Tech

MahiFX Launches e-FX Suite for Institutional Clients

Foreign-exchange (FX) trading technology provider MahiFX has launched MFX Compass, a suite of FX trading tools designed for institutional clients.

Newedge Adds Ullink Post-Trade Monitoring Solution in Asia

Multi-asset broker Newedge has added UL Monitoring, a post-trade monitoring solution from connectivity and trading solution provider Ullink, to its Direct Market Access (DMA) platform in Asia.

Eze Mulls Buying a Risk Company

Eze Software Group may purchase a risk software vendor in the near future, according to co-president David Quinlan.

Access to Equity Syndication, Hedge Fund Allocation Drives Two-Sided Growth at US Capital Advisors

Boutique broker-dealers often grow out of teams leaving larger wirehouses, just as David King's did at UBS on the way to co-founding Houston-based US Capital Advisors (USCA). But like proprietary trading desks spinning off, these firms often discover new…

Imagine Adds New Risk Service, Eases Spreadsheet Reliance

Last week, Imagine Software announced it was expanding its Imagine Financial Platform (IFP) and App Marketplace with the launch of Imagine Risk Services. Officials say this latest rollout will provide users with greater customization for portfolio…

SimCorp Buys Reporting Specialist Equipos

Copenhagen-based vendor SimCorp has acquired Equipos, a London-based developer of reporting software.

Bats Chi-X Europe Hires Jill Griebenow as CFO

Bats Chi-X Europe has appointed Jill Griebenow as chief financial officer with immediate effect. She will be responsible for all financial controls and human resource functions, including financial planning and reporting.

CME Clearing Europe Set To Expand Swaps Support

CME Clearing Europe, the Chicago Mercantile Exchange (CME) Group's European clearing house, has received Bank of England approval to add a number of derivatives to its interest-rate swap service.

Multi-Bank Group TESI to Adopt Fix Protocol

The Fix Trading Community has announced that the Trading Enablement Standardisation Initiative (TESI), developed by Etrading Software and supported by the investment banking community, has adopted the Fix Protocol guideline in order to reduce operational…

KKR's Colorful Personality: CIO Ed Brandman

Ed Brandman’s friendly quirks don’t conjure the conventional image of an IT chief, especially at KKR, one of the more white-shoe firms in a space famous for them. But don’t let the CIO’s charms fool you. He effectively redefined enterprise-grade…

James Rundle: The Big Whimper

While derivatives markets have seen huge transformations in both the US and Europe this month, James says they haven’t brought about the Big Bang effect that many predicted.

Anthony Malakian: The Power of the Investor

Anthony says that while new reporting guidelines and technologies will help firms to make the business case to move away from spreadsheets in favor of automated systems, investors will hold the most sway in making this a reality.

Michael Shashoua: Steadying Data Flows

Data management professionals will need to achieve smooth input and output to make investment books of record into useful systems for their firms. And, Michael explains, the European Market Infrastructure Regulation rules implementation is raising…

Max Bowie: Lights, Camera, Data!

With movies about corporate espionage and greedy tycoons—from the high-flying The Wolf of Wall Street to the grimy Boiler Room—always popular, the average person’s understanding of market data and trading technologies comes from the big screen, not the…

March 2014: Breaking the Habit

Microsoft Excel as an operational tool is as flawed as it is ubiquitous on Wall Street—even the regulators are guilty of over-reliance on spreadsheets—but Victor says cutting back on its use in favor of automated processes can mean serious long-term…

EFront to Streamline Portfolio Monitoring for Private Equity

EFront, a Paris-based provider of alternative investment solutions, believes its latest product will reduce the process of gathering portfolio company data by private equity investors from weeks to hours. FrontPM offers portfolio monitoring and analysis…

Aviva Investors Goes Live with Commcise Commission Management

London-based asset manager Aviva Investors has implemented a commission sharing agreement (CSA) and share-of-wallet management software solution from Commcise.

JSCC Taps Calypso for Client-Clearing Services

The Japan Securities Clearing Corporation (JSCC), a member of the Japan Exchange Group, has gone live with Calypso Technology’s system for client clearing of JPY interest-rate swaps (IRS) and collateral management.

Linedata Reporting Now Accessible On Mobile Devices

Linedata has made its Linedata Reporting service accessible via mobile devices, allowing end-investors access to real-time fund data when away from their desks.

Eris Exchange Achieves Open Interest Milestone: What's Next?

The venue's chief operating officer, Michael Riddle, discusses why more of the same is in store. After all, why fix what isn't broken?

Imagineer Partners with Abacus

Abacus Group, which provides hosted IT solutions to hedge funds and private equity firms, will host Imagineer Technology Group's Clienteer software platform in the AbacusFLEX private cloud.

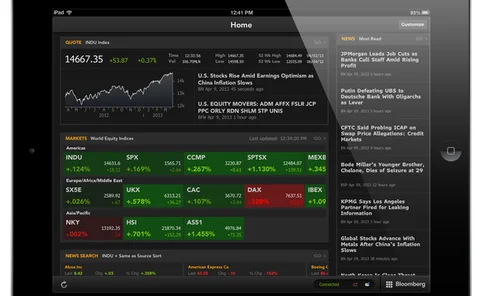

Regional Fixed Income Dealers Get Bloomberg Service

Bloomberg has unveiled its Electronic Trade Order Management Solution, or ETOMS, a managed service used by US regional broker-dealers to access and engage fixed income electronic markets as both liquidity providers and liquidity takers.

ASX Eyes Upgrade to T+2 Settlement

The Australian Securities Exchange (ASX) is considering shortening its settlement cycle for cash market trades in Australia.

Raiffeisen Bank Taps Broadridge for CEE Reconciliations

Broadridge Financial Solutions has announced it will provide automated reconciliation processing to Vienna-based Raiffeisen Bank International across six of the bank’s regional subsidiaries.