What makes a good PM? New algos separate the skillful from the lucky

$15 billion investment manager Xponance’s web-based platform, Aapryl, helps asset allocators distinguish skillful investment managers from those who are simply lucky.

Selecting an investment manager is a lengthy process that involves looking at historical performance data, products and asset classes, and then comparing them to other managers that employ similar strategies.

Philadelphia-headquartered Xponance, a multi-strategy investment firm with $15 billion in assets under management, used an internally-generated methodology to identify equity investment managers that have a higher chance of performing well in the future. Fiduciary Investment Solutions Group (FIS Group) rebranded to Xponance in April 2020 following the integration of FIS Group and Piedmont Investment Advisors, an institutional money management firm it acquired in 2018.

Xponance’s initial methodology for selecting investment managers was a manual, laborious task, often involving two to three months of heavy number-crunching and modeling using various third-party tools.

In 2016, Xponance brought in David Andrade as its CTO, tasked with codifying that methodology into software. “My job originally when I joined Xponance six years ago was to take this concept that our CEO had generated over the last 12 to 15 years and try to codify it in a way that makes it accessible to customers,” he tells WatersTechnology.

Andrade developed the methodology into a set of tools for Xponance to use internally. But about four years ago, Xponance saw an opportunity to provide access to the platform as a software-as-a-service (SaaS) model to other money managers and asset allocators.

The platform, now known as Aapryl, launched in 2017 as an Xponance subsidiary. It helps asset allocators identify investment managers, build portfolios, and manage risk. It also now has fixed income capabilities. What used to take two to three months of number-crunching can be done in two to three minutes using the web-based interface Xponance developed, says Andrade, who also serves as general manager at Aapryl.

Before the methodology was codified into what is Aapryl today, it was used to build a better funnel to identify which managers would perform better. “There are thousands of different managers out there, and if you start to filter down based on your criteria, you may be left with a hundred managers. The underlying methodology allowed us to say, ‘Let’s look at a smaller pool, for which we can do a deeper set of qualitative analysis,’ because it’s impossible—unless you have hundreds of research members on your team—to do all of the qualitative research on a set of a hundred managers,” he says.

The Aapryl methodology allowed Xponance to use quantitative analysis to cut that list of 100 managers down to a more manageable set of fewer than 10 managers on which research members could then do their qualitative analysis.

“We don’t have time to talk to 100 managers, but we really want to identify the best of breed within the set, so how do we boil it down into a more manageable number? That was step one,” he says.

A director from a pension fund that uses Aapryl, says the fund previously used traditional benchmarks and regressions to evaluate alpha. “We would manually complete multi-factor regressions using the Fama–French five factors to better understand manager factor exposures. This was a time-consuming process that required collecting a lot of information and manually running regressions in Excel,” the director says.

Now the team uses Aapryl to understand managers’ skill levels versus factors like timing. “We now use the tool as our primary source to screen equity managers and to understand how skillful the manager is and what is really driving performance,” the director says.

Building Aapryl

To build Aapryl, the first thing Xponance’s Andrade did was understand the underlying methodology and figure out how to contextualize it in a single platform. “[This is] so we didn’t have to go out looking at multiple different data providers and then bring things into RStudio, or Excel, and have multiple different analytic algorithms. It’s a lot of number-crunching and it was time-consuming. It was a manually intensive task when we first started looking at it,” he says.

This process included figuring out how to consolidate data from various providers that Xponance was using to make some of the decisions. The returns-based methodology is heavily reliant on data and indices from third parties, such as Informa Financial Intelligence’s Zephyr PSN separately managed accounts data.

“We’re [also] getting benchmark and index data from Bloomberg, and what we did was basically structured agreements with data providers used at that time so we could take all that data that gets reported on a monthly or quarterly basis and streamline the data collection efforts to make sure the data was being housed centrally in a data lake,” Andrade says.

Next, Xponance devised procedures that use that data and generate an Aapryl score from 1 to 5 indicating how well a manager would perform in the future, with 1 being the best score.

