Tech

Nasdaq Opens Bangalore Tech Unit

Nasdaq OMX has announced the opening of a new office in Bangalore, India, dedicated to technology development.

BBVA Adds Neoris, AuthenWare for Employee Identification

Banco Bilbao Vizcaya Argentaria (BBVA) has enlisted the services of consultancy Neoris and biometrics firm AuthenWare, to develop a system of cyberbiometrics for employee identification purposes.

Asset Management Shift Inspires IT Transformation Among Middle Eastern Banks

While markets along the Persian Gulf have conspicuously built up financial infrastructure in recent years to attract foreign firms and capital, local banks elsewhere in the Middle East are bolstering their technological capacity to do precisely the…

Abacus Teams With Global Relay for Message Archiving

Abacus Group, a New York-based provider of hosted IT solutions for hedge funds and private equity funds, has partnered with Global Relay, a Vancouver-based provider of hosted email archiving, messaging and compliance services, to institute a message…

ITRS, Excelian Partner on Murex Systems Monitoring

The monitoring software provider and specialist consultancy are collaborating on real-time system performance metrics and monitoring for cross-asset trading and risk management platform Murex.

Solarflare Releases Network Server Security Solution

Solarflare, a California-based producer of 10 gigabit ethernet (10GbE) networking software and hardware, has launched a distributed, active security solution that is implemented within network servers, the prime targets of cyber security breaches.

Tass Signs Etrali for Unified Trading Communications

German institutional bond trading firm Tass Wertpapierhandelsbank GmbH (Tass) has deployed a unified trading communications solution from Etrali Trading Solutions across its trading floors in London and Hofheim, Germany.

EU-Project First Launches Social Media Sentiment Analysis Tool

An European Union-backed consortium, Project First, has launched a prototype tool for near-real-time social media sentiment analysis for financial services firms.

Plug and Play

In the course of my job, I primarily speak with technologists. That is to say, the people who actually do the implementations in firms, and who are involved in the purchase, decision making and the due diligence.

Should Kill Switches be Fully Automated?

If it were up to Dave Lauer, technology architecture consultant at Norwegian case-based reasoning specialist Verdande Technology, the surveillance of software-related trading glitches, and the subsequently activated kill switches, would be performed…

Spreadsheets Still Rule, But for How Long?

Automation is good, but comfort can sometimes prove better. Anthony questions why Excel spreadsheets are still so prevalent on the buy side, especially at new firms that can choose their own path with new, advanced data management tools.

OptionsCity Colocates in Equinix in Frankfurt

OptionsCity, a Chicago-based provider of trading solutions for futures and options, has chosen the Equinix data center campus in Frankfurt as its hub for access to German derivatives exchange Eurex.

Fund Managers Gear Up for AIFMD Costs, Compliance

With only six months to go until the July 22 deadline for fund managers to comply with the Alternative Investment Fund Managers Directive, Marina Daras looks at how the industry is gearing up in the homestretch.

Saxo Bank Launches Social Trading Floor

Copenhagen-based Saxo Bank has launched the beta version of its new social media-style trading floor.

European Insurer Uniqa Taps SimCorp for Structured Products

Austrian and Central European insurance firm Uniqa Group AG, with €26 billion in assets under management, will use XpressInstruments to manage its structured products support.

Kaminski: Risk Management Investment Must Go Beyond IT

While Wall Street firms have recently thrown money into their risk management systems, that is likely a short-term trend, says Vincent Kaminski. This makes it all the more necessary for asset managers to invest in analysts and give them the ear of the…

BAML Consolidates Options Algorithms

Bank of America Merrill Lynch (BAML) has streamlined its algorithmic offerings for options trading, consolidating them into four strategies.

US Treasuries' Trading Quietly Under Transformation, Panel Says

At a TabbForum event last week, a quartet of buy-side and sell-side participants highlighted how electronic trading in treasury bonds has advanced in the past 12 months, even if they've done so with little fanfare. Both opportunities and apprehension…

Indian Regulator Plans HFT Conference

The Securities and Exchange Board of India (Sebi) has announced plans for a two-day conference next week, aimed at discussing the market risks associated with algorithmic and high-frequency trading (HFT).

We'll Connect to Only Five or Six SEFs, Say Buy-Siders

If the two buy-side representatives from a Tabb Group conference panel are typical, then firms are not interested in connecting to all 22 swap execution facilities (SEF) on the market. Speakers from Babson Capital Management and Vanguard Group said they…

SGX to Introduce Circuit Breakers in February

The Singapore Exchange (SGX) has announced it will introduce circuit breakers in the securities market starting February 24.

Traiana Connects to Pre-Trade Repositories for Emir Reporting

Traiana, the New York-based provider of post-trade services owned by UK interdealer ICAP, has announced it will connect to four trade repositories through its Harmony TR Connect trade reporting service to ease regulatory reporting.

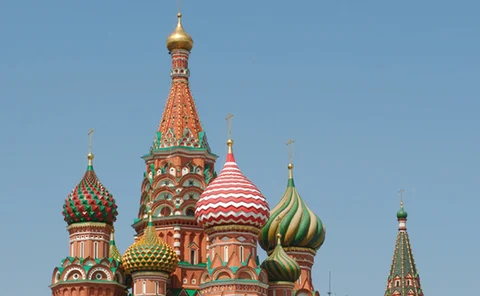

Euroclear Bank and NSD Launch Post-Trade Services for Russian Bonds

Eurolcear Bank and the Russian National Settlement Depository (NSD) are to launch their post-trade services for the Russian corporate and municipal bonds market on January 30 this year.

Etrali Partners with Natterbox for Voice Recording Solution

Etrali Trading Solutions has partnered with UK-based voice intelligence provider Natterbox to provide the first regulatory compliance solution for mobile and fixed recording, archiving and analytics services via a private cloud.