Trading Tech

ADR Services Now Available on RealTick

ConvergEx Group has made its ADR Direct and Reverse ADR products available through its execution management system, RealTick.

MarkitSERV, CME to Support FX Derivatives Clearing

Over-the-counter (OTC) derivatives processing service MarkitSERV has announced that has connected with the Chicago Mercantile Exchange (CME) in order to support the clearing of foreign exchange (FX) derivatives contracts.

Modernizing Data Infrastructure webcast

Inside Market Data gathered leading industry experts for a webcast on March 21, 2013 to discuss how firms are looking to modernize their data infrastructures to drive business growth in a timely and cost-effective way.

FXSpotStream Adds UBS as Liquidity Provider

Multibank foreign exchange (FX) aggregation service FXSpotStream has announced that UBS will provide liquidity to clients.

Circuit Breakers Adequate for Flash-Crash Prevention

A recent report by London-based consultancy GreySpark Partners has found that circuit breakers and venue controls on algorithms should be sufficient measures to control aberrant behavior related to algorithmic trading, without a need for further…

The Road to Shorter Settlement Cycles

In March 2012, the wheels were set in motion for a pan-European Union move to shorter settlement cycles (SSC), following the publication of the proposed regulation for Central Securities Depositories Regulation for improving settlement efficiency (CSDR)…

Oanda Upgrades fxTrade Mobile App

New York-based foreign exchange (FX) trading services provider Oanda has upgraded its fxTrade mobile applications for iPhone, iPad, and Android devices.

Napier Park Selects Options For Infrastructure

Napier Park Global Capital will use the PIPE Core and Momentum services from Options as its fund’s technology infrastructure, the New York asset manager, a spinout from Citigroup, announced today.

Bonaire Adds Rebate and Invoice Reconciliation

The buy-side provider says its Revport solution will now calculate distribution fees and fully audit fund rebates.

High Stakes: An Examination of Risk Management on the Buy Side (Part 1)

In part one of his two-part feature, Anthony Malakian examines the state of risk management at the portfolio/trade-book level among buy-side firms. Part two will look at the middle- and back-office functions of risk across the buy side.

KCM Taps eFront for Private Equity

Kazakhstan-based Kazyna Capital Management (KCM), a wholly-owned subsidiary of sovereign wealth fund Samruk-Kazyna, has chosen eFront to support its private equity investments.

Japan Exchange Group Publishes IT Strategy

Japan Exchange Group (JPX), the business formed by the merger of the Tokyo Stock Exchange (TSE) and the Osaka Securities Exchange (OSX), has released its technology strategy and roadmap covering the two exchanges' integration and forward IT movement.

MarkitSERV Launches OTC Pre-Trade Credit Checking Facility

Trade processing specialist MarkitSERV has announced the release of Credit Center, its pre-trade credit checking facility for over-the-counter (OTC) derivatives transactions.

Updated: SAC Capital Settlement, Investigation Widens

SAC Capital’s $616 million compounded penalty handed down by the Securities and Exchange Commission (SEC) is an enormous number, but the outcome is both manageable for SAC and, given previous insider investigations, expected. Just the same, other funds…

Danish Bank Chooses SmartStream for Corp Actions Processing

The software vendor says its TLM Corporate Actions product will help Ringkjøbing Landbobank transform the management of corporate actions into an exception management process rather than a manual one

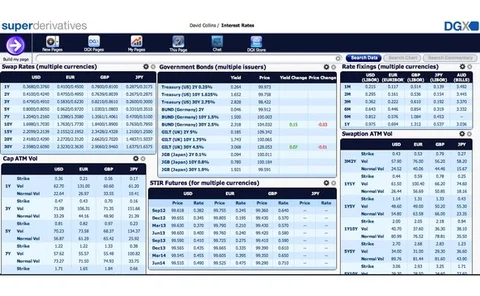

Open Platform: Intelligent Approaches for a Changing Sell-Side Landscape

The growth in market complexity, combined with decreasing trading volumes and an unrelenting churn in global regulation, has had a fundamental effect on traditional sell-side business models. Downward pressures on revenues are accompanied by the soaring…

Ringkjøbing Landbobank Selects SmartStream for Corporate Actions

Ringkjøbing Landbobank, based in Denmark, has chosen SmartStream Technologies' TLM solution for the processing of corporate actions, the vendor has announced.

Thomson Reuters Signs 21 Banks for Nepalese FX Platform

Information and technology vendor Thomson Reuters has announced that 21 banks have signed up for its Thomson Reuters Dealing foreign exchange (FX) platform.

Moscow Exchange Implements T+2

Moscow Exchange has announced that it will settle securities on a T+2 basis, or two days after trade date, starting today.

Ruffer Partners Calastone for Automatic Trade Notifications

Ruffer LLP, a London-headquartered investment management firm, has partnered with fund transaction network Calastone to launch a new automated trade notification service.