Data Manager

Digital employees have BNY talking a new language

Julie Gerdeman, head of BNY’s data and analytics team, explains how the bank’s new operating model allows for quicker AI experimentation and development.

Market data costs defy cyclicality

Trading firms continue to grapple with escalating market data costs. Can innovative solutions and strategic approaches bring relief?

Data managers worry lack of funding, staffing will hinder AI ambitions

Nearly two-thirds of respondents to WatersTechnology’s data benchmark survey rated the pressure they’re receiving from senior executives and the board as very high. But is the money flowing for talent and data management?

As AI pressures mount, banks split on how to handle staffing

Benchmarking: Over the next 12 months, almost a third of G-Sib respondents said they plan to decrease headcount in their data function.

Everyone wants to tokenize the assets. What about the data?

The IMD Wrap: With exchanges moving market data on-chain, Wei-Shen believes there’s a need to standardize licensing agreements.

TCB Data-Broadhead pairing highlights challenges of market data management

Waters Wrap: The vendors are hoping that blending TCB’s reporting infrastructure with Broadhead’s DLT-backed digital contract and auditing engine will be the cure for data rights management.

CME, LSEG align on market data licensing in GenAI era

The two major exchanges say they are licensing the use case—not the technology.

Tokenization & Private Markets: Where mixed data finds a needed partner?

Waters Wrap: Reading the tea leaves, Anthony predicts BlackRock’s Preqin deal, Securitize’s IPO, and numerous public comments from industry leaders are just the tip of the iceberg.

MayStreet founder says LSEG abandoned integration in new court filing

In response to LSEG’s motion to dismiss a lawsuit filed by the founder of one of its acquired companies, lawyers for Patrick Flannery have offered more details around communications between MayStreet and the exchange group.

SIX, ViaNexus build market data platform to unite data consumers, producers

The assets that formerly comprised IEX Cloud will underpin a new market data platform that hopes to give SIX Group and its data consumers a closer, more controlled relationship.

Bloomberg integrates AI summaries into Port

One buy-side user says that while it’s still early for agentic tools, they’re excited by what they’ve seen so far.

The great disappearing internet—and what it could mean for your LLM

AI-generated content, bots, disinfo, ads, and censorship are killing the internet. As more of life continues to happen online, we might consider whether we’re building castles atop a rotting foundation.

Messaging’s chameleon: The changing faces and use cases of ISO 20022

The standard is being enhanced beyond its core payments messaging function to be adopted for new business needs.

The industry is not ready for what’s around the corner

Waters Wrap: As cloud usage and AI capabilities continue to evolve (and costs go up), Anthony believes the fintech industry may face a similar predicament to the one facing journalism today.

Overbond’s demise hints at cloud-cost complexities

The fixed-income analytics platform provider shuttered after failing to find new funding or a merger partner as costs for its serverless cloud infrastructure “ballooned.”

Buy-side transformation requires data stabilization

The IMD Wrap: Insightful and actionable data tools require reliable and accurate underlying data. Max looks at some startling findings from recent reports that highlight the key data challenges that lie ahead.

Agentic AI comes to Bloomberg Terminal via Anthropic protocol

The data giant’s ubiquitous terminal has been slowly opening up for years, but its latest enhancement represents a forward leap in what CTO Shawn Edwards calls, “the way we should talk to the world.”

M&G Investments braves cost headwinds in pursuit of AI

The UK asset manager’s AI ambitions started with the creation of a data lake to ensure high-quality data is being fed into models.

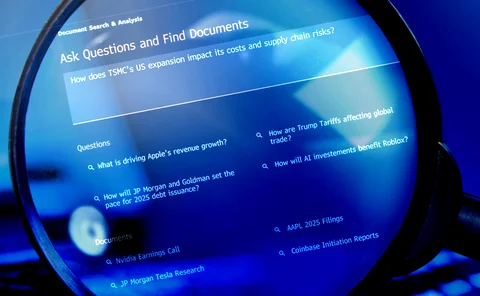

Bloomberg expands user access to new AI document search tool

An evolution of previous AI-enabled features, the new capability allows users to search terminal content as well as their firm’s proprietary content by asking natural language questions.

CDOs must deliver short-term wins ‘that people give a crap about’

The IMD Wrap: Why bother having a CDO when so many firms replace them so often? Some say CDOs should stop focusing on perfection, and focus instead on immediate deliverables that demonstrate value to the broader business.

Perceive, reason, act: Agentic AI, graph tech used to assess risk

Industry executive Jay Krish is experimenting with large language models to help PMs monitor for risk.