Strategy

Deutsche Bank First Looks to Interop, Chatbot Projects After Partnering with Google

The bank will look to enhance existing capabilities and potentially introduce new solutions with Google’s help.

Manulife Refines ESG Methodology and Plugs Data Gaps with NLP

The asset manager has adopted materiality tools, industry handbooks, and NLP techniques to help navigate ESG data limitations.

Digital Rights Project for Data Usage Faces Legal, Operational Hurdles

Keen to trim the resources they expend on interpreting licenses, investment firms are exploring how they can turn data agreements into machine-readable code. Doing so is fraught with challenges.

This Week: IHS Markit, SGX/HSBC, LedgerX, TNS, TraditionData and more

A summary of some of the past week's financial technology news.

HKEx's Data Play Slowly Comes Together

The exchange is currently working on building its enterprise data bus for better internal data management, but Wei-Shen finds that the exchange is still short on long-term answers.

IPC Looks to Partner with Additional Transcription Service Providers

The comms and networking provider is expanding its service after partnering with OpenFin.

Bloomberg Adds New NLP Capabilities to TOMS

The tool allows traders to search their own data to find trade information specific to them.

After Acquisitions, Broadridge Looks to Expand Continental Europe Fund Comms Business

The financial services firm aims to branch out beyond the UK and Ireland with its fund communication solutions business.

Causality Link Building Next-Gen ESG Dashboard

The research provider will release a dashboard that decouples and drills down into the E, S, and G factors of ESG.

Lazard Asset Management Implements ESG Mapping Tool

The investment manager has developed frameworks to better understand how ESG issues impact individual company performance and sectors.

Boosted.ai Rolls Out New Models for Navigating Covid-Specific Risks

As Covid-19 impacted companies and markets in March, the machine-learning startup sought to help clients better manage risk exposures that couldn't be explained by traditional risk factors.

This Week: VMWare, Samsung and Salesforce; Wolters Kluwer; Verint, Cloud9; TP Icap; and more

A summary of some of the past week's financial technology news.

Wavelength Podcast Ep. 204: Nasdaq on Cloud Strategy

Nikolai Larbalestier, head of cloud strategy at Nasdaq, joins the podcast to talk about cloud computing and cloud adoption.

Finos Targets Retail Banking

The open-source nonprofit is looking to leverage its capital markets membership to expand its footprint.

Meet Cosaic, the New Name for ChartIQ and Finsemble

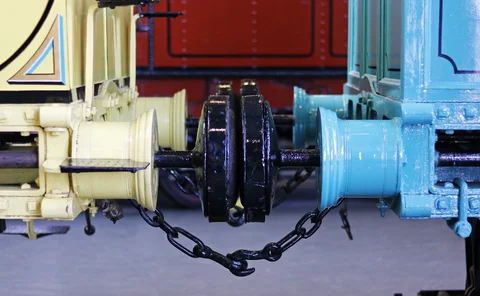

The move is intended to bridge clients' perception gap between its ChartIQ charting and Finsemble smart desktop integration businesses.

Lazard Asset Management Revamps Data Model to Reflect Covid-19 Reality

The firm developed a short-term data strategy to avoid the use of unreliable data and better understand the effects of the pandemic on the market as it evolves.

Data Integration, Interop Drive State Street’s Alpha Platform Strategy

The bank and Charles River are planning the next phase of enhancements to the Alpha trading platform.

Big xyt Readies New Liquidity & Trade Analytics Tools

The vendor is beta testing three new data and analytics tools that will give greater insight into their best options to liquidate positions quickly during volatile market conditions.

People Moves: CFTC; Eventus Systems, Rozetta, RJ O'Brien, Outset Global

Some of the key people moves from this week, including CFTC Chairman Heath Tarbert (pictured), who joins the Iosco board.

Fador Taps Fintech Experts for Advisory Board

Fador has enlisted a cadre of partners who will bring their expertise to his consulting business.

Quants Use Nowcasting As Covid Crystal Ball

Experts from UBS, Unigestion, MIT and QuantConnect discuss the need for nowcasting, and what the alt data boom has made possible in trying to navigate today’s crisis.

This Week: Northern Trust/BackRock, Nasdaq, IHS Markit/OpenGamma, MEMX, and More

A summary of some of the past week’s financial technology news.

Nowcasting Provides Macro Insights, say Active Managers

Using alternative data to understand macroeconomic conditions in almost real time can give investment teams an edge.

ChartIQ Tightens Charting & Finsemble Integration, Readies Rebrand

Having developed two separate product lines to showcase its charting and smart desktop integration offerings, ChartIQ is now bringing them closer together to solve client needs.