Technology

WatersTechnology has been covering the industry’s technology needs for over 30 years, focusing on the sell side, the buy side, exchanges, intermediaries and the regulations driving the industry, covering topics such as emerging technologies and front-, middle- and back-office platforms. Combining news, events, awards, research and thought-leadership, this site should be a resource hub to help educate the market on these areas.

Price check: Is your firm keeping pace with IPV?

How growing regulatory pressure around data is affecting banks’ pricing and valuation control.

DTCC urges affirmation focus ahead of T+1 move

On May 28, large numbers of securities transacted across the North American marketplace will be required to settle one day after they are executed. DTCC is urging all market participants to scrutinize their existing technology and operational procedures,…

Northern Trust: Improving transparency across the asset servicing market

Northern Trust won three categories in the 2023 American Financial Technology Awards. Paul d’Ouville, global head of technology solutions and servicing at Northern Trust, discusses his firm’s fourth consecutive win in the Best reporting initiative…

Finding the investment management ‘one analytics view’

This paper outlines the benefits accruing to buy-side practitioners on the back of generating a single analytics view of their risk and performance metrics across funds, regions and asset classes

A fireside chat with Regnology's Linda Middleditch

Linda Middleditch, chief product officer of Regnology, sits down with Victor Anderson and looks back at what has been a productive year for the RegTech specialist.

Operational resilience using the cloud

This webinar focuses on the business and operational benefits to firms on the back of their cloud strategies, across an industry that is often unforgiving to those not able to guarantee 100% uptime, operational robustness and competitiveness

Post-trade processing via NYFIX matching

A case study underscoring how a global asset management firm successfully addressed post-trade processing challenges by adopting NYFIX Matching from Broadridge.

The move to T+1: This time is different

This whitepaper, created by Broadridge, focuses on leveraging robotic process automation and AI to ensure a smooth transition from T+2 to T+1 settlement.

Tick History – Query: Looking back to the future

The advantages of cloud-based services is well documented, from reduced upfront and ongoing operating and infrastructure costs to improved time-to-market for new services and datasets. Here, Tim Anderson, LSEG explains how the benefits of the service…

Navigating the adoption of generative AI

This whitepaper, created by Xoriant, focuses on generative artificial intelligence (AI) and its potential to transform the way financial services firms operate, make business decisions and innovate.

T+1: Complacency before the storm?

This paper, created by WatersTechnology in association with Gresham Technologies, outlines what the move to T+1 (next-day settlement) of broker/dealer-executed trades in the US and Canadian markets means for buy-side and sell-side firms

Increasing securities settlement successes with unique transaction identifiers

Major improvements have been made to the securities services operating model over the past decade, but inefficiencies in trade settlement processes remain, leading to thinning margins and longer settlement cycles. Key to addressing these challenges is…

Crypto: Too important to ignore

This WatersTechnology Rapid read survey report examines the crypto finance priorities of institutional investors, how far along they are on their crypto journeys, the challenges in entering and participating in this market, and what they value most when…

ASX, SGX earnings driven by diversified revenue

After the Chess disaster, ASX focuses on rebuilding confidence, while SGX continues investing in its derivatives business. Meanwhile, HKEx mulls data play.

Automating collateral management processes crucial for T+1 move

The reduction of settlement times from T+2 to T+1 for many US securities is likely to impact firms’ collateral management processes when it comes into force at the end of May 2024.

T+1: Cash and liquidity management functions impacted

The reduction of settlement times from T+2 to T+1 for many US securities, set to come into force at the end of May 2024, is likely to impact a number of business processes across the sell side. Nadeem Shamim, head of cash and liquidity management at…

Smashing barriers: How shortwave frequencies are making trading firms faster

Improvements in shortwave radio frequencies could be a leap forward in the latency race. But given the costs and technical challenges, is it worth the investment?

Waters Wavelength Podcast: Fixed income execution & innovation

This week, Spencer Lee, chief markets officer at TS Imagine, joins Tony on the podcast to discuss execution issues and innovation within the fixed income space.

Post-trade tech and the back/front office

Vijay Mayadas, president, capital markets at Broadridge, discusses the biggest challenges in the back office and how post-trade technology is transforming the relationship between the front and back office.

Why post-trade still needs more attention

After years of neglect, back-office processes are beginning to garner the attention they deserve. However, the post-trade technology landscape remains fragmented and opportunities are being left uncaptured. By Vijay Mayadas, president, capital markets at…

Waters Wavelength Podcast: Tradeweb’s Bruni on electronification of repo markets

Enrico Bruni, managing director and head of Europe and Asia at Tradeweb, joins the podcast to discuss electronification in the repo space.

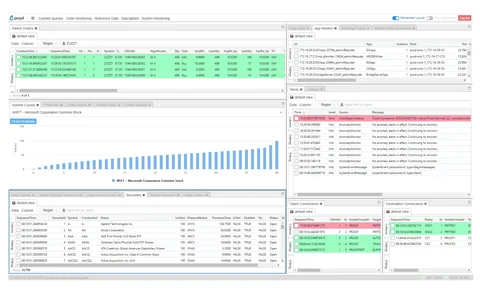

Burden of Proof: Meet the IEX breakaways looking to shake up broker algos

Founded with the principles of “transparency and academic rigor,” some say Proof’s model and technical approach is a test case for a new generation of cloud-native broker startups.

Modular Applications and Integrated Platforms—The Best of Both Worlds

Traditionally, sell-side front offices have been forced to make difficult choices between single integrated trading platforms and discrete modular applications designed to support specialist front-office functions such as trading and execution management…