QuantHouse Launches Stress Testing for Algos Ahead of Mifid II

Vendor partners with datacenter specialists Interxion for algorithmic stress-testing facility

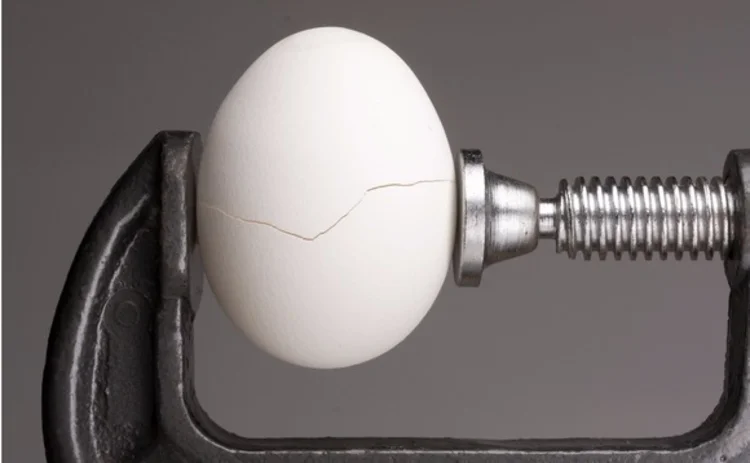

The review of the Markets in Financial Instruments Directive (Mifid II) will require firms engaged in algorithmic trading to be able to stress test their platforms by simulating two times the highest volume of trades over a six-month period.

This is designed to mitigate concerns around the stability of automated trading systems, which have been variously blamed for flash crashes, programming glitches that have cost hundreds of millions of dollars thanks to algorithms erroneously buying and

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@waterstechnology.com or view our subscription options here: https://subscriptions.waterstechnology.com/subscribe

You are currently unable to print this content. Please contact info@waterstechnology.com to find out more.

You are currently unable to copy this content. Please contact info@waterstechnology.com to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@waterstechnology.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@waterstechnology.com

More on Regulation

Why UPIs could spell goodbye for OTC-Isins

Critics warn UK will miss opportunity to simplify transaction reporting if it spurns UPI.

Re-examining Big Tech’s influence over the capital markets

Waters Wrap: A few years ago, it seemed the big cloud providers were positioning themselves to dominate the capital markets tech scene. And then came ChatGPT.

Pressure mounts on Asia to fall in line for T+1

With the US already on a T+1 settlement cycle, and the UK and EU preparing for the shift in 2027, there’s pressure for Asia to follow suit. But moving may involve more risks than expected.

Brokers must shift HFT servers after China colocation ban

New exchange guidance drives rush for “proximity colo” in nearby datacenters.

Banks split over AI risk management

Model teams hold the reins, but some argue AI is an enterprise risk.

New EBA taxonomy could help banks track AI risk

Extra loss flags will allow banks to track transversal risks like geopolitics and AI, say experts.

Risk managers question US reach of Dora third-party list

Some EU subsidiaries included, but regulator control over cloud providers could still be limited.

Where have four years of Cusip legal drama gone?

The IMD Wrap: The antitrust case against Cusip Global Services has been a long, winding road. Reb recaps what you might have missed.