Portfolio

Multi-asset investing: Capturing diversification and alpha in a complex market

How multi-asset and cross-asset strategies are redefining performance and scale across institutional portfolios

Larry Fink: ‘We need to be tokenizing all assets’

The asset manager is currently exploring tokenizing long-term investment products like iShares, with an eye on non-financial assets down the road.

Bloomberg introduces geopolitical country-of-risk scores to terminal

Through a new partnership with Seerist, terminal users can now access risk data on seven million companies and 245 countries.

Aussie super fund overhauls investment platform with BlackRock Aladdin

Aware Super’s Project Odin includes implementations of BlackRock Aladdin, eFront and GoldenSource EDM

AI co-pilot offers real-time portfolio rebalancing

WealthRyse’s platform melds graph theory, neural networks and quantum tech to help asset managers construct and rebalance portfolios more efficiently and at scale.

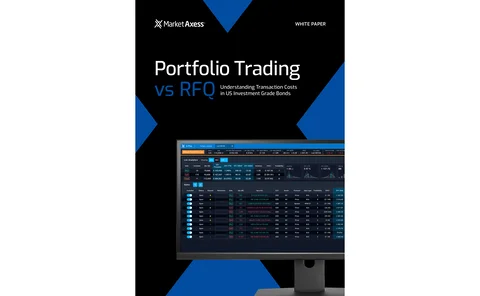

Portfolio trading vs RFQ: Understanding transaction costs in US investment-grade bonds

The MarketAxess research team explores how such factors as order size, liquidity profiles and associated costs determine whether a portfolio trade or an RFQ list trade is the optimal choice.

The coming AI revolution in QIS

The first machine learning-based equity indexes launched in 2019. They are finally gaining traction with investors.

FactSet looks to build on portfolio commentary with AI

Its new solution will allow users to write attribution summaries more quickly and adds to its goal of further accelerating discoverability, automation, and innovation.

Interop tech buys time for buy-side fixed-income traders

A few buy-side traders and portfolio managers spearheading a drive for greater interoperability are reaping the rewards of increased workplace efficiency. Is interoperability the fixed-income panacea the buy side has been looking for?

This Week: SimCorp/Deutsche Boerse, Moody's, SS&C, and more

A summary of the latest financial technology news.

FactSet lays out AI blueprint for discoverability, workflows, and innovation

The data provider is utilizing generative AI and large language models to provide a conversational interface in FactSet Workstation that will complement AI-powered workflows and products.

BNY Mellon streamlines the hunt for liquidity with LiquidityDirect updates

The bank spent the last three years evolving and expanding LiquidityDirect to include additional asset classes, and will white label the platform to customers.

Bloomberg creates one-stop shop for portfolio managers on Terminal

PM <GO> is a new workstation meant to support buy-side decision-making from analysis to implementation.

LiquidityBook buys Messer in effort to beef up portfolio management capabilities

The OEMS provider has purchased the Hong Kong-based PMS provider—but don’t say it’s solely a play for the buy side.

Behavioral analytics: the data trend that has asset managers looking inward

Vanguard and others are building tools that “nudge” investors to make better investment decisions.

BlackRock looks to expand Aladdin through accounting, data capabilities

Accounting, data, and analytics offerings make up part of Aladdin's strategy to become everything to everyone.

Buy side demands better data aggregation for primary corporate bonds

With electronification and tech development increasing in fixed income, participants are looking for better data access in the primary market for corporate bonds.

Deutsche Börse seeks seat at tech leader table with SimCorp buy

With exchanges such as Cboe, Nasdaq, LSEG, and ICE leading the pack of exchanges that double as technology companies, the German exchange is playing catch up with its proposed offer for buy-side tech vendor SimCorp.

Bank-backed Versana takes aim at syndicated loan tech

Born from a consortium that includes JP Morgan and Bank of America, Versana aims to bring up-to-date and permissioned data to the syndicated loan market—the first step to a more transparent and faster operating market.

BMO CIO: Open source boosts internal risk platform performance

The bank’s proprietary solution uses Apache Spark to calculate forward-looking loss scenarios in its loan portfolios.

Difficult transitions: Asset managers struggle to map future ESG risks

Investment firms have a role to play in incentivizing the green transition, but they must have forward-looking data.