News

Thomson Reuters Eikon Data to Shuttle Through Eze OMS

Data and content integration within Eze order management system for improved buy-side operational inefficiencies.

Virtu Financial Europe, Euronext Fined For Market Manipulation

French authorities ruled that certain trading practices were likely to have given false or misleading indications as to the supply and demand for certain financial instruments.

Broadridge Research Finds Back-Office Technology Ripe For Re-Engineering

Firms should sharpen business process efforts, according to survey report

Singapore Exchange Launches OTC Bond Trading Platform SGX Bond Pro

New trading venue aimed at solving institutional liquidity challenges within the secondary Asian bond market.

BlueBay AM Successfully Completes Implementation of SimCorp Dimension

With approximately $58 billion assets under management, BlueBay required a single system that enabled a high degree of automation and scalability.

First Trust, Chaikin Analytics Partner on New Offering

Unit trust specialist taps provider for portfolio construction.

Chinese Vendor Shenzhen Kingdom Technology Integrates McObject

Incorporating McObject's database platform will support low latency, high performance and resiliency.

EDI Adds Airex Distribution

Corporate actions and reference data provider supplies information through new channel

SGX Creates Market Data & Connectivity Unit in Business Reorg

Officials say the reorganization will help the exchange align products and better serve customers.

Fenergo Launches Client Lifecycle Product

Company integrates with DTCC data providers

MarketAxess Adds Asian Bond Trading to Platform

Asian local currency bond trading function designed to boost presence in APAC markets.

Diliger Adds Know-Your-Vendor Compliance Data to Procurement Platform

The additions to vendor surveys will help firms comply with vendor risk requirements.

Ned Davis Research Unveils Data Solutions Arm to Sell Underlying Datasets

Users will be able to subscribe to individual datasets from the same library used by Ned Davis analysts.

SPReD Utility Adds Data Sources

RDU administrator SmartStream signs seven major data providers to offer information through the service

Nasdaq Expands Equities Trading with Chi-X Canada Acquisition

The deal marks Nasdaq's movement back towards daily equities trading in search of growth opportunites

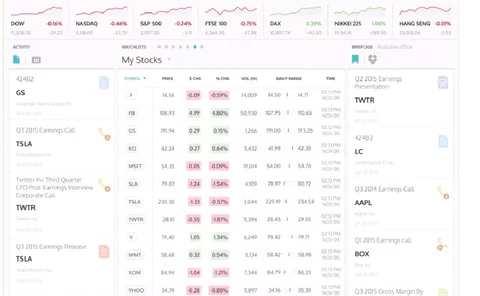

Scout Finance Bows Fundamental Research App for Buy Side, Investors

The app will allow users to search, view, cache and share research and company documents.

Slocum Adopts RiskFirst's PFaroe

Advisory adds software for asset allocation, dynamic de-risking.

ING Joins Swift KYC Registry

Dutch global firm will provide correspondent banking information

Deutsche Bank Debuts AnlageFinder for Maxblue

Robo-advisor AnlageFinder designed to offer automated asset allocations.

American Financial Technology Awards 2015 ─ All the Winners

The winners of the AFTAs 2015 were announced on the evening of December 7 at an awards dinner in New York.

Thomson Reuters Adds LNG to Eikon Commodity Trade Flows Service

The service will appeal to traders, analysts, oil refiners and freight analysts.

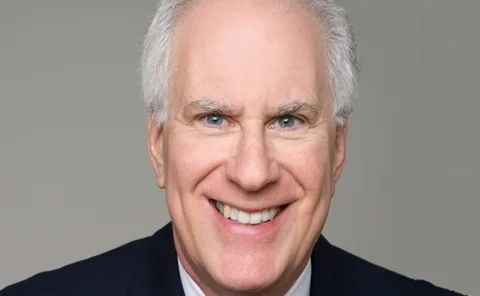

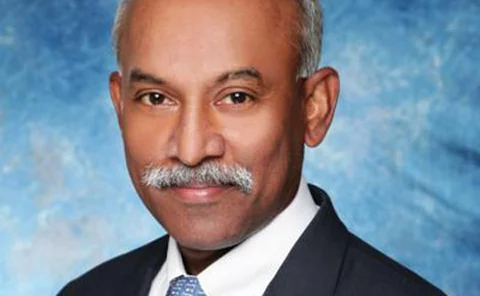

RavenPack Swoops on Pandolfi as Ned Davis Taps Taggart

Former S&P, QuantHouse exec joins news analytics provider RavenPack.

OMG Adopts FIGI Identifier Standard

Standards consortium recognizes instrument identifier

BATS Preps 2016 Equity Depth Data Fees

The fees will target internal use by trading firms and non-display use by other markets for onward-routing.