Chicago Board Options Exchange (CBOE)

Statistical Data Products Vet Goldberg Climbs at CBOE

The Chicago Board Options Exchange has promoted 34-year CBOE veteran Alicia Goldberg to vice president of statistical analysis.

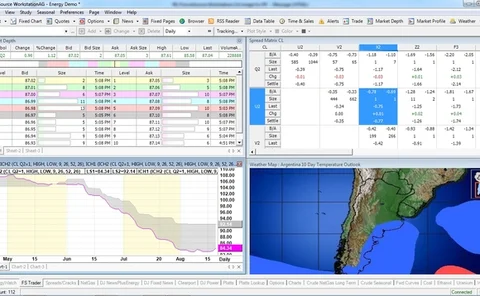

Interactive Data Rolls Out FutureSource 4.0

Interactive Data has released version 4.0 of its web-based FutureSource market data and analytics platform, featuring new content sets and capabilities.

Update: Q2 Exchange Data Revenues Rise, Despite Mixed Overall Financials

Major exchanges worldwide posted significant increases in market data sales in their latest round of their financial results, though they also recorded a mixed bag of total revenues as a consequence of low volumes and low interest rates.

Dickey to Direct OPRA

Market data industry veteran Steve Dickey has been appointed director of the Options Price Reporting Authority, which manages the OPRA consolidated feed of US exchange-traded options quote and trade data.

CBOE to Invest in Tradelegs

Chicago Board Options Exchange (CBOE) says it will stake the analytics and decision-support software provider to institutional investors.

Exchange Data Revenues Run Gambit of Gains and Losses

Major exchanges reported a mixed bag of fourth-quarter financial results, with some reporting spectacular gains as a result of acquisitions and new initiatives, and others reporting lower revenues from data sales as a result of fewer subscriber numbers.

CBOE Eyes 12-Month Latency Cuts

The Chicago Board Options Exchange is in the middle of an ongoing project to reduce data and transaction latency across its trading systems to less than 100 microseconds, building on existing latency reductions achieved as a result of moving its primary…

Opening Cross: Things That Go Bump in the Night

The combination of Halloween and Mercury in retrograde is creating some haunting technical glitches and cost challenges for the data industry.

Update: OPRA Data Issue Halts Options Exchanges

The Options Price Reporting Authority was forced to cancel a software upgrade for its feed of consolidated US options quote and trade data on Monday Sept. 16, after the upgrade caused issues with calculation of the national best bid and offer price,…

OPRA Data Issue Halts Options Exchanges

Unidentified system issues at the Options Price Reporting Authority, which creates the OPRA consolidated feed of US options quote and trade data, forced options exchanges to halt trading this afternoon.

Chicago Board Options Exchange Readies Customized Option Pricing Service

Market Data Express (MDX), an affiliate of Chicago Board Options Exchange (CBOE), will launch the CBOE Customized Option Pricing Service (COPS) next week.

Industry Set to Battle Patents via Courts, Rewrites, M&A

Companies are turning their attention from the IP in their content to the IP in their content delivery mechanisms, prompting firms fearful of litigation to ditch incumbent technologies and demand contracts that indemnify them against infringement.