Trading Tech

This Week: Bloomberg, Broadridge, Rimes, Glue42, and more

A summary of some of the past week’s financial technology news.

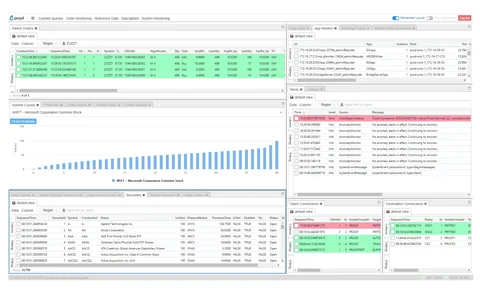

Burden of Proof: Meet the IEX breakaways looking to shake up broker algos

Founded with the principles of “transparency and academic rigor,” some say Proof’s model and technical approach is a test case for a new generation of cloud-native broker startups.

Holding Pattern: As Trading Technologies awaits new owner, the vendor adjusts development strategy

The Chicago-based futures trading platform recently rolled out a new OMS offering, while other projects, like its Echo Chamber market data platform, have been put on pause until a sale goes through.

Research management systems vie to double as data, analytics providers in one-stop-shop bid

RMS providers Sentieo and MackeyRMS feel the pressure to become quasi-data and analytics providers in their quest to cover the gamut of the buy-side research analyst workflow.

Swedish bank finds Covid-19 recovery insights in alt datasets

High-frequency data such as human mobility data and plastic shipments can help investment professionals understand the post-pandemic economic reopening.

People Moves: LedgerEdge, JP Morgan, MarketAxess, Enfusion, and more

A look at some of the key people moves from this week, including Michelle Neal (pictured), who has joined enterprise software vendor LedgerEdge as CEO of US operations.

Dutch asset manager turns to decision trees for currency predictions

APG has improved prediction accuracy for G10 currency movements after adopting decision tree-based machine learning.

This Week: Nasdaq, NSCC, State Street, OpenFin/Broadridge, and more

A summary of some of the past week’s financial technology news.

Investment bank wraps up major tech overhaul after Covid-19 setback

Stifel Europe weathered 2020 volatility and switched vendors in looking to simplify its middle- and back-office functions and increase tech investment.

EBA to consult on banks’ machine learning use

The watchdog will set out a new stance on ML-based capital models at a time of conflicting guidance from other supervisors.

Symphony taps Google for cloud, AI, data-sharing tools

By leveraging Google’s AI and data-sharing capabilities, Symphony is strengthening its ties with the tech giant, which is also an investor in the platform.

This Week: FactSet, Six, Nordic Capital, State Street, SmartStream, and more

A summary of some of the past week’s financial technology news.

UBS AM builds model for quantifying greening of heavy industry

The asset manager's quant research arm, QED, has published a framework for valuing companies in industries like cement or steel that transition to more sustainable tech.

Banks and HFTs team up to solve exchange outage dilemma

There are hopes that a ‘gentlemen’s agreement’ between industry participants can break the first-mover disadvantage for liquidity providers.

SF quant firm uses 'nearest neighbor' machine learning for equities predictions

Creighton AI is using a regression-based approach to machine learning to help make predictions about the excess return of a stock relative to the market.

Waters Wrap: A blockchain problem (And an alt data problem)

Anthony first looks at the alternative data industry and connects to QAnon, before explaining why there needs to be more hard numbers in the world of blockchain.

A blockchain believer: Broadridge looks to expand its DLT influence

The market infrastructure provider has rolled out its blockchain-based repo transaction platform with plans to further build on the emerging technology.

Symphony’s Seven-Year Itch

After seven years and half a billion dollars in funding, Symphony has made strides but arguably has not delivered the “big win” of living up to its early hype as a Bloomberg-killer. Max asks how long its investors will continue to back the venture,…

Rimes shutters market surveillance business amid strategy overhaul

The data management firm is undergoing a multi-year program to unravel its surveillance business, as it looks to throw its weight behind its flagship data offerings.

ASX automates corporate actions with issuer forms

The exchange group has completed the multi-year program aimed at standardizing data capture and message delivery using the ISO format.

Waters Wrap: Broadway Technology, Symphony, and new beginnings (And other new CEOs)

Anthony takes a look at some major CEO changes from the last year, and what those moves might mean for clients of those vendors.

Modular Applications and Integrated Platforms—The Best of Both Worlds

Traditionally, sell-side front offices have been forced to make difficult choices between single integrated trading platforms and discrete modular applications designed to support specialist front-office functions such as trading and execution management…

New entrants want to feed bond market’s hunger for data

In the absence of a consolidated tape for debt securities in the EU, vendors with different approaches to distributing fixed-income market data are emerging.