European Market Infrastructure Regulation (Emir)

Not the Home Stretch

The data management demands facing the industry continue to expand, and the plans and systems available or being devised to deal with them need to grow at the same rate, as ISITC's chair observed at its recent annual conference.

EuroCCP Gains Emir Authorization

Cash equities clearing house EuroCCP has announced that it has received European Market Infrastructure Regulation (Emir) authorization.

iMeta Adds Credit and Legal Functions to Entity Data Platform

A new module providing legal and credit information now sits alongside the know-your-customer and standing settlement instruction data functionality of iMeta's Assassin platform

Misys Launches Emir-Compliant Trade Reporting Service

Software provider Misys has launched a regulatory reporting service to assist corporate and buy-side clients with European Market Infrastructure Regulation (Emir) reporting requirements.

ISITC's Zoller on Conference Highlights

Jeff Zoller, chair of ISITC, talks about the new middle office group announced at the organization's 20th annual conference in Boston on March 24, as well as other issues on the agenda

Thomson Reuters Launches KYC Managed Service

Thomson Reuters has launched a central hub for know-your-client data to make it easier and cheaper for financial firms to manage their regulatory requirements

Nasdaq OMX Clearing Receives First EMIR Authorization in Europe

The Stockholm-based clearinghouse, Nasdaq OMX Clearing, has received regulatory approval by the Swedish Financial Services Authority (SFSA) to operate as a central counterparty under the European Market Infrastructure Regulation (EMIR).

Thomson Reuters Unveils Managed KYC Service

Thomson Reuters has launched Accelus Org ID, a new platform to support financial institutions and their clients increase the efficiency and reduce the costs associated with complying with Know Your Customer (KYC) requirements.

Wake-Up Calls

Data management professionals are being alerted to several new developments in the areas of semantic technology, Unique Trade Identifiers, collaboration, data costs and big data

Trade Identifier Tangle

Unique trade identifiers have quickly emerged as the most complicated element of the European Market Infrastructure Regulation’s trade reporting requirements, which came into effect on February 12. Nicholas Hamilton finds out why using the new identifier…

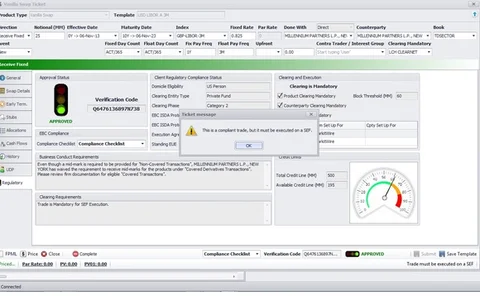

Kinetix Adds New Regs Support to Data Compliance Tool

Princeton, NJ-based trading technology provider Kinetix Trading Solutions has added support for new regulations to the Pre-Trade Verification module of its Monaco trading platform, which combines market data with trading firms' databases of counterparty…

Scotiabank Chooses Fenergo Onboarding System

The client data software provider's onboarding system uses a rules-driven process to classify Scotiabank clients affected by European Market Infrastructure Regulation, the US Dodd-Frank Act and the Foreign Account Tax Compliance Act

ICBC Turns to AxiomSL for Euro Compliance Support

Beijing-headquartered ICBC, formerly known as the Industrial and Commercial Bank of China, has contracted New York-based Axiom Software Laboratories to support its European Market Infrastructure Regulation (EMIR) over-the-counter (OTC) transaction…

Master and Commander

Getting to grips with Emir.

Headaches Abound for UTI Generation, EMIR Reporting

On February 12, as part of the European Market Infrastructure Regulation (EMIR), buy-side firms began producing unique trade identifier (UTI) data, as have their sell-side counterparts. A choppy start could leave many smaller hedge funds and corporates…

Troubled by Issues, EMIR Reporting Kicks Off

Mandatory reporting of derivatives trades came into force earlier this week as part of the European Market Infrastructure Regulation (EMIR), but market participants continued to raise concerns amid technology problems and far from ideal preparations.

UTIs, Pre-LEIs Are Top Concerns as EMIR Reporting Begins

Industry participants are worried about confusion surrounding unique trade identifiers and a shortfall in pre-legal entity identifier registrations, as trade reporting requirements come into force for derivatives trades in the European Union

Data Interoperability Needed For Hedgers After EMIR Deadline

Properly creating unique trade identifier (UTI) data is only half the challenge for buy-side firms as the European Market Infrastructure Regulation (EMIR) reporting mandate takes hold today. The other half? Making sure counterparties are doing the same…

EMIR and Wikis: A Wealth of Data

Reporting requirement aspects of European EMIR regulation are spurring service provider offerings, along with concerns about legal entity identifier issuance. Also, wikis present a data sourcing choice for the industry.

Calypso Upgrades Repository Interface For EMIR Reporting

Software and services provider adds new data fields and functionality to its interface to the DTCC's trade repository so it can be used for both EMIR and Dodd-Frank Act trade reporting

Bloomberg Integrates EMIR Reporting into Terminal Service

The data vendor has integrated EMIR reporting functionality into its terminal service, will generate unique trade identifiers and help users report outstanding trades

Short-Term Pain, Long-Term Gain

European legal entity identifier requirements have created a lot of work for data management practitioners. But HSBC’s Hany Choueiri tells Nicholas Hamilton that in the long term, the identifier can help firms manage big data, make a success of data…

Reval Poll Indicates Half of Respondents Not Ready for EMIR Compliance

According to a recent poll conducted by Reval, a New-York based provider of treasury and risk management technology, 65 percent of firms are not ready to fall in line with the February 12 EMIR compliance deadline.