News

Chi-X Canada on IPC's Connexus

Members on the connectivity provider's Connexus Extranet service can now access Chi-X Canada's automated trading system, as well as its recently-launched CX2 platform for small to mid-tier brokers and retail investors.

Interactive Data Upgrades Workflow for Fixed-Income Web Portal

The pricing and data vendor says enhancements to its Vantage web portal will allow users to avoid the manual price review processes usually required to explore price movements

State Street Global Exchange Adds Bohn, Hughes to Analytics Team

State Street Global Exchange, which provides data, analytics and electronic trading solutions, has added Jeffrey Bohn and Thomas Hughes to its analytics team.

Aquis Names Three to Board, Reflecting WSE Deal

Aquis Exchange has added three to its executive board in reflection of its recent strategic partnership with WSE.

NYSE Euronext Taps ITRS Geneos for Performance Monitoring

NYSE Euronext is using ITRS Geneos to monitor its US cash equities trading infrastructure.

Turquoise Derivatives Arm Relaunched Under New LSEG Colors

London Stock Exchange Group (LSEG) today announced it has acquired the derivatives business of Turquoise, the London-based multilateral trading facility.

AIMCo Turns to SimCorp for Investment Management

Alberta Investment Management Corporation (AIMCo) has gone live with SimCorp Dimension for automation of investment workflow.

Linedata Launches New I-BOR Solution

Paris-based buy-side vendor Linedata has launch I-BOR, an Investment Book of Records (IBOR) solution, to answer the increasing demand from its client base to establish an independent and granular view of their investment positions.

HSBC Hires Experienced Data Executive

Lorraine Waters has joined the firm's data management unit as deputy group chief data officer and head of data policies

EACH Names Plata Secretary General

The European Association of Central Counterparties (CCPs) Clearing Houses (EACH) has appointed Rafael Plata as its first secretary general.

Thomson Reuters, ICAP Gain Temporary SEF Approval

The US Commodity Futures Trading Commission (CFTC) has granted Thomson Reuters and ICAP temporary registration to operate swap execution facilities (SEFs).

NYSE Taps ITRS for Performance Monitoring UPDATED

NYSE Euronext has completed the first phase of a multi-phase project to deploy UK-based real-time systems and latency monitoring vendor ITRS’ Geneos monitoring platform across its US equities and options exchange environment to gain an end-to-end view of…

Deutsche Börse Bows Historical Data Cloud

German exchange Deutsche Börse will this week launch a cloud-based historical data service, Data on Demand, to provide analysts, application developers and vendors with on-demand access to historical data from its Xetra and Eurex securities and…

Tech Panel: Act ‘Appropriate,' But Speed Still Needs Spend

With today's capital markets increasingly automated and reliant on high-performance technologies, budget constraints resulting from the economic crisis of recent years are forcing firms to be more selective about building proprietary systems in-house…

CJC Taps Beebeejaun as Sales Head

Market data consultancy and real-time systems support and management provider CJC has hired Feroze Beebeejaun as head of sales, responsible for generating new business for CJC's outsourced support operations and for its commercial management business…

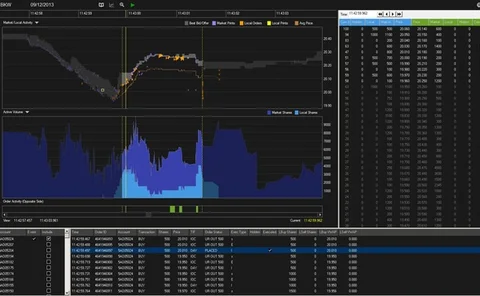

Trillium Begins Post-Trade Analytics Push

Trillium Labs, a software development spin-off from New York-based proprietary trading firm Trillium Trading has filed a patent for a new post-trade compliance monitoring tool for US equities trading that compares traders' order data to full order book…

Misys Adds Medlock as CFO

Rick Medlock will join the buy-side technology provider in 2014 after leaving Inmarsat, a mobile satellite services company where he has overseen finances since 2004.

New Regulations Will Drive Data Costs Higher, Panel Warns

The growing raft of new regulations are increasing the market data burden on all market participants for risk analysis and for meeting reporting requirements, while also increasing the cost of connecting to and aggregating new datasets, said panelists at…

UBS Finds Data Opportunity in Client Onboarding

Client onboarding teams have taken on responsibility for managing data, particularly for linking client and legal entity data with other key reference data, operations executive Simon Feddo said at the European Financial Information Summit

EFIS User Panel: Data Cost Control Becomes Cultural Shift

Continuing pressure on data budgets at end-user firms following the financial crisis is creating challenges for market data managers, but is also creating opportunities to bring new approaches to how firms source and consume data, said panelists at this…

Data Execs: "We Need Consolidated Pre-LEI Files"

As the number of utilities issuing pre-legal entity identifiers increases, delegates at the European Financial Information Summit called for a single source they can use to find all of the pre-LEI data they need

EFIS Keynote: HSBC Chief Data Officer Baker Defines Value of Data

Unlike precious assets such as gold, the value of market data is governed not by its rarity, but by its significance and usefulness, which depends on its ability to inform decisions and solve problems-and which in turn depends on having a dedicated…

Thomson Reuters Expands TRPS Evaluations with CDO Pricing

Thomson Reuters has unveiled a new collateralized debt obligation pricing service, providing end-of-day valuations based on asset-level analysis by the vendor's evaluators for CDOs on asset-backed securities, commercial real estate, and trust preferred…

Hedgebay Launches Electronic Settlement for Secondaries

The Nassau-based platform for trading in hedge fund secondaries and related products has added the new settlement service to speed up transactions, reducing overall trading time by 20 percent.