European Market Infrastructure Regulation (Emir)

Calypso Unveils DTCC Interface to Support EMIR Reporting

San Francisco-based Calypso Technology has released an interface to the Depository Trust and Clearing Corp’s (DTCCs) Global Trade Repository (GTR) service, a repository holding global OTC derivatives transaction data, to assist firms with their European…

Traiana Partners Confisio for Cypriot Emir Reporting

Traiana has announced a strategic alliance with Confisio Managed Services, which will see the two firms launch a service for Cyprus-based clients who are required to report transactions due to incoming European Market Infrastructure Regulation (Emir)…

SIX Chooses Avox to Map LEIs to Securities Database

A new partnership between the two data vendors means SIX will be able to provide entity-level data to its clients, based on instrument-level requests

Are You Sure You Don't Need A Pre-LEI?

Some industry participants have fallen into the trap of assuming requirements to report pre-legal entity identifiers under EMIR will not affect them, and they are running out of time to put things right

Pre-LEI Waiting Times Range From 24 Hours to Three Weeks as EMIR Looms

With implementation of EMIR weeks away, the production time for mandatory pre-legal entity identifiers varies between the pre-local operating units that issue the codes and depends on a number of factors

Xtrakter Partners with CME European Trade Repository for Emir Reporting Tool

European fixed-income trade matching and regulatory reporting service provider Xtrakter has launched a transaction reporting solution, TRAX Repository Link (TRL), in a strategic alliance with the Chicago Mercantile Exchange European Trade Repository (CME…

Kyriba Partners GRC for Emir Reporting

Global Markets Exchange Group-backed GRC has announced a partnership with Kyriba, enabling the vendor's clients to implement a reporting system that complies with European Market Infrastructure Regulation (Emir) requirements.

Customers Begin Testing Swift Services for EMIR Reporting

The messaging services vendor is providing two ways for market participants to report data on over-the-counter derivatives trades, when European regulatory requirements to do so come into effect on 12 February

Complexity or Simplicity - The Data Quality Question

Those seeking to increase data quality, cope with new identifier standards or meet the mandates laid out by Europe's new market infrastructure regulation, are looking at how to reduce the complexity of the methods designed to meet simple goals

GRC Partners Regis-TR for Emir Reporting

Global Reporting Company (GRC) has announced a partnership with Regis-TR, in order to provide European Market Infrastructure Regulation (Emir) reporting services ahead of the February 12 deadline.

Coping With EMIR Derivatives Data Requirements

A new International Swaps and Derivatives Association protocol designed to help market participants comply with the European Market Infrastructure Regulation has brought greater clarity to the procedures counterparties should follow to reconcile their…

Esma Updates Derivatives Reporting Guidance

The European Securities and Markets Authority (Esma) has clarified its position on the reporting of derivatives, updating an online Q&A with the scope of requirements, as well as the counterparties that it expects to report transactions.

ESMA Seeks Data Expert Advisors

European regulator the European Securities and Markets Authority (ESMA) is recruiting market data reporting experts to advise on potential complications stemming from the overlap of recent EU financial regulation.

Commerzbank Taps Regis-TR for Trade Reporting

Commerzbank, has selected European trade repository Regis-TR to ensure its trade reporting service is in line with the European Market Infrastructure Regulation (EMIR) obligation to report over-the-counter and listed derivative transactions.

Mizuho Chooses GoldenSource for Data Quality, Regulatory Compliance

Mizuho International will use GoldenSource's enterprise data management platform to help it comply with regulations such as the European Market Infrastructure Regulation by improving data quality and transparency

IRD's Senior Reporter On LEI's Role in EMIR

Nicholas Hamilton discusses how the legal entity identifier can be used to easy the challenges of aggregating large amounts of data when the trade reporting requirements of the European Market Infrastructure Regulation comes into force on February 12

Traiana Facilitates Reporting of Common UTIs

The post-trade and risk management vendor is using its Harmony network to allow counterparties to exchange unique trade identifiers and ensure they report the same codes to trade repositories

HSBC Exec: Entities Without LEIs May Face Trading Restrictions in Europe

HSBC's Chris Johnson has warned market participants to ask their banks and brokers about possible trading restrictions for entities that do not have legal entity identifiers after the European Markets Infrastructure Regulation reporting requirements are…

Risk data trends and challenges: what implications does EMIR have for risk data? -- webcast

Inside Reference Data gathered leading industry experts for a webcast on November 18, 2013 to discuss how financial trading firms are improving transparency and mitigating risk in light of the European Market Infrastructure Regulation (EMIR).

Bafin 'Mindful' of EMIR Reporting Challenges

A representative of the German regulator said it is aware of the challenges firms face to comply with the European Market Infrastructure Regulation, which were highlighted by speakers from the buy- and sell-side at the Frankfurt Financial Information…

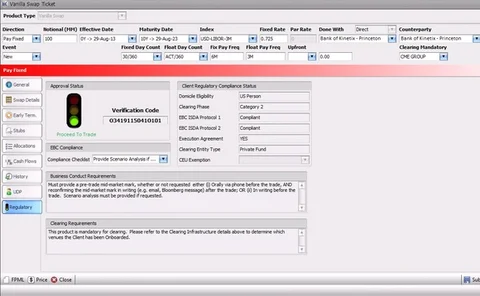

Swift App To Help Firms Confirm Trades Electronically

The Affirmations app allows users to view the details of their trades on a single screen, where they can confirm them electronically, as recommended by the European Market Infrastructure Regulation