Algorithmic trading

BoE model risk rule may drive real-time monitoring of AI

New rule requires banks to rerun performance tests on models that recalibrate dynamically.

Banks, asset managers look to vendors for T+1 support

This whitepaper focuses on the upcoming move in the US to T+1 (next-day settlement) of broker-dealer-executed trades.

Integrating Pillars 1, 2 and 3: A better way to Basel IV

This Wolters Kluwer report provides actionable insights on how banks can navigate the challenges of Basel IV effectively

RBC eyes AI to bolster FX and rates algos

Canadian bank plans to take deep reinforcement learning tech from equities to fixed income and currencies

Can algos collude? Quants are finding out

Oxford-Man Institute is among those asking: could algorithms gang up and squeeze customers?

Podcast: Leveraging real-time data feeds for faster business decisions

The markets have been on a very volatile ride in 2022, which makes low-latency data more crucial to the business.

Spot the difference: Why crypto data can’t be treated like traditional market data

As institutional participation in cryptocurrency markets increases, traditional data vendors and new specialist crypto data providers are taking different approaches to supplying necessary data to financial firms.

This Week: Bloomberg; Charles River, DTCC, SmartStream & More

A summary of the latest financial technology news.

Barclays (and others) strive for machine learning at quantum speed

Embryonic work on quantum neural networks raises hope of faster, more accurate models

People Moves: Digital Asset, Coalition Greenwich, NZX, Symphony, and more

A look at some of the key "people moves" from this week, including J. Christopher Giancarlo (pictured), who joins the board of directors of Digital Asset.

The future of algo trading: Using deep learning to more accurately predict equity market volumes

OpEd by Sam Clapp, Mizuho Americas equities, and Don Hundley, Japan head of Mizuho equities electronic trading

Buy one, get one free: Algos learn to multi-task

For years, brokers have offered suites of algorithms, each geared toward a certain strategy and outcome. Now, firms are compressing these into multifaceted algorithms that can switch between different strategies or markets in response to trading…

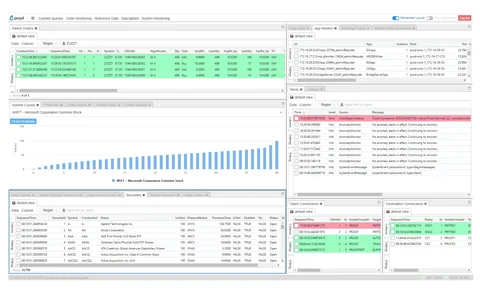

Burden of Proof: Meet the IEX breakaways looking to shake up broker algos

Founded with the principles of “transparency and academic rigor,” some say Proof’s model and technical approach is a test case for a new generation of cloud-native broker startups.

This Week: BNY Mellon/Milestone Group, IHS Markit, Broadridge/China Renaissance, and more

A summary of some of the past week’s financial technology news.

Waters Wrap: Broadway Technology, Symphony, and new beginnings (And other new CEOs)

Anthony takes a look at some major CEO changes from the last year, and what those moves might mean for clients of those vendors.

Banks fear Fed crackdown on AI models

Dealers say the agencies’ request for info could prompt new rules that stifle model innovation.

Four years of academic study on HFT yields complicated results

A transatlantic group of researchers has examined a treasure trove of market data to see whether or not high-frequency trading is a necessary component of today’s market structure. The answer is largely ‘yes,’ but with caveats.

One step closer: How exchanges are seeking tighter relationships with clients

Increasingly, exchanges are trying to get closer to their customers, in a bid to better understand how they use market data. This move may come at the expense of data vendors that are being gradually squeezed out of the exchange-client relationship.

Inside RBC’s Aiden project: 5 years of deep learning

Aiden, a trading platform launched last year, is the product of five years of experimentation with deep learning by RBC Capital Markets on top of an additional five years of hypothesizing about what best execution would one day require.

CDS trading remains stubbornly human

Buy-sider traders remain skeptical of the benefits of algo execution for credit derivatives.

Futures trading algos ripe for disruptive new entrants

Algorithm development specialist BestEx Research is making a play to address inefficiencies in futures trading algorithms.

QuantConnect Brings Low-Code Principles to Quant Finance

Later this year the vendor is looking to allow users to clip together various components of an algorithmic trading strategy, making it easier for users with limited programming skills to build their own trading strategies.

This Week: SGX/Cassini, UBS/GitLab, QuantConnect & Snowflake

A look at some of the past week's financial technology news.

EU's AI Regulations Could Lay Blame With CTO

Jo wonders if the EC's approach to regulating AI could adapt existing liability laws—with implications for individuals.