News

Enyx Embeds TS-Associates Latency Monitoring Tools into FPGA

Paris-based hardware-accelerated data capture and network technology provider Enyx has integrated latency monitoring software vendor TS-Associates' TipOff network and latency monitoring appliance as well as its Application Tap monitoring API into its…

Newedge UK to Partner with GMEX MTF

French broker Newedge has joined forces with Global Markets Exchange Group International (GMEX Group), a market operator, consultancy, and technology provider.

Post-CEO, Ownership Change, MarketPrizm Ups Colt Collaboration

Market data and trading infrastructure services provider MarketPrizm is planning to align its capital markets business more closely with that of its parent company, London-based network vendor Colt, following the repurchase of Japanese bank Nomura's…

Moody's Analytics Provides Analysis, Economic Forecasts on Fed's 2014 CCAR Scenarios

Moody's Analytics, the data and software arm of ratings agency Moody's, has analyzed the Federal Reserve's Comprehensive Capital Analysis and Review (CCAR) scenarios for 2014 to produce economic scenarios for more than 50 countries and well as reports…

CameronTec, Object Trading Ally for Expansion of Catalys DMA Platform

FIX messaging engine supplier CameronTec has embedded trading technology and data platform provider Object Trading's direct market access platform into its FIX-based Catalys Market Access offering, expanding the coverage to more than 60 equity,…

Fund Administrator Apex Moves to Eze Private Cloud

Apex Technologies, which provides IT backing for administration of about $25 billion in buy-side assets across both on- and offshore locations, will now operate its strategic IT solutions and private cloud services from an installation with Eze Castle…

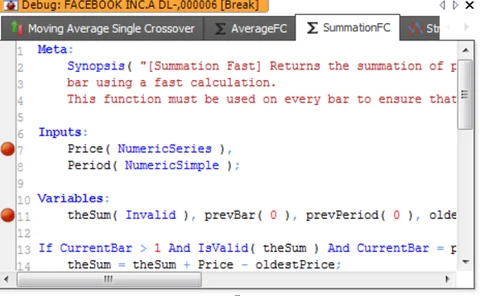

Tradesignal Bows Version 7 of Data Platform

German data display and analytics vendor Tradesignal has released version 7.0 of its Enterprise Edition data and analytics workstation, which includes a new user interface to enable more efficient access to Tradesignal's functions.

DataContent's Harris Talks China at WFIC Part 2

Following a panel discussion on business inside China at the World Financial Information Conference in Lisbon, Keiren Harris, Hong Kong-based director of market data consultancy DataContent speaks to IMD about the types of data in demand in China, and…

PTS Partners Taps OneMarketData's OneTick

Global quantitative fund PTS Partners has deployed New York-based tick database and complex event processing engine provider OneMarketData's OneTick tick database and complex event processing system to support its quantitative investment strategies.

Pershing Enhances PrimeConnect with Sec Lending Link

The securities services subsidiary of BNY Mellon says it has added a seamless link to the fully-paid securities lending program, among other upgrades, to its PrimeConnect application.

Bloomberg, Markit Agree Distribution Deal For EDM Businesses

An agreement between data vendors Bloomberg and Markit will see them distribute one another's reference and pricing data via their respective enterprise data management (EDM) businesses, Bloomberg PolarLake and Markit EDM

Markit Taps former UBS CIO Trogni for Solutions

Michele Trogni, former group chief information officer at UBS, has joined data provider Markit in New York as managing director and global head of the vendor's solutions business (which is co-headed by Daniel Simpson, who joined Markit as a result of its…

SIX Financial Information Adds APA Austrian News to iD Terminal

Swiss data vendor SIX Financial Information has added real-time news from Austrian news provider APA-Finance to its Telekurs iD desktop data, news and analysis terminal, as a free add-on for Austrian subscribers to its Wealth and Asset Management…

CFTC Gives CME SEF Approval

The US Commodity Futures Trading Commission (CFTC) has issued a notice of temporary registration to operate as a swap execution facility (SEF) to the Chicago Mercantile Exchange (CME).

Hawaiian Investment Manager Goes Mobile with IPC

The Honolulu-based firm Scotty D Group has moved its traders to IPC's Unigy Pulse Mobile solution, complementing its existing connectivity provided through IPC Network.

Activ Unveils Version 2.0 of Data Platform

Low-latency market data provider Activ Financial will this week launch an optimized version of its market data distribution platform, dubbed Activ Content Platform (ACP) 2.0, with enhanced features including a new API and next-generation FPGA (field…

Corvil Adds Monitoring for Database Systems and Others

Corvil, a Dublin-based provider of operational performance monitoring, has debuted a new range of solutions for monitoring applications and services.

UL Bridge FIX 5.0 Compliant

Ullink, a Paris-based provider of connectivity and trading solutions, has made its UL Bridge connectivity platform compliant with FIX 5.0, the preferred communication protocol for swap execution facilities (SEFs).

Brownstone Investment Group Taps Martines for Munis Trading

The fixed income investment firm has hired Matthew Martines as new managing director for its municipal trading and electronic market-making units.

Aquis Exchange Gets FCA Approval to Operate as MTF

Pan-European trading exchange Aquis Exchange has received the UK Financial Conduct Authority (FCA) approval to operate as a multilateral trading facility (MTF).

Liquity Names Director of Operations and Technology

Private equity marketplace Liquity has appointed Julian Jaffe director of operations and technology to design and pilot the company’s technology strategy.

Eze Software Integrates Markit’s TCA Tools

UK-based data provider Markit has announced the integration of its Transaction Cost Analysis (TCA) product into Eze Software’s order management system (OMS) to provide users of its Eze OMS with a seamless access to pre- and post-trade analytics.

Markit Adds TCA Analytics to Eze OMS

Buy-side order management system vendor Eze Software is making transaction cost analysis capabilities from UK-based data vendor Markit available to clients of its Eze OMS, to allow users to vice pre-trade forecasts-covering the market impact nad…

SmartTrade Launches New FX-Focused OMS

SmartTrade Technologies has recently launched its next generation of Order Management System (OMS), focused on foreign exchange (FX).