Sentiment

Examining how adaptive intelligence can create resilient trading ecosystems

Researchers from IBM and Wipro explore how multi-agent LLMs and multi-modal trading agents can be used to build trading ecosystems that perform better under stress.

LLMs are making alternative datasets ‘fuzzy’

Waters Wrap: While large language models and generative/agentic AI offer an endless amount of opportunity, they are also exposing unforeseen risks and challenges.

Bloomberg offers auto-RFQ chat feed—but banks want a bigger prize

Traders hope for unfettered access to IB chat so they can build their own AI-enhanced trading tools

New Bloomberg study finds demand for election-related alt data

In a survey conducted with Coalition Greenwich, the data giant revealed a strong desire among asset managers, economists and analysts for more alternative data from the burgeoning prediction markets.

Vanguard cautiously explores neural networks for alt data analysis

John Ameriks, head of Vanguard’s Quantitative Equity Group, explains the rationale behind dataset selection and how the group has been using machine learning.

Domain-specific AI: the hot topic of 2024?

Generative AI is increasingly being applied to specific domains within finance. But experts are divided on whether targeted models will take over from their general-purpose cousins.

Bloomberg deploys new chatbot tool to Terminal

The offering allows users to surface data and notifications from internal systems without ever having to leave Instant Bloomberg chatrooms.

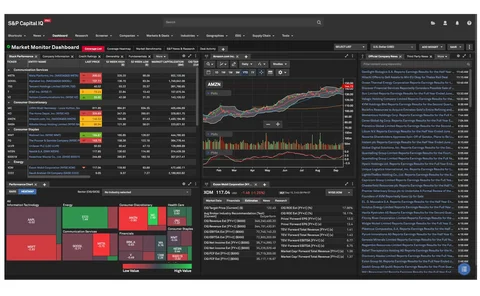

S&P tests ‘ChatIQ’ genAI search tool in revamped CapIQ desktop

The new tool is the culmination of integrating recent acquisitions, including IHS Markit, ChartIQ and Kensho.

Waters Wrap: The path to generative AI is paved with solid data practices

While large language models are likely to proliferate, those that can develop a solid data infrastructure of taxonomies, ontologies, data sourcing, mapping and lineage will be the ultimate winners, Anthony says.

Waters Wrap: ChatGPT and the next wave of AI evolution

As the December holiday break loomed, a new tool released by OpenAI had engineers, analysts, programmers and even writers like Anthony wondering what the future of their professions might hold.

Here’s what ML and NLP powered in capital markets in 2022

As machine learning and natural language processing continue to spread across the industry, WatersTechnology highlights stories from 2022 that feature new use cases.

All the pieces fit: connecting trader voice and messaging across workflows

Cloud9 expands Symphony's communication channels to trader voice, in an effort to simplify workflows as Wall Street struggles with compliant communications.

Continuous evolution: Researchers work to specialize NLP for finance

From academics to data teams at investment banks, those in and adjacent to the capital markets are looking to specialize natural language processing models to understand and break down financial data.

Advancements in NLP bring focus to document insight

Vendors are looking to provide AI models to help financial professionals get more value out of unstructured data sources.

In the world of financial data, context—not content—is the new king

For years, the mantra of the market data world has been ‘content is king.’ But with trading strategies now more dependent on being able to see the big picture, the value of context could quickly overtake the data itself.

Meme stocks, Reddit, and QAnon: A postcard from the origin of the metaverse

Join WatersTechnology for a look back at the most absurd stories of the year—Reddit/GameStop, the advent of meme stocks, and QAnon—and what they mean for you.

Machine learning & NLP in the capital markets: Some examples from 2021

To show how ML and NLP are spreading across the industry, WatersTechnology highlights 20 stories from the last 12 months that feature unique uses of AI.

This Week: LSEG/Quantile, Ice, Morningstar/Sentifi, SimCorp/FundApps, and more

A summary of some of the past week’s financial technology news.

ESG asset manager taps Symphony, FinTech Studios for thematic ‘mini-Bloomberg’

Sycomore Asset Management is preparing to roll out an expansion of how it uses the vendors’ combined platforms to be able to create and share targeted thematic investment data across its organization.

Disinformation campaigns coming to a Wall Street near you

Rebecca examines the tangled web woven between Reddit, meme stocks, and QAnon, and asks how well prepared data providers looking to jump on the meme stocks bandwagon are to recognize organized disinformation campaigns.

Meme stocks: Data providers conflicted on offering investment analyses

While some alternative data providers are jumping in on the meme-stock craze by producing new datasets and analyses geared toward risk management and alpha generation, others—perhaps rightly so—are staying cautious.