JP Morgan

JP Morgan gives corporates an FX blockchain boost

Kinexys digital platform speeds cross-currency, cross-entity client payments.

BlackRock and DRW execs bullish on tokenization potential

DRW’s Don Wilson expects every instrument to be traded on-chain in five years’ time.

FactSet adds MarketAxess CP+ data, LSEG files dismissal, BNY’s new AI lab, and more

The Waters Cooler: Synthetic data for LLM training, Dora confusion, GenAI’s ‘blind spots,’ and our 9/11 remembrance in this week’s news roundup.

Chief investment officers persist with GenAI tools despite ‘blind spots’

Trading heads from JP Morgan, UBS, and M&G Investments explained why their firms were bullish on GenAI, even as “replicability and reproducibility” challenges persist.

Wall Street hesitates on synthetic data as AI push gathers steam

Deutsche Bank and JP Morgan have differing opinions on the use of synthetic data to train LLMs.

Halftime review: How top banks and asset managers are tackling projects beyond AI

Waters Wrap: Anthony highlights eight projects that aren’t centered around AI at some of the largest banks and asset managers.

Waters Rankings 2025: Best data analytics provider—JP Morgan

Name of product or service: Fusion by JP Morgan

Jump Trading CIO: 24/7 trading ‘inevitable’

Execs from Jump, JP Morgan, Goldman Sachs, and the DTCC say round-the-clock trading—whether five or seven days a week—is the future, but tech and data hurdles still exist.

Market data woes, new and improved partnerships, acquisitions, and more

The Waters Cooler: BNY and OpenAI hold hands, FactSet partners with Interop.io, and trading technology gets more complicated in this week’s news round-up.

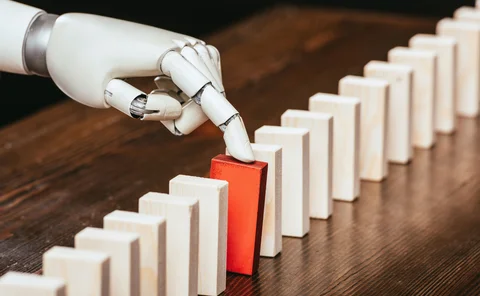

JP Morgan, Eurex push for DLT-driven collateral management

The high-stakes project could be a litmus test for the use of blockchain technology in the capital markets.

BST Awards 2024: Best ESG data provider to the buy side—Fusion by JP Morgan

Product/service: Fusion by JP Morgan—Sustainable Investment Data Solution

The Waters Cooler: No Singapore Slings

Market microstructure, a prediction exchange, ETF and T+1 woes—does it get any more exciting than this?

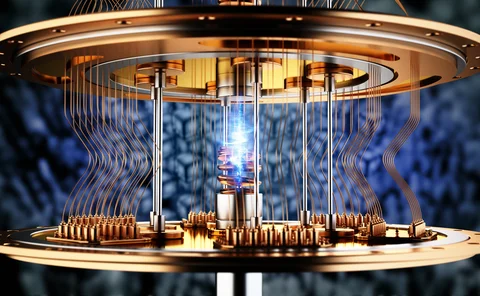

Fidelity’s quantum exploration unites theory and proof

The asset manager and Amazon have teamed to put a quantum twist on machine learning.

The Waters Cooler: Why can’t we be friends?

The ABA vs most every regulator. LSEG vs BBG. AI vs SaaS. Buy vs build. Lots of drama in the capital markets.

JP Morgan’s goal of STP in loans materializes on Versana’s platform

The accomplishment highlights the budding digitization of private credit, though it’s still a long road ahead.

JP Morgan touts DLT, tokens for collateral management

Distributed-ledger technology could make moving non-cash collateral more efficient, said managing director Toks Oyebode during an Isda conference on Thursday.

SocGen pushes data, analytics use cases for SG Markets

The bank is letting a handful of clients experiment with its proprietary data and models to inform their research.

Ace high or busted flush? Digital Asset’s mixed fortunes mirror DLT adversity

The vendor hoped to remodel post-trade using blockchain technology—and it still might—but its bumpy progress raises questions over the future of DLT in finance.

People Moves: Broadridge, IEX, DTCC, and more

A look at the past month’s people moves in the capital markets technology and data space.

US banks seek to open vendors’ black box on green data

Inaugural Fed climate scenario analysis flags lack of transparency around third-party models.

Octaura preps for CLO trading launch

The consortium-born loan trading platform is adding tech partners and new protocols as it looks to launch CLO trading later this year.