Algorithmic trading

FXCM Integrates Seer Trading Solution for Algorithmic Testing

US-based foreign exchange (FX) broker Forex Capital Markets (FXCM), has integrated Seer Trading’s technology with its offering, giving clients the ability to test and develop algorithmic trading strategies.

Instinet Unveils MAKE Algorithm Globally

Instinet, the equity execution services arm of the Tokyo-based Nomura Group, has launched what it has dubbed its MAKE algorithm, the broker’s latest addition to its Execution Experts algorithmic trading suite.

BAML Consolidates Options Algorithms

Bank of America Merrill Lynch (BAML) has streamlined its algorithmic offerings for options trading, consolidating them into four strategies.

Indian Regulator Plans HFT Conference

The Securities and Exchange Board of India (Sebi) has announced plans for a two-day conference next week, aimed at discussing the market risks associated with algorithmic and high-frequency trading (HFT).

January 2014: Do Algorithms Dream of Super-Fast Sheep?

While algorithms are far from sentient, Victor wonders what they would think about if they could.

Aizawa Securities Selects Fidessa for Proprietary Trading

Japanese broker Aizawa Securities has selected Fidessa for its proprietary and wholesale agency trading businesses.

2013's Trading Technology: A Year of 'Accelerating Returns'

Readers of Waters' ongoing coverage will have noticed several themes that blossomed over the past 12 months. Some of them were predictable. But 2013 also offered up more than a few unexpected hints of opportunities to come—whether imminently, or further…

ITG Introduces Algo Prism in Canada

Agency broker and technology provider ITG has introduced ITG Algorithms Prism to the Canadian market, providing traders with up-to-the-second visibility into the behavior of its algorithms.

Does Speed Still Sell?

It’s been a very buy-side focused week, here at Sell-Side Technology. On Friday, we had the seventh annual Buy-Side Technology Awards, and around that, of course, all of the organizational and editorial work it entails. Thanks have to go to everyone…

China Securities Deploys Fidessa Asian Trading Platform

Investment bank China Securities (International) has selected Fidessa’s Asian trading platform to operate on its first subsidiary outside mainland China.

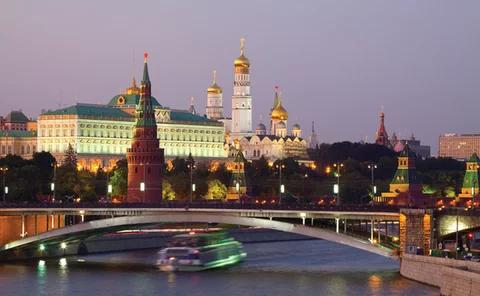

Citi Clients to Get DMA and Algos Trading in Moscow

Citi plans to begin offering clients algorithmic trading and direct market access (DMA) to securities traded on the Moscow Exchange this month.

Instinet Extends Nighthawk Algo to Japan

Instinet, the New York-based agency-only broker, has introduced Nighthawk VWAP, a variant of its Nighthawk algorithm, which provides buy-side firms with aggregated access to the pre-market volume-weighted average price (VWAP) crosses in Japan.

CSRC Widens Everbright Glitch Probe

The China Securities Regulatory Commission (CSRC) has announced that it will expand its investigation of trading systems to include all Chinese brokerages, following a glitch in Everbright Securities' high-frequency engine that caused it to mistakenly…

Futures Trading Algorithms Find Traction

Equities and futures microstructures have always functioned differently—and in terms of algorithmic application, the latter has always benefited from the adventures of the former. From order placement optimization to a revived debate on pricing…

Risk Management a Challenge When Algos Go Rogue

In an article published in May, Waters explored the problematic task of performing market surveillance in automated, high-frequency trading environments. Another challenging area for algorithmic trading is that of risk management, when questions of risk…

ITG Updates Implementation Shortfall Algorithm

ITG has enhanced its Dynamic Implementation Shortfall algorithm with optimized capabilities to handle imbalanced and illiquid portfolio trades.

Fox River Algos Available Through Silexx EMS

SunGard's Fox River Execution Solutions has made its algorithms available to users of the Obsidian execution management system (EMS) from Sarasota, Florida-based Silexx.

All I Ask is a Tall Ship and a Star to Steer Her By

A little high concept with your high technology.

Lessons from the Hash Crash

Over the past few months, a series of glitches similar to the one that caused the Hash Crash has made it clear that the financial markets are at the mercy of high-frequency trading machines. Some of these systems feed mostly on social media content,…

Citi Opens ‘Open' to Client Base, Improves Order Entry and SOR

After working with its buy-side clients and vendors, Citi made several announcements today: It will now make available its Citi Open algorithm to its entire client base; it has enhanced its Citi Close algorithm; it has redesigned its global order-entry…

Q&A With Wolverine's Kevin Kernan

Kernan, director of product development at Wolverine Execution Services (WEX), dishes on his firm's algorithmic adaptations.

SunGard Extends FoxRiver Algo Suite to Japanese Equities

SunGard Financial Systems has extended the international reach of its Fox River algorithm suite to support trading in the Japanese equities market.

RSJ Implements Kx Systems' kdb+

The Prague-based proprietary trading shop, among the leaders in derivatives trading on NYSE Liffe, will use Kx's database and time-series analysis platform to support modeling for its algorithmic trading systems.