service providers such as Google, Amazon Web Services and Microsoft. And now, in certain platforms, it’s possible for clients to instantly access, analyze and apply AI tools to normalized, ready-to-use data.

- Infused reasoning has the ability to democratize the capital markets by transforming data analysis, automating contextual summaries and producing detailed reports in minutes rather than weeks.

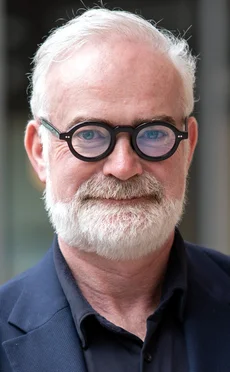

Tim Anderson, director of tick history and quantitative and economic data at LSEG Data & Analytics, has witnessed significant change during his time in the industry, ushered in largely by the emergence of new technologies. However, nothing comes close to matching the transformational role artificial intelligence is already playing across the capital markets. It seems only a matter of time before every conversation inevitably broaches the subject of AI, given its capacity to touch and shape the bulk of business processes underpinning the industry. This conversation is no different, and for good reason: AI is set to transform industry practitioners’ relationships with the ever-increasing data volumes they are being forced to consume.

Learn more

AI is transforming financial markets. Discover how LSEG Data & Analytics’ unmatched data, infrastructure and partnerships are at the forefront of this change.

Anderson explains that analyzing the 30 years of tick history data LSEG Data & Analytics has compiled in its entirety is mostly impossible for humans, given the sheer scale and complexity of the undertaking. The use of AI, therefore, unlocks new opportunities to identify tradable patterns through its immense computational power, he says.

The technology allows users to apply fractal geometry—a branch of mathematics focusing on complex and seemingly chaotic shapes and patterns—to help identify hidden signals within vast datasets, which Anderson likens to people moving seemingly at random through an airport terminal. “At eye level, you see people running everywhere, going in all different directions,” he explains. “It looks like chaos but, if you were to view the terminal from above, you would see that people are actually going to certain gates to catch planes. The markets behave in a similar way, and the key to unlocking them is identifying where patterns exist and where they begin.”

Connecting patterns

AI is especially adept at identifying and connecting market patterns with external influences such as policy changes, news or social media activity. However, unlike traditional business processes such as algorithmic trading, which requires intimate market knowledge, experience and mathematical expertise, AI can deliver almost instant results through the use of natural language interaction, essentially democratizing the markets and opening them up to a much wider range of users.

Beyond trading

According to Anderson, the availability of AI-enhanced, cloud-based tick history data represents a significant step toward what he refers to as “infused reasoning”, where vast datasets can be merged with other LSEG Data & Analytics data sources—quantitative analytics or machine-readable news, for example—to generate entirely new insights into newly created, summarized outputs. He emphasizes that this initiative extends beyond pure trading applications. “Tick history is used in many different contexts, and a lot of that context is research,” he says. “By combining datasets through AI, users can move beyond surface-level correlations to obtain synthesized summaries that integrate market movements and underlying drivers, such as news events.”

Anderson explains that AI functionality can be used to drive dynamic calculations—such as VWAP (volume-weighted average price), TWAP (time-weighted average price) and data aggregation into one-minute or one-hour bars—on a near real-time basis. This automation reduces the need for separate teams to compile and process large data volumes manually, he says, allowing organizations to gain faster, more judicious insights, while simultaneously deploying staff to manage higher-value tasks: “It’s very exciting for a lot of people because you don’t need separate teams to pull all of that data together—it can be done systematically by the AI.”

As with so many other business processes, cloud plays a crucial, enabling role in delivering LSEG Data & Analytics’ tick history data to its clients. It does this in collaboration with the key cloud providers and, in certain cases, allows clients to use AI tools and apply them to LSEG Data & Analytics’ data. “It’s literally AI with a mouse click. The data is already stored, it’s normalized, structured and is instantly available to the customer—they just apply the AI,” Anderson explains.

Learn more

Unlock powerful insights from LSEG Data & Analytics’ historical tick data, now enhanced through the integration of Google Cloud’s Vertex AI platform within BigQuery

Transformational tech

It is fair to say that Anderson is an ardent supporter of infused reasoning, specifically in the context of LSEG Data & Analytics’ AI-enhanced, cloud-based tick history data strategy. He describes the technology as a “transformative leap beyond traditional data analysis,” which, by comparison, is limited by its reactivity and reliance on user inputs or prompts. By contrast, infused reasoning allows users to receive natural language responses to their interrogations of large volumes of both numeric and alphanumeric data.

Unlike conventional machine learning, which is primarily correlation-based, infused reasoning has the ability to integrate multiple datasets, including—in the context of LSEG Data & Analytics—tick history, quantitative analytics and machine-readable news. It is also able to generate entirely new insights rather than simply restating existing information.

Anderson illustrates its value with the following example: the AI will recognize that trading volume rose by 7% and will automatically embed that finding into a contextualized summary linked to a relevant news event. “It won’t just say a number,” he explains. “It will incorporate that 7% increase into a machine-readable news article, summarize it with the context that the volume went up by 7% and provide a new summary. It’s not just regurgitating what is stored in that news event. You’re literally getting new data.”

This is a significant enhancement compared with current processes where teams are required to undertake analysis, which they cannot start until they receive the various calculations. “It’s a long and complicated process to get to a signal with some meaning,” Anderson says.

New data

This new process, made possible by infused reasoning, produces “new data” and eliminates the need for teams to manually compile and interpret disparate datasets—a task that is invariably lengthy and complex.

Anderson goes on to describe a demonstration where LSEG Data & Analytics leveraged AI capabilities developed by Google Cloud within Google BigQuery to generate a detailed 15-page analyst report on two London Stock Exchange-traded stocks. This process conducted the necessary calculations, applied infused reasoning and even issued a buy-hold-sell recommendation. “It did all the calculations and infused reasoning, and, at the end, it gave a buy-hold-sell rating, which typically takes a human a very long time,” Anderson explains.

Additionally, support with regulatory compliance was built into the process, with the AI verifying the report against various mandates—including the Volcker Rule and General Data Protection Regulation—before completion.

However, it is important not to rely solely on AI for compliance; human oversight is still essential. “What once required six to eight weeks can now be done within a matter of minutes,” Anderson says. Ultimately, he believes infused reasoning has the potential to “lower the bar so anyone can participate in the market”.

Conclusion

The impact of AI across the capital markets is no longer theoretical, especially when it comes to data and data-driven functions. As LSEG Data & Analytics’ cloud-based tick history data strategy illustrates, AI is already a practical tool that allows users to consume, process and analyze complex data at speed and scale. By exposing decades of high-quality market data with sophisticated AI functionality, including infused reasoning, firms can now meaningfully move from retrospective analysis to near-real-time identification and understanding of what is happening in the markets, and, crucially, why.

This development has implications far beyond trading, supporting a range of business processes including reporting, compliance and better-informed decision-making across the full investment life cycle. Significantly, the automation of calculations and contextual summaries allows industry specialists to focus on judgment—making the most judicious, repeatable and defendable business and investment decisions—rather than data preparation.

While human oversight remains essential, the direction of travel is clear: AI is reshaping how market participants interact with data, lowering barriers to entry and redefining what is possible when insight is generated at the same pace as the markets themselves.

Sponsored content

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@waterstechnology.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@waterstechnology.com