Tech

Numerix Introduces New Volatility Framework for CrossAsset

The universal local stochastic volatility model with jumps (ULSVJ) will help firms to price and manage semi-exotic derivatives such as barrier options, and should prove particularly useful for market makers in FX and EQ options.

Caplin Launches Core FX Motif for Single-Dealer Platforms

Trading technology vendor Caplin Systems announced today the launch of Core FX Motif, a tool that gives foreign exchange (FX) traders basic functionalities for building single-dealer platforms.

Schroder Automates NAV Validation with Milestone

Schroder Investment Management (Luxembourg) has implemented Milestone Group’s pControl platform to automate its net asset value (NAV) validation processes.

Oppenheimer & Co. Goes Mobile with Interactive Data's Market-Q

The real-time streaming market data desktop and mobile solution for tablet was implemented after a comprehensive analysis of the Oppenheimer's new operating requirements was undertaken.

OTCex Connects to Etrali for TCSnet Access

Global broker OTCex Group has connected to Etrali Trading Solutions’ extranet, TCSnet, to improve their connectivity and access to the markets.

FIX Creates Global Post-Trade Working Group

FIX Trading Community, the industry standards body, has combined its Americas Buy-side Post-Trade working group with its EMEA Post-Trade working group to form the Global Post-Trade working group. The decision to merge the two existing groups was made in…

Visualization Tools Highlight Linedata Global Hedge Version 6.2

More even than compliance, Linedata’s hedge fund clients have been asking for help with real-time P&L and exposure management. Older versions of the Linedata Global Hedge product already included the requisite analytics, but its latest, version 6.2,…

CLS Debuts USD/CAD Same-Day Settlement

CLS Group, the firm responsible for settlement risk mitigation in foreign-exchange (FX) markets, has announced that it has gone live with T+0 settlement for the US Dollar and Canadian Dollar currency pair (USD/CAD).

Eurex Clearing to Become CCP for SL-x Trading

Eurex Clearing has signed an agreement with SL-x Trading Europe (SL-x), to start clearing securities borrowing and lending (SBL) transactions, executed through the latter's proposed electronic trading platform.

If Deadlines Aren’t Fixed, They’re Guidelines

Running out of time on derivatives reform.

Oh, Those Sneaky Hedge Funds

This week two articles in the Financial Times caught Anthony's eye. Are hedge funds really an extension of some covert government agency, or are they desperately seeking alpha?

ITG Eyes Predictive FX TCA

Agency broker and technology provider ITG launched its foreign exchange (FX) transaction cost analysis (TCA) tool last year, and is looking ahead at possible developments for the future. These include a form of day-start predictive analytics that can…

T2S and CSD Regulation to Obviate National Depositories

The double-tap effect of both the Target2-Securities (T2S) project and the implementation of the Central Securities Depositories (CSD) Regulation will spell the end of single-nation depositories, according to Jean-Michel Godeffroy, director general and…

Javelin Gains Temporary Approval for SEF Offering

Javelin Capital Markets has been given temporary approval by the US Commodity Futures Trading Commission (CFTC) to operate its swap execution facility (SEF).

SunGard Launches IntelliMatch Enterprise Management Studio

SunGard has announced the release of IntelliMatch Enterprise Management Studio, which allows firms to better control the delivery of reconciliations as a line of service.

BGC Gets Temporary SEF Approval

BGC Derivative Markets has received temporary registration approval from the US Commodity Futures Trading Commission (CFTC) to operate a swap execution facility (SEF).

Advent Unveils New Cloud Offering, Geneva 10.0 and Tamale 7.0 at Client Conference

Advent Software, at its annual AdventConnect conference in San Francisco, unveiled its new cloud offering, version 10.0 of its Geneva platform, and version 7.0 of its Tamale RMS solution.

Tech Questions Loom After Major Exchanges Tie the Knot

A period where no meaningful exchange M&A made it to the finish line has been followed by two announced megadeals that appear likely to be approved. Jake Thomases looks at what IT advantage is gained by such massive mergers, and whether these latest…

TeraExchange Granted SEF Status

The multi-asset class execution venue has been granted temporary swap execution facility (SEF) registration from the CFTC.

Aquis Exchange Connects to AlgoSpan for Low Latency

Aquis Exchange, the proposed pan-European equities trading exchange, has selected AlgoSpan to enhance order execution quality and latency.

Options Deploys Arista's Low-Latency Switching

Options, the New York-based private financial cloud provider, has deployed Arista Networks’ new low-latency switching for the firm’s ultra-low latency co-location clients in European exchange hosting facilities operated by the London Stock Exchange (LSE)…

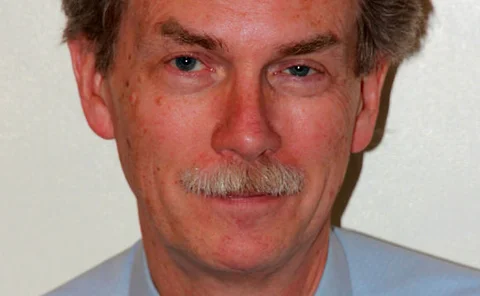

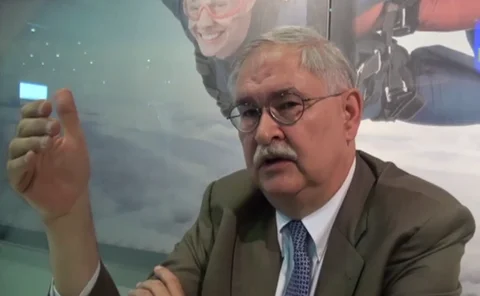

Swift's Taylor on Regulation, Post-Trade Technology

Paul Taylor, director of global matching at Swift, talks to Waters at Sibos 2013, in Dubai.

Daiwa Partners Torstone for Myanmar Broker Product

Torstone Technologies has announced that it will power the back-office component of the Daiwa Institute of Research's (DIR) end-to-end broker solution, designed for Myanmar's fledgling capital market.

Six Securities Prepares for T2S, as Survey Finds Increased Settlement Costs Likely

A survey of attendees at Sibos 2013, in Dubai, has found that participants expect settlement costs to increase thanks to the Target2-Securities (T2S) project, according to the conductor, Six Securities Services.