Andrade says this predictive component differentiates Aapryl from other platforms. “If you look at, for example, Morningstar ratings, which are commonly used as a ratings classification, what we found through our research was that they are a good predictor of past performance but not necessarily a good predictor of what future performance could be,” he says.

Xponance focused on developing algorithms that look at how a manager will perform in the future by creating cloned portfolios. Rather than looking at the manager, Aapryl looks at a clone of the manager and how it would perform backwards in time. Then, using regression techniques, Xponance developed computations to predict what the manager will do in the future.

But what if a manager is relatively new? How would an asset allocator compare a manager that has only three years of performance data with a manager that may have 20 years’ worth of performance data?

Using the clone concept Andrade and his team developed, a minimum of three years’ worth of historical data is needed, which can then be extrapolated back an additional 10 years, for example.

“Using regressions, we can derive that data and say, ‘Here’s how we think this product would have performed prior to their inception based on what their style factors are,’” he says.

That 10 years then serves as a foundation to predict how that manager will perform in the future.

Skill vs. luck

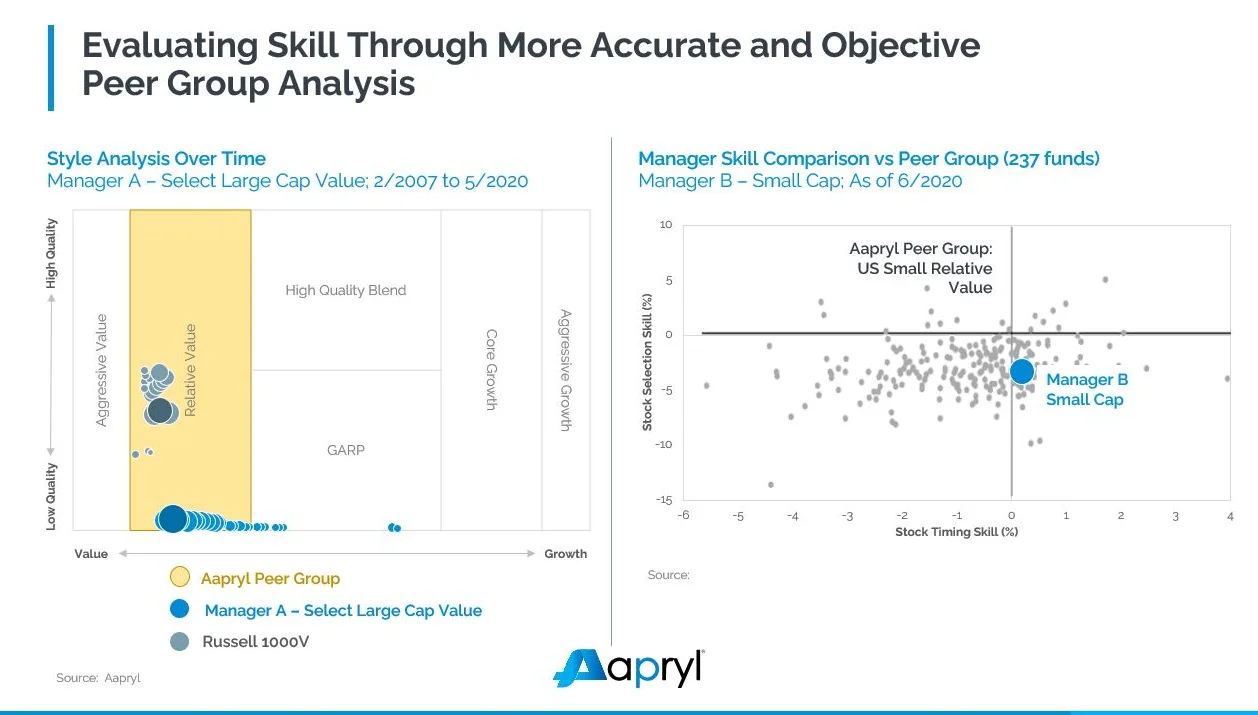

Using a proprietary set of algorithms, Aapryl constructs a clone portfolio to distinguish between skillful and lucky investment managers.

