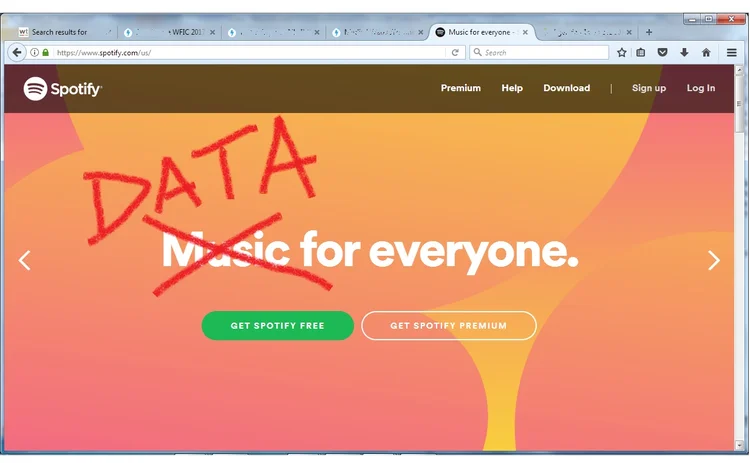

WFIC 2017: Could Spotify Shape Data Consumption?

Panelists say current market data licensing practices are stuck in the past, and should evolve along similar lines to the music industry, which has dealt with similar intellectual property challenges.

Before Spotify took off around five years ago, musicians and record labels who owned the intellectual property were faced with huge challenges, caused by a shift in way people were consuming music. Piracy was rife across the internet, leading to millions of dollars in lost revenues. Streaming sites such as Spotify, which give subscribers unlimited access to a catalogue of music, have reinvented the way we view intellectual property. Panelists on Monday agreed that music streaming platforms have to a degree broken the separation between the record providers and the consumer, giving them the ability to control content, and consume what they want, when they want it. With market data users wanting to consume data in this way, and with providers and aggregators constantly on the lookout for new pricing models, mirroring a model like Spotify could bridge the gap between the two.

One vice president of market data at a buy-side firm described the hope for Spotify-type model as an “I have a dream” topic, but said they hope the industry will be able to create a marketplace where all available data is available and easy to access from one place—or “a world where we don’t have to have individual connections to individual suppliers to access every data-byte that we need.” The marketplace would enable consumers to “access the elements of data that are actually required, and pay for what is used, no more, in an efficient and streamlined way,” the VP said.

A global head of market data at a bank said the “attractive thing about looking at the characteristics of Spotify is the ability for end-consumers to be able to curate what they want, how they want, and when…. It’s not about reducing the value of data to just a commodity; this is more about access. There is a shared responsibility—not only from a provider perspective, but I would hold all the consumers responsible for better articulating what our requirements are… there needs to be a collaborative relationship,” they said.

A head of market data for EMEA at a bank urged data vendors to also think about the positives of this model over the three-day WFIC event. “Data vendors are always concerned about realizing the full value of their data. This approach is not about devaluing data, but about making information easier to get to, and using technology to achieve efficiency,” the bank exec said.

Attendees will be able to contribute their support or thoughts on ‘the dream’ during roundtables on Tuesday. Vendors and exchanges will debate the subject during panels on Wednesday.

Click here to return to our WFIC hub for all the latest stories from the event

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@waterstechnology.com or view our subscription options here: https://subscriptions.waterstechnology.com/subscribe

You are currently unable to print this content. Please contact info@waterstechnology.com to find out more.

You are currently unable to copy this content. Please contact info@waterstechnology.com to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@waterstechnology.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@waterstechnology.com

More on Emerging Technologies

Banks split over AI risk management

Model teams hold the reins, but some argue AI is an enterprise risk.

Waters Wavelength Ep. 344: Hot topics for 2026

Tony and Shen preview some of the topics they think will be big this year.

Fintechs grapple with how to enter Middle East markets

Intense relationship building, lack of data standards, and murky but improving market structure all await tech firms hoping to capitalize on the region’s growth.

SimCorp–MSCI expand partnership, quantum exploration, Dora concerns, and more

The Waters Cooler: Droit launches GenAI regtech tool, bids for EU OTC derivatives tape open, and more in this week’s news roundup.

The quantum leap: How investment firms are innovating with quantum tech

While banks and asset managers are already experimenting with quantum computing to optimize operations, they should also be proactive in adopting quantum-safe strategies.

‘The end of the beginning’: Brown Brothers Harriman re-invents itself

Voice of the CDO: Firms who want to use AI successfully better start with their metadata, says BBH’s Mike McGovern and Kevin Welch.

2026 will be the year agent armies awaken

Waters Wrap: Several AI experts have recently said that the next 12 months will see significant progress for agentic AI. Are capital markets firms ready for this shift from generative AI to agents?

Editor’s Picks: Our best from 2025

Anthony Malakian picks out 10 stories from the past 12 months that set the stage for the new year.