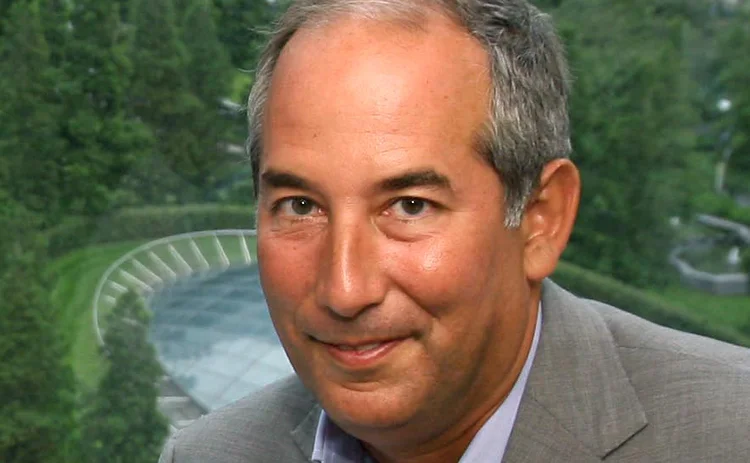

Tom Glocer Joins Algomi's Team as Strategic Advisor

Additionally, Howard Edelstein has been appointed to Algomi's board.

"Fixed income markets continue to suffer from a lack of liquidity," said Glocer in a statement. "This will only worsen as capital requirements bite. Algomi's approach of creating a bank balance-sheet based on actual data, and virtualizing the assets in the market is fascinating and I'm looking forward to working closely with them."

Algomi's Honeycomb Network helps banks create a virtual balance sheet based on live bond data ─ including trade information, enquiries, and holdings ─ and lets buy-side firms see this validated virtual balance sheet at the banks, according to the company. Algomi has over 160 buyside and 15 banks signed up to the Honeycomb Network.

Deep Experience

After four years as Thomson Reuters' CEO, Glocer departed in 2012 to take over as managing partner of Angelic Ventures, where he still resides. Angelic focuses on early-stage investments in fintech, media, big data and healthcare. It was also announced that Glocer has made an investment in the business for an undisclosed amount.

Edelstein is currently the chairman of REDI Holdings, which provides an order/execution management system (OEMS).

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@waterstechnology.com or view our subscription options here: https://subscriptions.waterstechnology.com/subscribe

You are currently unable to print this content. Please contact info@waterstechnology.com to find out more.

You are currently unable to copy this content. Please contact info@waterstechnology.com to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@waterstechnology.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@waterstechnology.com

More on Emerging Technologies

Ram AI’s quest to build an agentic multi-strat

The Swiss fund already runs an artificial intelligence model factory and a team of agentic credit analysts.

Fidelity expands open-source ambitions as attitudes and key players shift

Waters Wrap: Fidelity Investments is deepening its partnership with Finos, which Anthony says hints at wider changes in the world of tech development.

Fiber’s AI gold rush risks a connection drop

In search of AI-related profits, investors flocked to fiber cables, but there are worrying signals on the horizon.

JP Morgan gives corporates an FX blockchain boost

Kinexys digital platform speeds cross-currency, cross-entity client payments.

BlackRock further integrates Preqin, Nasdaq and Osaka Exchange partner, and more

The Waters Cooler: SGX remodels data lake, ICE seeks tokenization approval, TNS closes Radianz deal, and more.

ICE to seek tokenization approval from SEC under existing federal laws

CEO Jeff Sprecher says the new NYSE tokenization initiative is not dependent on the passage of the US Clarity Act.

Waters Wavelength Ep. 346: TS Imagine’s Andrew Morgan

This week, Andrew Morgan of TS Imagine talks with Wei-Shen about how fixed income trading behavior is changing.

State Street expands in Abu Dhabi, Etrading advances UK bond tape, and more

The Waters Cooler: Avelacom expands access into Argentina’s capital markets, Seven Points Capital opens a London office, and more in this week’s news roundup.