Buy-Side Technology/News

Vescore Completes Implementation of SimCorp Dimension

Swiss asset manager, formally known as Notenstein Asset Management, implements SimCorp investment book of record solution.

Markit Adds JPMorgan Integration Software for Syndicated Loans

Technology expected to be deployed in second half of 2016.

SS&C Adds Service to Help with New Margining Requirements

This service will help with IOSCO- and BCBS-related requirements.

Major UK Fund Managers Team on Blockchain

According to the Financial Times, five large fund managers are partnering to explore the benefits of blockchain technology.

Liquidnet Expands Execution & Quantitative Services Business with New Duo

Jerry Casey joins Liquidnet as head of trading strategy, while Craig Viani joins Liquidnet’s Algo Services group.

Tradeweb Expands Into US with New ETF Trading Platform

In 2012, Tradeweb launched its European ETF platform, which supports more than 45 percent of OTC electronic ETF trading in Europe.

Nikko Asset Management Taps SmartStream’s TLM OnDemand for Reconciliations

TLM OnDemand for reconciliations is the software-as-a-service version of SmartStream's reconciliations technology.

RHB Investments Taps Fidessa for Asian Trading Platform

Malaysian bank implements front-office platform for Asian algorithmic trading.

Chi-X Australia Selects Solarflare's Flareon Ultra

California-based vendor will aid Chi-X Australia's trading platform.

Nordea Bank SA Goes Live with Temenos’ WealthSuite

Temenos' integrated wealth management solution combines back-office standardization with front-office differentiation

Fincad’s Updated Platform Aims to Bring Quantitative Analytics to the Masses

Version 5.0 of the F3 platform provides functionality for both advanced quants and layperson traders.

DTCC Looks to Blockchain Technology to Improve Manual Processes

Without standards across the industry, blockchain technology could become a group of siloed solutions,

Big Buy-Side Merger: StatPro Acquires Investor Analytics

Investor Analytics CEO Damian Handzy will take over as StatPro’s global head of risk.

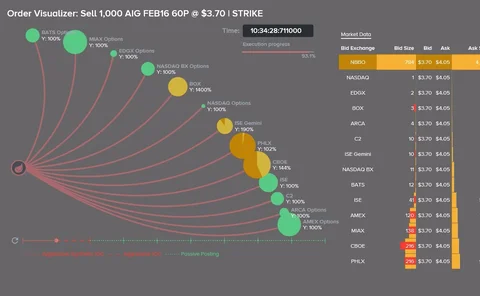

Dash Releases New Dashboard for Order-Routing Visualization, Execution

Dash360 is geared toward bringing transparency to the US options market.

Splice Machine Secures $9 million in Additional Funding

Funding will come from existing investors, including Mohr Davidow Ventures (MDV), Interwest Partners and Correlation Ventures.

Axioma Taps Morokoff as Head of Research

Morokoff has previously worked at S&P, Moody's and Goldman Sachs.

Confluence Creates Investor Communications, Expense Solutions Position for Casagrande

Gary Casagrande comes to Confluence from Brown Brothers Harriman.

Liquidnet Rolls Out New EMEA Block Trading Algo Suite

EMEA Next Gen Algo suite to provide combination of block trading and broader market execution functionality.

Nikko Asset Management Taps Vermilion for Global Reporting

Japanese asset manager to roll out VRS across its global operations for reporting requirements.

DataArt Bolsters Financial Practice With Addition of Moyce

Cliff Moyce joins after spending three years as the head of a consultancy

Prophet Capital Selects Broadridge Portfolio & Trading Platform

The structured credit hedge fund adopts integrated trading and operations platform for scalable infrastructure.

Numerix Rolls Out Latest CrossAsset Release

Version 12.5 expands real-world modeling coverage.

Maybank Taps Fidessa's Equities Trading Platform

Brokerage division of investment bank implements Fidessa equities platform in response to fragmented Asian markets.

Trillium Launches Surveyor for iPhone

New York-based Trillium unveils a new mobile compliance and monitoring tool to provide users with depth-of-book quotes for US equities.