Max Bowie

Max is editor-at-large at WatersTechnology, based in Infopro Digital's New York office.

Max joined then-Risk Waters Group (prior to its acquisition by Incisive Media) in 2000, and has worked as a reporter on Risk Magazine, FX Week, Trading Technology Week (now Sell-Side Technology) and Buy-Side IT (now Buy-Side Technology), before joining Inside Market Data as European reporter in 2003. He moved to New York as US reporter in 2005, and became editor in 2006. He was a contributor to sibling Inside Reference Data, and was founding editor of Inside Data Management, which merged the IMD and IRD newsletters into a monthly glossy magazine.

Follow Max

Articles by Max Bowie

The IMD Wrap: As crypto rises, yes, reference data is VERY important

With the SEC’s approval of spot Bitcoin ETFs, Max explains why reference data will take on greater importance—whether non-data people know it or not.

The IMD Wrap: AI efforts will force renewed focus on data in 2024

Machine learning and generative AI offer a tremendous opportunity to help users obtain more insights from raw data, but these tools first need perfect datasets on which to base their decisions.

Breaking news: How the Grinch stole data

Will the greedy Grinch get his comeuppance for trying to steal the Whos’ valuable market data at Christmas? Max Bowie investigates.

The IMD Wrap: Exchange, data vendor audits continue to rankle end-users—what will change in 2024?

While the data auditing process has been contentious for a long time, Max looks at some of the positive improvements made in 2023 and explains why more improvements need to be made in the New Year.

Firms step up non-compete use to protect tech, data IP

US states are increasingly banning or limiting the use of non-compete contracts, but financial firms are using them more frequently to safeguard proprietary tech and data assets—including the knowledge of the individuals who work on them.

The IMD Wrap: Dining on data, from pay-as-you-go to all-you-can-eat

Max puts on his best Anthony Bourdain voice to reminisce about seminal sushi experiences, and to look forward to the future, where perhaps the industry will also adopt more consumption-based approaches to market data (and hopefully more sushi).

The IMD Wrap: Are server life extensions putting profits before performance?

Cloud providers are having to make more hardware available to keep pace with takeup—including older machines that under previous policies would have been retired already. But the move is proving profitable … and risky.

Industry unsure of SEC’s new short-selling transparency rule

Does the SEC’s recent 10C-1a rule provide sufficient transparency while protecting traders’ short-sale positions from a GameStop-style backlash? The data will be key.

The IMD Wrap: Price you gotta pay

With regulators taking aim at data providers in the ongoing war over data fees, Max says that data doesn’t need to be free, but it should be transparent, that price increases should accompany increases in value, and that technology already exists to…

The IMD Wrap: Talkin’ ’bout my generation

As a Gen-Xer, Max tells GenAI to get off his lawn—after it's mowed it, watered it and trimmed the shrubs so he can sit back and enjoy it.

Data catalog competition heats up as spending cools

Data catalogs represent a big step toward a shopping experience in the style of Amazon.com or iTunes for market data management and procurement. Here, we take a look at the key players in this space, old and new.

Has cloud cracked the multicast ‘holy grail’ for exchanges?

An examination of how exchanges—already migrating to the cloud—are working to solve the problem of multicasting in a new environment.

Ignoring ESG data simply doesn’t make business sense

There’s a brewing controversy about “woke” ESG investments. But politics aside, ESG as a dataset brings more transparency to investment decisions.

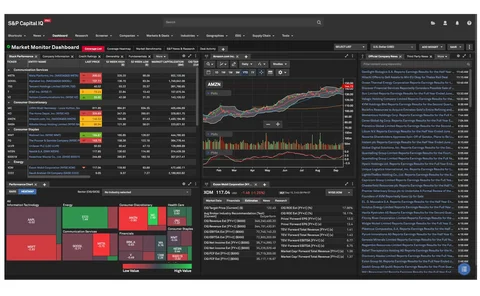

S&P tests ‘ChatIQ’ genAI search tool in revamped CapIQ desktop

The new tool is the culmination of integrating recent acquisitions, including IHS Markit, ChartIQ and Kensho.

Bloomberg rolls out integrated alt data for Terminal users

The initial launch includes consumer spend and foot traffic geolocation data—pre-integrated with all the other data on the Bloomberg Terminal.

Six banks team with Expand Research to create data vendor catalog

The initiative aims to help firms better manage the data they already use and to identify and compare alternatives available in the market.

Nasdaq moves second matching engine to AWS cloud

The exchange and its cloud partner are encouraged by the smooth migration so far—and also by capacity and latency improvements from running in the cloud.

Social distancing: Putting a $ value on the ‘S’ in ESG

The ‘social’ pillar of ESG has been much overlooked and underserved in terms of reporting and accurate and available data. That’s changing.

TMX, CanDeal strike deal for Canadian benchmark transition

Canada is one of many countries moving away from opinion-based benchmarks like Libor in favor of alternatives based on observable trade data. TMX and CanDeal are working to deliver a new rate which will take over as Canada’s official loan benchmark next…

Ex-LSEG execs partner to offer data strategy consulting

Dunlap and White have held senior roles on the buy side, sell side, and at vendors and exchanges, over careers spanning more than 30 years each.

ICE: LLMs drove 60% increase in ICE Chat trades

The exchange revealed it has been working with LLMs for a decade to drive automation around its messaging platform. Now, it’s looking for more uses across all asset classes.

CME-Google cloud partnership already yielding new data analytics

CME is spending a small fortune to migrate its technology to Google’s cloud, betting on the cloud’s ability to return a large fortune from development of new data products and services.

As ESG investing faces headwinds, MSCI’s CEO says ESG ‘most popular’ topic for clients

For future analytics enhancements, the vendor will also lean into large language models and generative AI.

Charles River, software, data sales drive State Street in Q2

As traditional revenue lines declined at the custodian as a result of market forces, front-office software sales made big gains in its quarterly results.