Anthony Malakian

Anthony joined WatersTechnology in October 2009. He is the Editor-in-Chief of WatersTechnology Group, running all editorial operations for the publication. Prior to joining WatersTechnology, he was a senior associate editor covering the banking industry at American Banker. Before that, he was a sports reporter at daily newspaper The Journal News. You can reach him at anthony.malakian@infopro-digital.com or at +646-490-3973.

Follow Anthony

Articles by Anthony Malakian

Investor, Regulatory Demands Drive Latest Linedata Rollout

Yesterday, it was announced that Linedata had enhanced Linedata Global Hedge, its overarching platform for hedge fund managers.

PDQ Rolls Out New Auction Venue

Alternative trading system PDQ has unveiled Auction1, an electronic equity auction designed for larger orders with heightened sensitivity to market impact.

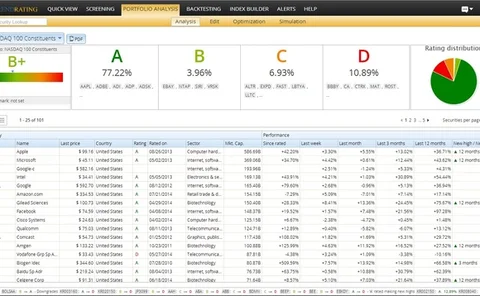

Trendrating Rolls Out Index Builder

Trendrating, which specializes in momentum factor analytics, has added a premium Index Builder module to its Trendrating Momentum Analytics Platform (TMAP).

DataArt Acquires AW Systems, Will Open New Development Center in Argentina

DataArt says it has bought South American consulting specialist AW Systems.

EEX's COO Discusses TT Partnership & What's Ahead

European Energy Exchange (EEX) chief operating officer Steffen Köehler talks about how the Germany-based exchange will look to continue to grow through the use of Trading Technologies' front-end trading platform.

EEX Goes With TT's Trading Platform

The European Energy Exchange (EEX) has decided to implement Trading Technologies' SaaS-based trading platform.

SimCorp Appoints Corrigan as MD of North America

SimCorp has named James Corrigan the managing director of its North American operations.

Dark Pools in the Firing Line

As the New York attorney general, the SEC and Finra set their sights on dark pool trading, larger market structure issues are coming to the fore that will force institutional traders to reexamine how they seek out liquidity. By Anthony Malakian

With Swap Volumes Slacking, Tech to Serve as SEFs' Differentiator

As the new world of SEF clearing starts to shape, TrueEX's Sunil Hirani says that smaller venues will have differentiate themselves against the larger players by being better at second-order functions.

ICBC Taps IBM's Active-Active for DR

Industrial and Commercial Bank of China (ICBC) will employ IBM's mainframe computing solution Active-Active to provide "near-continuous" availability and disaster recovery (DR) in an effort to enhance its business continuity processes.

Liquid Takes the Covers off New Cloud Offering

Liquid Holdings unveiled its new cloud-based offering, LiquidFIRM, short for Financial Intermediary Risk Management.

Trendrating Unveils v1.0 of Momentum Analytics Platform

Trendrating, which provides momentum factor analytics to asset managers, has released version 1.0 of its Momentum Analytics platform.

Waters Rankings 2014: Best Execution Management System Provider — Eze Software Group

Eze Software Group, launched in January of last year when ConvergEx Group made the decision to exit the front-office technology provider market and then promptly sold two of its leading lights—the Eze OMS and its sibling RealTick EMS—has pulled off…

Waters Rankings 2014: Best Reconciliation Management Provider — DTCC

After winning this category on its own from 2010 to 2013, Omgeo continues to lead the pack when it comes to reconciliations, although since the fall of last year, it has been part of the Depository Trust & Clearing Corp. (DTCC).

Waters Rankings 2014: Best Sell-Side OMS Provider — Bloomberg

For the fifth year in a row, Bloomberg’s Trade Order Management Solutions (TOMS) has won the Waters Rankings award for best sell-side OMS. The platform, which provides fixed-income cash and derivatives trading firms with a multitude of tools to manage…

Waters Rankings 2014: Best Buy-Side OMS Provider — Eze Software Group

Since its creation in January 2013, Eze Software Group has established itself as the de facto buy-side order management system (OMS) with its Eze OMS offering, winning the category at both last year’s and this year’s Waters Rankings. An award-winning OMS…

Waters Rankings 2014: Best Sell-Side Clearing Provider — DTCC

The best sell-side clearing provider category in the Waters Rankings is one that has seen rapid change after years of stability. JPMorgan was the perennial leader in this category before being dethroned last year by Goldman Sachs. But this year we see a…

Waters Rankings 2014: Best Mobile Solutions Provider — Morningstar

One of the most exciting—albeit challenging at times—enhancements to the trading landscape has been the introduction of tablet devices and, specifically, the Apple iPad. Traders, portfolio managers and even compliance officers are increasingly looking to…

SimCorp Unveils New Dashboards

SimCorp has launched Asset Services Dashboards and Alerts, which provide users with a real-time overview of asset-servicing metrics, while alerting them of areas that need attention, such as acting on exceptions.

Eze Software Adds AIFMD Reporting Component to Regulatory Filings Manager

Eze Software Group can now support Alternative Investment Fund Managers Directive (AIFMD) filings through its Regulatory Filings Manager offering.

Broadridge Launches Web-Based Reporting Tool

Broadridge Financial Solutions has unveiled a new web- and mobile-based reporting solution, dubbed Report Manager, which will allow portfolio managers to access important information on their desktop, tablet or smartphone.

Linedata Partners with InvestSoft for Fixed Income, Derivatives Analytics

Linedata has entered into a partnership with InvestSoft Technology where Linedata will provide InvestSoft's BondPro analytics engine for fixed income and credit derivatives to its asset management clients.

Imatchative Goes Live with Inaugural Product AltX

San Francisco-based startup Imatchative has launched AltX, an online platform that allows institutional investors to connect with hedge funds for due diligence and capital allocation purposes.