Trading Tech

LSEG to replatform Matching and FXall

Migration to stock exchange’s tech platform aims to deliver faster speeds and more order types.

Ping An Asset Management zooms in on NLP models for sentiment analysis

The asset management arm of Ping An Insurance (Group) Company of China is enhancing its NLP models to solve complex, non-linear challenges such as overfitting.

Quandl goes live with new dataset for measuring dollar value of patents

The data vendor’s product is its first that aims to sort what it believes to be truly innovative companies from the pack.

People Moves: Bitvore, KX, Wolters Kluwer, Neuravest & more

A look at some of the key people moves from this week, including Elizabeth Pritchard (pictured), who joins Bitvore as CEO.

This Week: JP Morgan, Deutsche Börse, Refinitiv, and more

A summary of some of the past week’s financial technology news.

Financial institutions battle cyber threat info overload

Cyber threat intelligence is crucial for the defense of an organization’s network, but financial firms have to figure out how to make sense of all the data first.

People Moves: HSBC/Solidatus, AWS, West Highland, CloudMargin, and more

A look at some of the key people moves from this week, including Lorraine Waters (pictured), who joins Solidatus as chief data officer.

This Week: ICE, IHS Markit, Commerzbank/Deutsche Börse, TNS & more

A summary of some of the past week’s financial technology news.

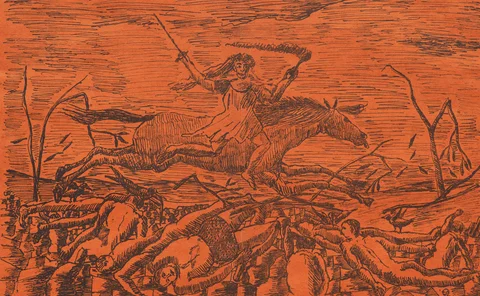

Is history repeating itself?

Broadridge’s acquisition of Itiviti presents many opportunities but also raises many questions about the combined company’s future. For a glimpse into that future, Wei-Shen Wong takes a look into Itiviti’s past.

Avelacom buys Brazilian infrastructure specialist to accelerate LatAm expansion

Network provider says the deal arms it to operate in uniquely nuanced regional markets.

OpenFin outgrows container tech origins with Workspace UI launch

New interface will standardize notifications, user interactions and content presentation.

People Moves: HSBC AM, Trumid, SIX, and more

A look at some of the key "people moves" from this week, including Paul Griffiths (pictured) who has been appointed global head of institutional business at HSBC Asset Management.

Waters Wrap: The looming data storage wars (And Bloomberg killers)

Anthony first looks at the data storage space, explaining that fees are likely to increase for buy- and sell-side firms in the near-term. He also wonders if there’s a market in the terminal/workstation space for innovative startups to gain traction. As…

This Week: Deutsche Boerse, HSBC, S&P Global, Linedata, FlexTrade/QuantFeed & more

A summary of some of the past week’s financial technology news.

Money.Net files Chapter 7 bankruptcy amid lawsuit

Despite a series of ambitious content expansion projects and senior hires, the low-cost vendor failed to win over institutional clients.

Symphony suspends Sparc pending registration talks with CFTC

The comms provider may have to register its RFQ workflow and messaging tool as a Sef, or perhaps permanently shut down the business line.

Bloomberg’s new data retention policy vexes buy-side firms

Impacted users will have to pay extra costs to retain communications data for longer than two years.

People Moves: Symphony, BMLL, HKEX, CloudMargin, Tora, Baton, and more

A look at some of the key people moves from this week, including Brad Levy (pictured), who will take the reins at communications platform Symphony in June, after joining the vendor in July last year.

Waters Wrap: Would DLT really have prevented Archegos? (And thoughts on Itiviti)

While Christopher Giancarlo says distributed ledger technology could’ve helped prime brokers better monitor their risk exposures to Archegos Capital Management, Anthony (and others) are not so sure about that. He also looks at the Broadridge-Itiviti deal.

This Week: TP Icap, Confluence, Bloomberg, Iress-Cosaic, Tradeweb, SmartStream, and more

A summary of some of the past week’s financial technology news

Banks, asset managers weigh trade-offs in third-party tools for machine learning

Although many banks and asset managers still prefer to build models in-house, off-the-shelf products are maturing.

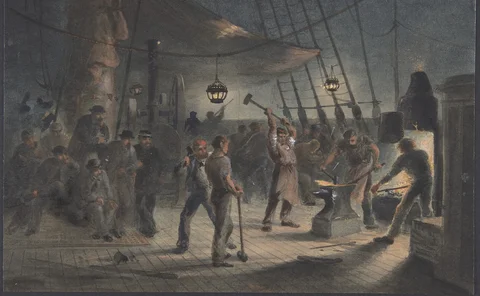

Bridging the gap: Broadridge looks front-to-back with acquisition of Itiviti

The deal signals a transformative move for Broadridge into the front-office space to help clients simplify their front-to-back technology stack. But some industry observers are skeptical about how it will achieve this.

Small alt data providers feel pressure to specialize

GTCOM-US, once a bespoke alt data shop for the buy side, has narrowed its offering to focus on Chinese datasets as the largest alt data players get even bigger.

‘Crypto Dad’ Giancarlo says DLT could have aided in Archegos

The former CFTC chair says managing collateral by using distributed ledger technology would enable the better oversight of risks.