Alliances, Mergers & Acquisitions

eFront Expands PE Coverage with AnalytX Acquisition

eFront, which provides technology to private equity (PE) and alternative investment firms, has acquired AnalytX in a move to expand its coverage to small and mid-sized firms.

Arqa Tech Integrates S&P Cap IQ Feed

Russian financial software vendor Arqa Technologies has integrated S&P Capital IQ Real-Time Solutions' ConsolidatedFeed product into its Quik front-office trading terminal for brokers and dealers, to provide clients with access to a global consolidated…

Deutsche Börse, BSE Ally on Data Sales, Development

Deutsche Börse's Market Data and Services division has struck a deal to become the exclusive licensor of the Bombay Stock Exchange's data products to international customers.

Alliance News Launches UK Equities Newswire, Partners with DPA-AFX, Proquote

UK-based newswire startup Alliance News will launch a real-time equities news service covering all listed UK stocks today, Friday, Oct. 4, to meet demand from traders and investors for UK-focused news to inform investment decisions.

CME, Perseus Bow Precision Timestamping in Aurora Co-Lo

CME Group has installed highly accurate timing technology from network provider Perseus Telecom in its Aurora, Illinois co-location center, to allow clients to synchronize timing across trading systems in multiple datacenters.

Thomson Reuters Taps TPI for China Bond Data

Thomson Reuters has added real-time Chinese bond data from Tullett Prebon Information, the data arm of interdealer broker Tullett Prebon, to its Eikon desktop terminal and standalone data applications, to provide domestic and international customers with…

SS&C Buys Prime Management for ILS Exposure

SS&C Technologies, a Connecticut-based software provider, has acquired Prime Management, a fund administrator and a service provider to the insurance-linked securities (ILS) market.

Platts Forges Metals Partnership with Germany's MVS

Energy and commodities data provider Platts has struck a deal to take an undisclosed investment stake in German iron ore and steel data provider Minerals Value Service and become the exclusive distributor of MVS's web-based value-in-use tool, which…

MDX, Ropnoy Ally for Spreadsheet Data Migrations

London-based market data connectivity platform and spreadsheet add-in provider MDX Technology has enlisted Ropnoy, a UK-based market data consultancy and software vendor, to help clients convert spreadsheets that consume data within their organizations…

Turquoise Derivatives Arm Relaunched Under New LSEG Colors

London Stock Exchange Group (LSEG) today announced it has acquired the derivatives business of Turquoise, the London-based multilateral trading facility.

Tech Questions Loom After Major Exchanges Tie the Knot

A period where no meaningful exchange M&A made it to the finish line has been followed by two announced megadeals that appear likely to be approved. Jake Thomases looks at what IT advantage is gained by such massive mergers, and whether these latest…

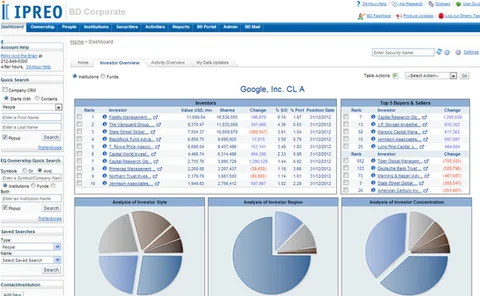

Ipreo to Market FactSet Data to Corporates

Company data and investor relations service provider Ipreo has struck a deal with FactSet Research Systems to distribute the FactSet workstation and the vendor's FactSet for Microsoft Excel spreadsheet add-in to corporate clients, as part of Ipreo's…

Axioma Adds Credit Suisse HOLT Fundamental Data

Risk management and index analytics provider Axioma has integrated fundamental factor data from Credit Suisse's HOLT fundamental analysis, idea generation and benchmarking platform into the Performance Attribution module of Axioma Portfolio Analytics and…

NYSE Tech, First Derivatives Ally for As-a-Service Offerings

NYSE Technologies, the data and technology arm of NYSE Euronext, is working with Northern Ireland-based data management software vendor First Derivatives to develop a suite of historical data-as-a-service solutions, dubbed Tick as a Service, that will…

Chi-X Canada Bows "Retail Professional" Intermediate Data Fee Tier

Alternative trading system Chi-X Canada has introduced a new tier of market data fees for professionals such as investment advisors serving retail investors, developed with the assistance of market data and technology product management and marketing…

African Exchange Links Could Draw Investment, Liquidity

The alliances that stock exchanges strike between themselves often turn out to be game-changers for a region’s economy. Marina Daras looks at regional initiatives to link up exchanges in one of the fastest evolving regions of the world—Africa.

S&P CapIQ Taps Arista to Speed Data

S&P Capital IQ Real-Time Solutions (formerly French low-latency data vendor QuantHouse, which S&P acquired last year) is leveraging switch technology vendor Arista Networks' EOS (Extensible Operating System) to improve the performance of its QuantLink…

Pico, SpryWare Ally on Latency Offerings

Chicago-based ticker plant and feed handler provider SpryWare has struck a deal with New York-based agency broker and infrastructure provider Pico Trading to offer Pico’s clients access to the vendor’s feed handlers, and in return gain access to Pico’s…

Tradeweb Takes Control of BondDesk

Tradeweb Markets has agreed to acquire bond trading platform provider BondDesk to extend its business interests into the fixed-income industry.

Tradition Taps Bloomberg Price Fixings for Volatis Trading Platform

Interdealer broker Tradition is to use daily price fixing observations from Bloomberg's independent valuation services for derivatives and structured notes, to provide prices that more accurately reflect realized volatility to Volatis, the broker's newly…

SocGen Bond Prices on Thomson Reuters Trading Platform, Data Services

Société Générale has begun contributing cash bond prices to Thomson Reuters' Fixed Income Trading electronic platform, expanding the bank's price distribution to a broader base of trading desks at private banks and wealth managers, while increasing the…

Derivative Path Taps Fincad for OTC Derivative Analytics, Valuations

Derivative Path, a Walnut Creek, Calif.-based startup provider of automated trading technologies for the over-the-counter derivatives markets, has incorporated Vancouver, Canada-based OTC derivatives pricing and risk management vendor Fincad's analytics…

ML Bond Index Adds Fitch Ratings

Bank of America Merrill Lynch has added credit ratings content from Fitch Ratings to its ML Bond Market index, as an additional factor in the assessment of investment-grade and speculative-grade bonds.

ITRS Grows Partner Data Interfaces

UK-based application monitoring software vendor ITRS has expanded its partner program to include Caplin Systems, Corvil, Misys, Niksun and VMware, to allow ITRS' Geneos platform to extract data to extract data from the vendors' applications, including…