Aapryl defines lucky managers as those who do well because their current strategy is in favor, as opposed to being skillful in stock selection, for example.

The clone shows how the manager would perform if they had a clone of themselves. Take a simple ETF that was constructed based on the manager’s characteristics. Based on that, Aapryl computes a score that tells users if the manager is skillful or not. And if the manager is skillful, in say, stock selection, then despite the underlying strategy—in favor or not—their stock selection would still be effective.

“We’re trying to strip away the noise and look at their skills despite what their style is, because styles change,” Andrade says.

The pension fund director says Aapryl helps the fund compare managers against factor clone portfolios to differentiate skill from luck.

“The cyclical manager positioning has become a normal part of our process to ensure that we have a diverse set of managers in our portfolios that will perform across different parts of the economic cycle,” the director says.

The director could not provide metrics about how performance has improved, as the fund is moving from an outsourced chief investment officer model to an internal staff-driven investment process.

However, they explain that the fund built a small-cap portfolio where it did its initial screening and manager analysis using the Aapryl tool. “And then we used the optimization tool to help us with funding allocations once we finished diligence on the managers. We implemented that portfolio on April 1, 2021, and it is outperforming the Russell 2000 by 800 basis points through February 2022,” they say.

Aapryl’s data goes down to the product level, Andrade says. “An asset manager may have multiple products that they’re positioning. We’re able to help asset allocators who are interested in picking out specific products within the product mix that an asset manager has. We’re going all the way down to the actual product and comparing it at a product level rather than at the firm level,” he says.

He adds that Aapryl is useful not only for asset allocators deciding which managers to choose but also for investment managers to compare themselves to their peers. “Some of these investment managers were interested in finding out what their Aapryl score is compared to other managers. It became an interesting benchmark for them to use,” he says.

According to a $40 billion public fund client, Appryl allows its users to perform fast and efficient evaluations of investment managers. “Our investment office believes this tool is useful in allowing proper comparisons between current managers and their peers. [Nasdaq’s] eVestment is a great search tool for prospective managers; however, Aapryl provides the opportunity to search for a strategy and the style of that strategy. This will allow our investment office to compare return, style deviation, and outcomes of managers and their universe of peers,” the client says.

Further reading

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@waterstechnology.com or view our subscription options here: https://subscriptions.waterstechnology.com/subscribe

You are currently unable to print this content. Please contact info@waterstechnology.com to find out more.

You are currently unable to copy this content. Please contact info@waterstechnology.com to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@waterstechnology.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@waterstechnology.com

More on Trading Tech

Ram AI’s quest to build an agentic multi-strat

The Swiss fund already runs an artificial intelligence model factory and a team of agentic credit analysts.

Fidelity expands open-source ambitions as attitudes and key players shift

Waters Wrap: Fidelity Investments is deepening its partnership with Finos, which Anthony says hints at wider changes in the world of tech development.

Market-makers seek answers about CME’s cloud move

Silence on the data center’s changes has fueled speculation over how new matching engines will handle orders.

SGX to modernize data lake

The work is part of the exchange’s efforts to enhance its securities trading platform.

Digital employees have BNY talking a new language

Julie Gerdeman, head of BNY’s data and analytics team, explains how the bank’s new operating model allows for quicker AI experimentation and development.

Everything you need to know about market data in overnight equities trading

As overnight trading continues to capture attention, a growing number of data providers are taking in market data from alternative trading systems.

TMX Datalinx makes co-location optionality play with Ultra

Data arm of the Canadian stock exchange group is leveling up its co-lo capabilities to offer a range of options to clients.

NYSE plans new venue, Levy leaves Symphony, and more

The Waters Cooler: MIAX sells (most of) its derivatives exchange, BNY integrates with Morningstar on collateral, and science delights in this week’s news roundup.