Buy-Side Technology/News

OneVue Joins Calastone Network

Australian fund manager OneVue has joined Calastone’s global funds transaction network to automate fund transactions previously communicated by fax.

Confluence Partners with Fundsquare for AIFMD Reporting

Confluence has announced its collaboration with Fundsquare to simplify regulatory filings within its AIFMD Transparency Reporting tool, as required by the Alternative Investment Fund Managers Directive (AIFMD).

Lombard Risk Enhances Collateral Management Solution

Lombard Risk has announced a new release of Colline, its collateral and clearing inventory management and optimization solution, to streamline operations across the firm and support its regulatory needs.

Your Next Security Threat is...POODLE

Three Google security researchers have discovered a new security hole in version 3 of the Secure Sockets Layer (SSL) protocol.

Buy-Side Firms Begin Trading Corporates Via MTS Bonds.com API

MTS Markets International announced liquidity-provisioned trades by buy-side institutions through its enhanced application program interface (API) on MTS Bonds.com have begun taking place.

Hermes Selects Calastone for Ucits Funds

Hermes Investment Management will distribute its Undertakings for Collective Investment in Transferable Securities (Ucits) funds via Calastone's global transaction network, the provider has announced.

Russia's Cinimex Extends Ties with Misys

The Russian provider has joined Misys' InFusion Partner Program after an existing 12-year relationship.

eFront Partners Methys for African Integrations

The alternative investments software provider will use South Africa-based tech consultancy Methys for all new integrations on the continent.

State Street TruCross/FX Platform Goes Live

State Street Global Markets has announced that its TruCross/FX foreign exchange (FX) spot benchmark execution platform, overseen by State Street Global Markets' agency FX unit, is now live.

TeraExchange Claims First Bitcoin Swap Trade

Swap execution facility (SEF) operator TeraExchange has said that the first ever Bitcoin derivative trade has taken place on its venue.

SimCorp Poll: Only 23 Percent on Buy Side Can Perform Intraday Calculations

Investment management solutions provider SimCorp has released a poll that surveyed 60 executives from North American-based capital market firms about performing intraday calculations on the impact of position-driving events.

Standard Bank Selects Eagle for Data Management, Accounting

Standard Bank South Africa will use Eagle Investment Systems' accounting and enterprise data management platform, taking the services on a hosted basis through the vendor's private cloud, Eagle Access.

SS&C Debuts Integrated Platform Offering

SS&C Technologies has announced the release of an integrated technology platform that spans the front, middle and back offices, aimed specifically at hedge funds.

NY Fed: Capital Markets Must Be More Wary of Data Cyber Threats

Capital markets firms must take more steps to protect sensitive information and market data from cyber-terrorists intent on stealing and reselling valuable data, including carefully guarding their internal data architectures and external providers,…

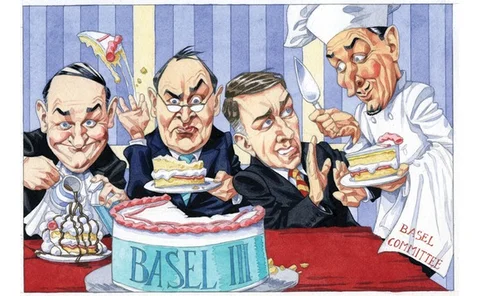

Portware to Offer S3's Counterparty Intel Analytics Platform to Clients

S3 announced its Basel III analytics solution, Blacklight, will be available for all Portware clients.

Liquid Introduces Beta Mobile Application

OEMS provider Liquid Holdings has begun rolling out the beta version of LiquidMobile to select platform users.

Schroders Selects ClusterSeven for Spreadsheet Management

Schroders has chosen ClusterSeven's Enterprise Spreadsheet Management (ESM) platform, the vendor has announced.

C-level Panel Talks Information Security at BST North American Summit

The evolution of information security was discussed at a C-level roundtable at this year's Buy-Side Technology North American Summit in New York.

Neuberger Berman's Ganim: CISOs Have Their Work Cut Out

Bob Ganim, chief information security officer (CISO) at Neuberger Berman, a $250 billion New York-based asset manager, delivered the keynote address at this year's Buy-Side Technology North American Summit, held today at the Marriott Marquis in Times…

Pictet Extends Wolters Kluwer Usage

Swiss wealth management firm Pictet has selected Wolters Kluwer's Financial Risk Management product for use at its head offices in Geneva, allowing the organization to perform complex calculations at top level as well as local.

S&P Capital IQ and Kuberre Partner for Real-Time News Aggregation Tool

S&P Capital IQ and Kuberre Systems, a US-based data management and analytics vendor, have launched a new trading tool, Event Fusion, that alerts traders, market-makers and portfolio managers about relevant investment news in real time.

FCA Approves Bondcube as Crossing Network

Bondcube, an electronic fixed-income trading system that aims to match buyers and sellers of difficult bond orders, has received approval from the UK Financial Conduct Authority (FCA) to operate as a crossing network.

Northern Trust Expands SunGard Implementation with Asset Arena

SunGard's Asset Arena Control Center will help Northern Trust benefit from further operational efficiency by converting complex work processes into electronic checklists and easy-to-read dashboards, enabling operational oversight and control of the firm…

TFG Financial Systems to Acquire RTS

TFG Financial Systems (TFG) has announced it has acquired US-based Risk Technology Solution (RTS) to support its portfolio risk management system and expand in the US.