Data Management

SmartStream RDU—More Pertinent Now than Ever

This whitepaper outlines the history of the Reference Data Utility (RDU), charts its development, scrutinizes its underlying technology and articulates the business benefits that users can reasonably expect on the back of subscribing to it

JP Morgan: New LEI scheme could make codes cheaper

The bank is offering identifiers for free to customers under a new scheme it hopes will drive down costs for entities wanting to sign up.

Avelacom buys Brazilian infrastructure specialist to accelerate LatAm expansion

Network provider says the deal arms it to operate in uniquely nuanced regional markets.

Esma plan ‘won’t help’ fix Mifid swaps data problem

Dealers say proposal to force disclosure of all big-bank OTC derivatives trades won’t improve data.

Waters Wrap: The looming data storage wars (And Bloomberg killers)

Anthony first looks at the data storage space, explaining that fees are likely to increase for buy- and sell-side firms in the near-term. He also wonders if there’s a market in the terminal/workstation space for innovative startups to gain traction. As…

Money.Net files Chapter 7 bankruptcy amid lawsuit

Despite a series of ambitious content expansion projects and senior hires, the low-cost vendor failed to win over institutional clients.

BNP Paribas AM turns to machine learning for carbon emissions

The asset manager is using machine learning to estimate carbon footprints for companies that do not report emissions.

Bloomberg’s new data retention policy vexes buy-side firms

Impacted users will have to pay extra costs to retain communications data for longer than two years.

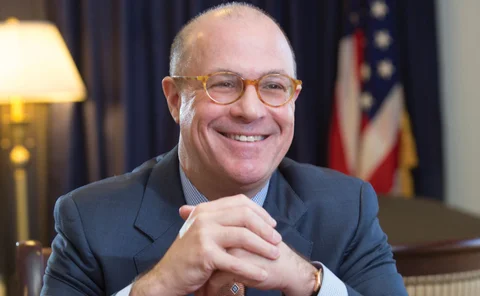

People Moves: Symphony, BMLL, HKEX, CloudMargin, Tora, Baton, and more

A look at some of the key people moves from this week, including Brad Levy (pictured), who will take the reins at communications platform Symphony in June, after joining the vendor in July last year.

Waters Wrap: Would DLT really have prevented Archegos? (And thoughts on Itiviti)

While Christopher Giancarlo says distributed ledger technology could’ve helped prime brokers better monitor their risk exposures to Archegos Capital Management, Anthony (and others) are not so sure about that. He also looks at the Broadridge-Itiviti deal.

This Week: TP Icap, Confluence, Bloomberg, Iress-Cosaic, Tradeweb, SmartStream, and more

A summary of some of the past week’s financial technology news

Small alt data providers feel pressure to specialize

GTCOM-US, once a bespoke alt data shop for the buy side, has narrowed its offering to focus on Chinese datasets as the largest alt data players get even bigger.

‘Crypto Dad’ Giancarlo says DLT could have aided in Archegos

The former CFTC chair says managing collateral by using distributed ledger technology would enable the better oversight of risks.

Data Management and Governance Take Center Stage

Data drives every business process across the buy side. The higher its quality, the more reliable, accurate and transparent the resulting downstream business processes are likely to be. That’s a simplistic characterization of what can be a highly…

Waters Wrap: Big Tech takes control of cutting-edge encryption (And consortium flat circles)

In addition to growing their cloud presence in the capital markets, Big Tech companies are, unsurprisingly, taking the lead on encryption and security in the cloud. Anthony sees positives and negatives. He also looks at bank-led consortiums.

This Week: Refinitiv; State Street/BlackRock; SteelEye; SimCorp; FEX Global/TT

A summary of some of the past week’s financial technology news.

What the inevitable ‘publicizing’ of private markets means for investors and exchanges

As markets for trading stock in privately-held companies become more prevalent and exchange-like, and potentially attract more investors, Max questions what impact this will have on fully-fledged exchanges and their offerings.

Citi, other banks set to ink ‘Octopus’ deal for new multi-bank CLO platform

Sources say initiative is designed to fend off higher fees and disintermediation in case established multi-dealer platforms start trading CLOs.

Engineers tap machine learning to improve graph analytics

Augmenting graph analytics with AI can detect more complicated anomalies, vendors say.

Waters Wrap: The nature of data and information (And Ion-List thoughts)

Anthony takes a look at the alternative data industry post-GameStop, and wonders about Ion Group’s strategy going forward after recent acquisitions.

This Week: Google Cloud/Commerzbank, SmartStream, Anna DSB, and more

A summary of some of the past week’s financial technology news.

Waters Wavelength Podcast: Episode 229 (World Backup Day)

On this episode of the Wavelength Podcast, Wei-Shen and Tony discuss their backup data habits.

A kick in the privates: In-demand unlisted stock trading faces tech, transparency challenges

Private stocks are opaque, illiquid, behave differently from public markets, and lack the same infrastructure as public marketplaces, creating back-office integration challenges for firms that want to trade these stocks in a more liquid manner. But as…

People Moves: State Street, Northern Trust, JonesTrading, LiquidityBook & More

A look at some of the key “people moves” from this week, including Vincent Georgel-O’Reilly (pictured), who's been appointed Emea head of alternatives at State Street.