Blockchain Frameworks Move Forward with Partnerships and Production Releases

Hyperledger Fabric has released its production-ready version 1.0, as R3 partners with Intel

Hyperledger has made Hyperledger Fabric 1.0 available for the development of applications, products and solutions on an open-source basis.

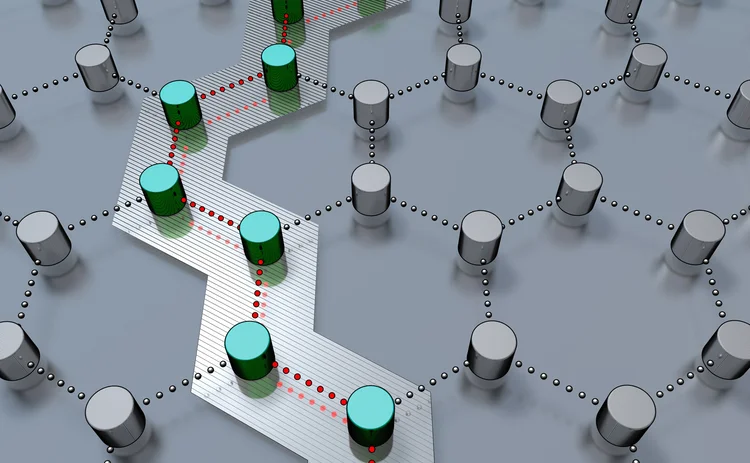

Hyperledger Fabric—hosted by The Linux Foundation—offers modular architecture for plug-and-play components, and leverages smart contracts it calls “chaincode” for the system’s application logic. The technology was incubated 16 months ago and placed on active status in March 2017.

Brian Behlendorf, executive director of Hyperledger, said the release of the technology is a milestone for distributed-ledger technology.

“After over a year of public collaboration, testing, and validation in the form of proof of concepts and pilots, consumers and vendors of technology based on Hyperledger Fabric can now advance to production deployment and operations,” Behlendorf. “I look forward to seeing even more products and services being powered by Hyperledger Fabric in the next year and beyond.”

The technology was developed by engineers from the Hyperledger community which includes CLS, the Depository Trust and Clearing Corporation (DTCC), Digital Asset, GE, the Linux Foundation, State Street, IBM, and SAP. In total, around 159 developers worked on the project.

Several Hyperledger community members have already begun using Hyperledger Fabric for their applications. CLS, for example, announced in September last year that it intends to develop a payments-netting service on Hyperledger Fabric and ANZ Banking Group is running a proof of concept to digitize guarantees for property companies.

“As a founding member of the Hyperledger community, ANZ is excited to be using Hyperledger Fabric 1.0 in its latest customer proof-of-concept, which has enabled the digitization of the bank guarantee, or standby letter of credit as they are known in the US, for property companies in Australia,” said Nigel Dobson, general manager for wholesale digital and digital banking at ANZ Banking Group, in an accompanying statement

Separately, R3 announced it is collaborating with Intel to strengthen data privacy and security for its own blockchain framework, Corda, which entered into public beta in June.

The collaboration adds elements of Intel’s security and privacy toolkit for Corda’s need-to-know feature, which assures confidentiality in trades by selectively sending information to parties who require it.

R3’s lead platform engineer Mike Hearn said the consortium is continually working on solutions to better protect privacy on the ledger.

“By partnering with Intel, we will be able to give Corda users more class-leading features as we continue to set the standard in distributed ledger technology data privacy,” Hearn said in a statement. “Corda addresses multiple problems identified by our 80-plus members across the globe but transaction privacy is usually the top issue blocking real-world deployment.”

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@waterstechnology.com or view our subscription options here: https://subscriptions.waterstechnology.com/subscribe

You are currently unable to print this content. Please contact info@waterstechnology.com to find out more.

You are currently unable to copy this content. Please contact info@waterstechnology.com to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@waterstechnology.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@waterstechnology.com

More on Trading Tech

Ram AI’s quest to build an agentic multi-strat

The Swiss fund already runs an artificial intelligence model factory and a team of agentic credit analysts.

Fidelity expands open-source ambitions as attitudes and key players shift

Waters Wrap: Fidelity Investments is deepening its partnership with Finos, which Anthony says hints at wider changes in the world of tech development.

Market-makers seek answers about CME’s cloud move

Silence on the data center’s changes has fueled speculation over how new matching engines will handle orders.

SGX to modernize data lake

The work is part of the exchange’s efforts to enhance its securities trading platform.

Digital employees have BNY talking a new language

Julie Gerdeman, head of BNY’s data and analytics team, explains how the bank’s new operating model allows for quicker AI experimentation and development.

Everything you need to know about market data in overnight equities trading

As overnight trading continues to capture attention, a growing number of data providers are taking in market data from alternative trading systems.

TMX Datalinx makes co-location optionality play with Ultra

Data arm of the Canadian stock exchange group is leveling up its co-lo capabilities to offer a range of options to clients.

NYSE plans new venue, Levy leaves Symphony, and more

The Waters Cooler: MIAX sells (most of) its derivatives exchange, BNY integrates with Morningstar on collateral, and science delights in this week’s news roundup.