Sell-Side Technology/News

Aquis Exchange Connects to Savvis

Savvis, a Missouri-based cloud infrastructure and hosting specialist, will expand connectivity to Aquis Exchange, the proposed pan-European equities trading exchange and software developer, via Savvis Markets Infrastructure. The connection will provide…

Bloomberg Supplies Fixings Valuation for Tradition's Volatis

Volatis, the interdealer broker's newly-launched hybrid platform for negotiation and trading of realized volatility futures, will use daily fixing observations from Bloomberg.

Fenics to Provide FX Options Analysis to Shanghai Bank

Bank of Communications (BoC), a financial services group based in Shanghai, has licensed Fenics Professional, a pricing and risk management system for foreign exchange (FX) options from GFI subsidiary Fenics.

MarkitSERV Connects to Nasdaq for FX Clearing

MarkitSERV, Markit’s electronic trade processing service for over-the-counter (OTC) derivative transactions, will be the first middleware provider to deliver foreign exchange (FX) trades for clearing to Nasdaq OMX.

Top Sales Role at Misys for Brienzi

Misys, the Paris-headquartered provider of capital markets technology and services, has appointed Frank Brienzi as its new president and chief sales officer.

DCCC Deal Extends Euroclear's Collateral Highway to Middle East

Euroclear has announced that the Dubai Commodities Clearing Corporation (DCCC) has joined its Collateral Highway network, the first firm from the Middle East to do so.

BCS Takes b-next for Market Abuse Surveillance

Russian brokerage BCS Financial Group has announced that it will implement b-next's CMC:Suite, in order to boost its market abuse surveillance and insider trading detection capabilities, at its London trading room.

Thomson Reuters Files SEF Application

Thomson Reuters has filed an application with the US Commodity Futures Trading Commission (CFTC) to register as a swap execution facility (SEF).

Lombard Risk Upgrades Colline

Lombard Risk has announced the release of Colline version 12.3, its collateral management and clearing product.

Mors Survey: Intra-day Liquidity Risk Projects Still Incomplete

Helsinki-based Mors Software, a provider of integrated real-time treasury and risk management technology to the sell side, has published the results of its annual liquidity risk management survey, carried out between May and July this year.

Nasdaq's Genium INET to Power German Exchange

Boerse Stuttgart, a 150-year old exchange serving private investors, has selected Nasdaq OMX’s Genium INET trading technology to power its market.

CFTC Gives Green Light for Tradeweb's SEFs

The US Commodity Futures Trading Commission (CFTC) has granted temporary approval to Tradeweb Markets' application for swap execution facility (SEF) status.

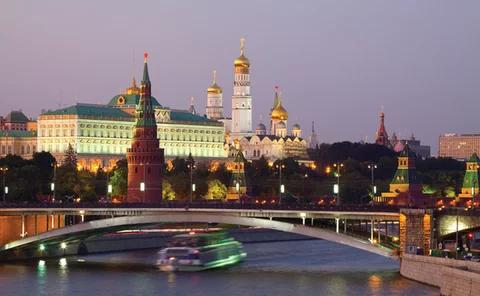

Citi Clients to Get DMA and Algos Trading in Moscow

Citi plans to begin offering clients algorithmic trading and direct market access (DMA) to securities traded on the Moscow Exchange this month.

Singapore Displaces Japan as FX Market Tops $5tn Daily

The foreign exchange (FX) market's daily turnover has reached an estimated $5.3 trillion, according to the Bank for International Settlements (BIS), with over half of the volume accounted for by electronic trading.

InfoReach Integrates "R" Language and Bloomberg Data

Electronic trading technology provider InfoReach has announced it has integrated the R programming language and Bloomberg data with its trading platforms.

BGC Partners Joins Cadre of SEF Applicants

The electronic and voice brokerage is the latest in a number of financial services firms to apply to the U.S. Commodity Futures Trading Commission (CFTC) to become a swaps execution facility, or SEF.

ATG, Risk Office to Build Clearinghouse in Brazil

Americas Trading Group (ATG), a liquidity center and provider of exchange technologies in Latin American markets, says it has partnered with Brazil-based Risk Office to build out clearing functions ahead of its 2014 launch of ATS Brasil.

ASX and NYSE Technologies to Connect Global Networks

The Australian Securities Exchanges (ASX) and NYSE Technologies have announced they have connected their global networks, ASX Net Global and the Secure Financial Transaction Infrastructure (SFTI).

Regis-TR and TriOptima Partner on Portfolio Reconciliation

TriOptima and Regis-TR have announced that they will provide portfolio reconciliation of the latter's trade repository data with that in the triResolve service.

Icap Petitions for SEF Status

London-based electronic broker-dealer Icap has filed an application with the Commodity Futures Trading Commission (CFTC) to establish a swap execution facility (SEF) subsidiary.

United Overseas Bank Taps FlexTrade Systems for FX Trading

Singapore-based United Overseas Bank Limited (UOB) has selected FlexTrade Systems to support its global foreign exchange (FX) trading activity.

ICBPI Takes Etrali Open Trade for Comms

Etrali Trading Solutions has announced that Instituto Centrale Banche Popolari Italiane (ICBPI) has taken its Open Trade turret platform, along with a recording solution, for its Milan trading room.

Moscow Exchange Completes First Day of T+2

Equity and bond markets have completed their first day of trading under T+2, or settlement two days after trade date, on the Moscow Exchange.

Siam Bank Selects BWise Platform for GRC

Thailand’s third-largest bank, Siam Commercial Bank (SCB), has selected BWise to support its governance, risk management and compliance (GRC)needs.